Question: The bottom part, asking about the general journal, is the question i need help on...Thanks! Rhoades Tax Services began business on December 1, 2015. Its

The bottom part, asking about the general journal, is the question i need help on...Thanks!

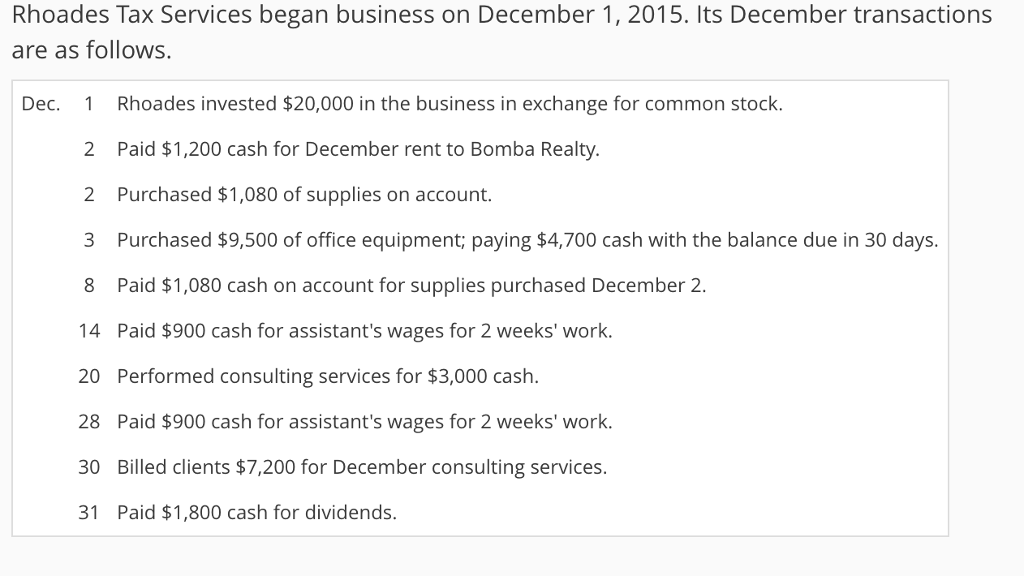

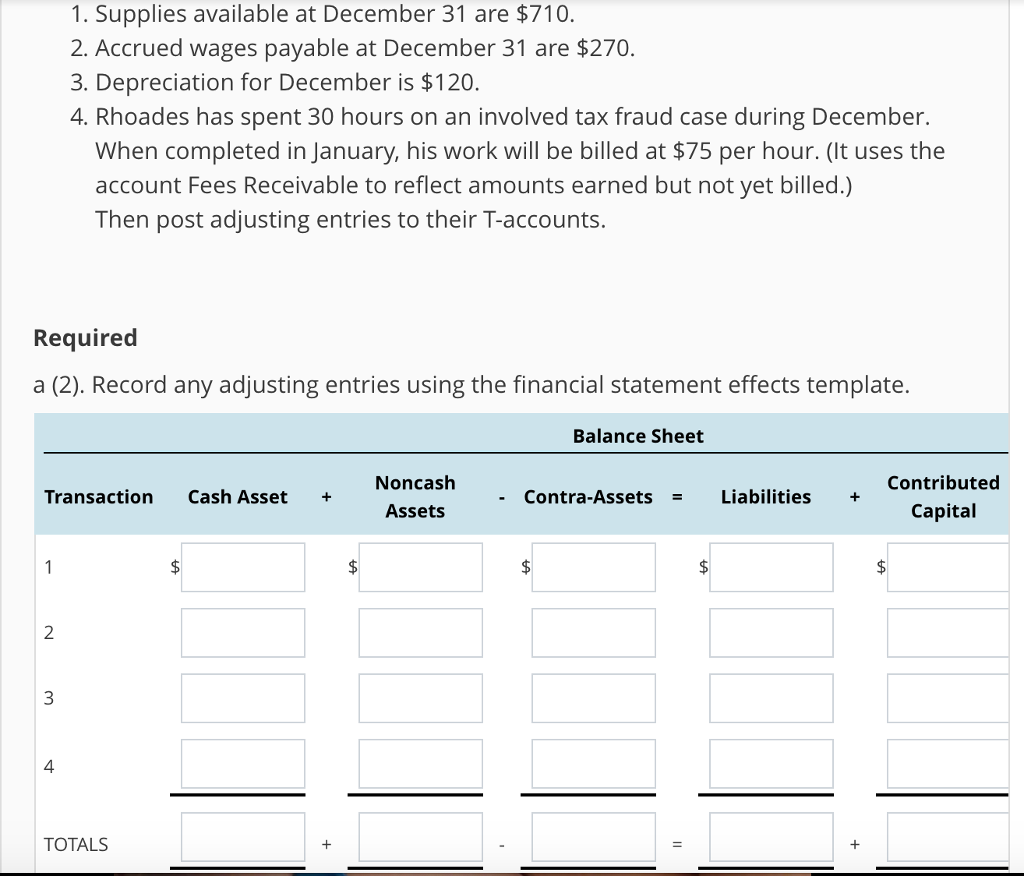

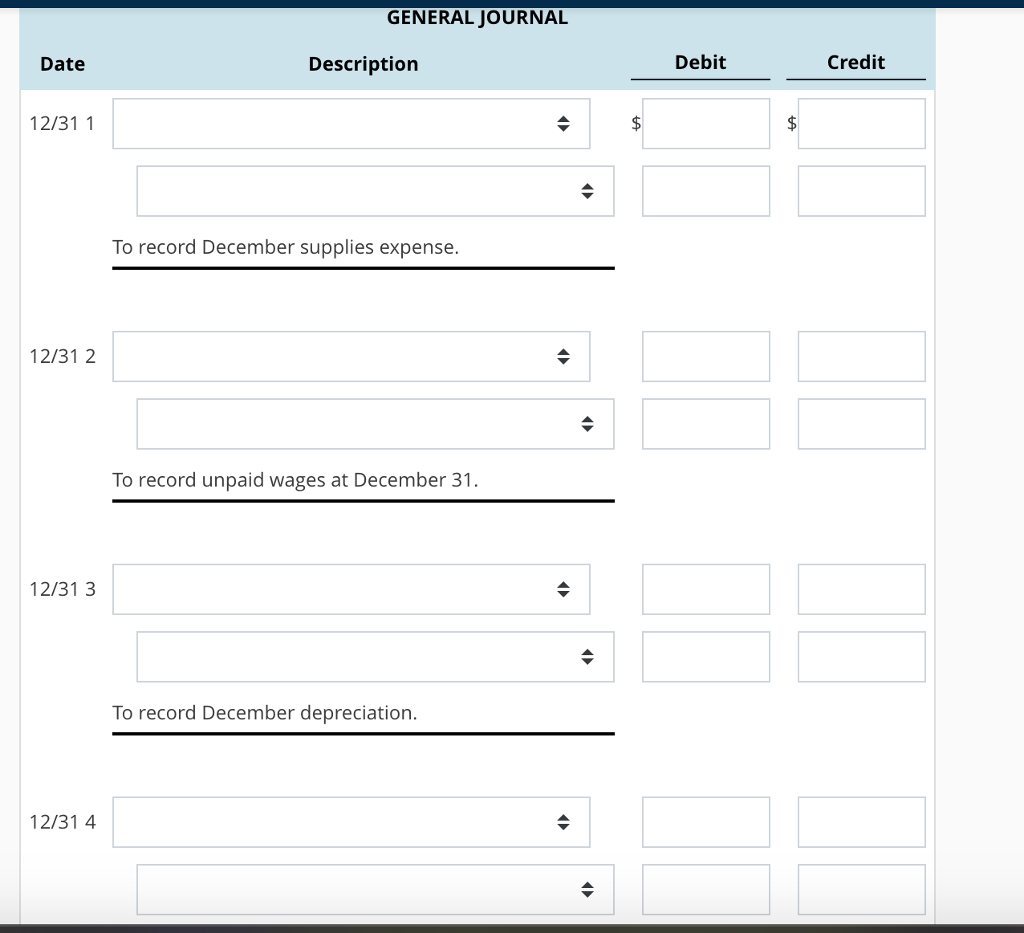

Rhoades Tax Services began business on December 1, 2015. Its December transactions are as follows. Dec. Rhoades invested $20,000 in the business in exchange for common stock. 2 Paid $1,200 cash for December rent to Bomba Realty. 2 Purchased $1,080 of supplies on account. 3 Purchased $9,500 of office equipment; paying $4,700 cash with the balance due in 30 days. 8 Paid $1,080 cash on account for supplies purchased December 2 14 Paid $900 cash for assistant's wages for 2 weeks' work. 20 Performed consulting services for $3,000 cash 28 Paid $900 cash for assistant's wages for 2 weeks' work 30 Billed clients $7,200 for December consulting services. 31 Paid $1,800 cash for dividends. 1 1. Supplies available at December 31 are $710. 2. Accrued wages payable at December 31 are $270. 3. Depreciation for December is $120. 4. Rhoades has spent 30 hours on an involved tax fraud case during December. When completed in January, his work will be billed at $75 per hour. (It uses the account Fees Receivable to reflect amounts earned but not yet billed.) Then post adjusting entries to their T-accounts Required a (2). Record any adjusting entries using the financial statement effects template. Balance Sheet Contributed Noncash Assets Transaction Cash Asset - Contra-AssetsLiabilities Capital 2 4 TOTALS GENERAL JOURNAL Date Description Debit Credit 12/31 1 To record December supplies expense. 12/31 2 To record unpaid wages at December 31. 12/31 3 To record December depreciation. 12/31 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts