Question: The break down on how to solve these problems ABC D EFIGHT 6. Washington Mutual Investors Fund (AWSHX) charged 0.24% for management fees, 0.11% for

The break down on how to solve these problems

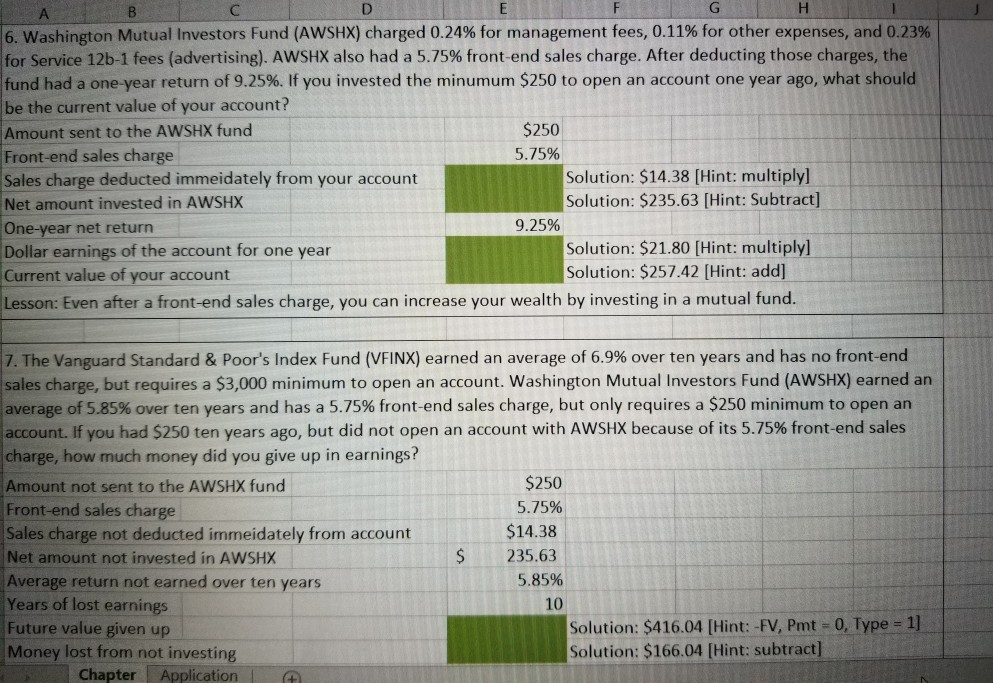

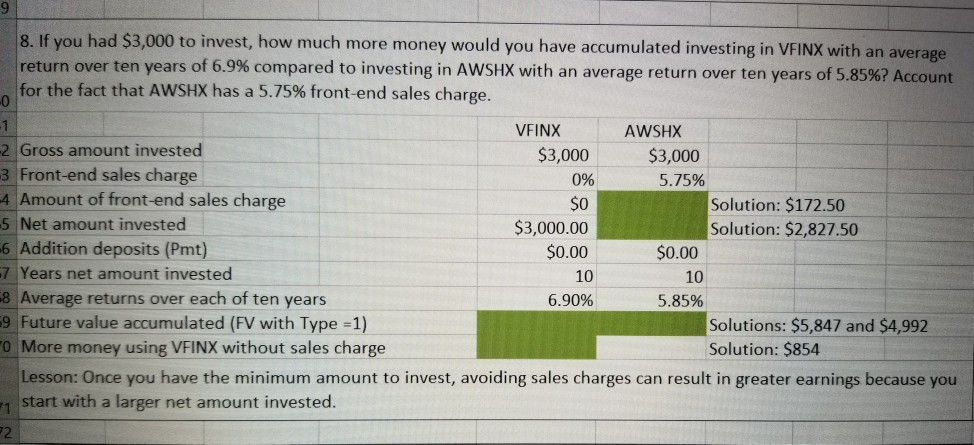

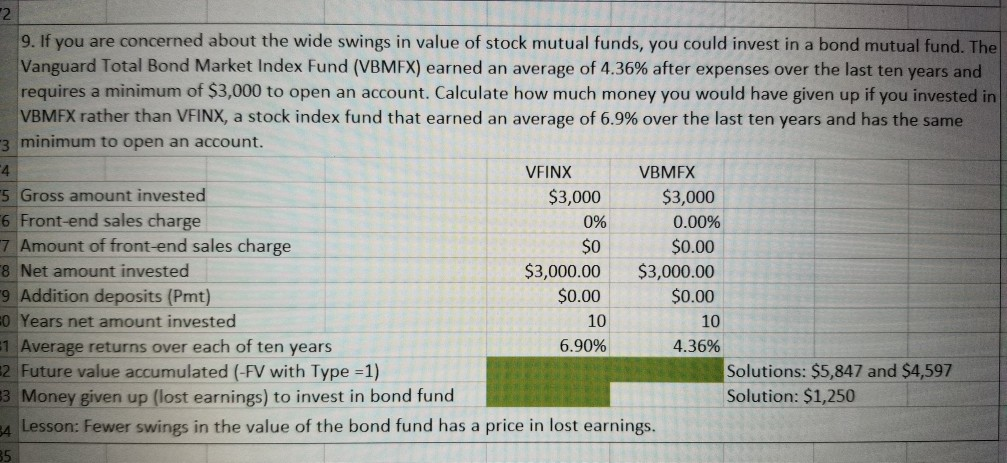

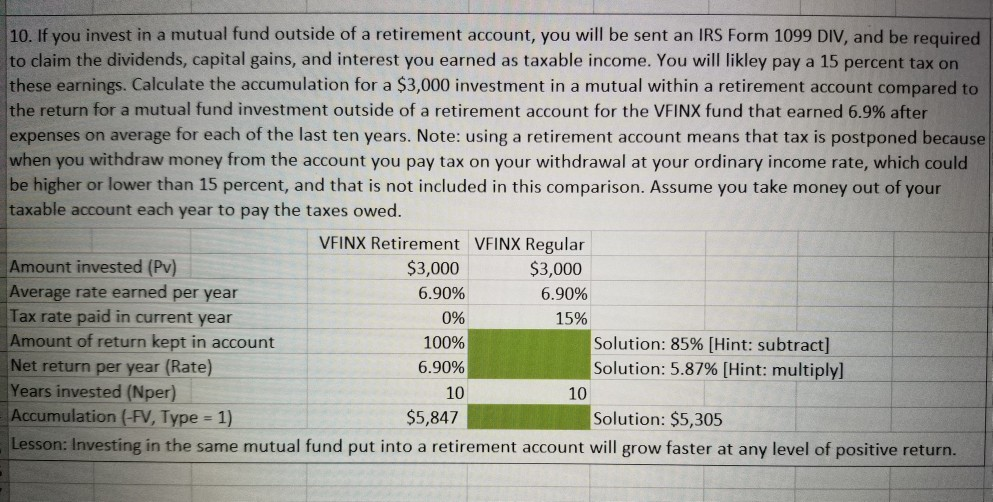

ABC D EFIGHT 6. Washington Mutual Investors Fund (AWSHX) charged 0.24% for management fees, 0.11% for other expenses, and 0.23% for Service 12b-1 fees (advertising). AWSHX also had a 5.75% front-end sales charge. After deducting those charges, the fund had a one-year return of 9.25%. If you invested the minumum $250 to open an account one year ago, what should be the current value of your account? Amount sent to the AWSHX fund $250 Front-end sales charge 5.75% Sales charge deducted immeidately from your account Solution: $14.38 (Hint: multiply] Net amount invested in AWSHX Solution: $235.63 [Hint: Subtract] One-year net return 9.25% Dollar earnings of the account for one year Solution: $21.80 [Hint: multiply] Current value of your account Solution: $257.42 (Hint: add] Lesson: Even after a front-end sales charge, you can increase your wealth by investing in a mutual fund. 7. The Vanguard Standard & Poor's Index Fund (VFINX) earned an average of 6.9% over ten years and has no front-end sales charge, but requires a $3,000 minimum to open an account. Washington Mutual Investors Fund (AWSHX) earned an average of 5.85% over ten years and has a 5.75% front-end sales charge, but only requires a $250 minimum to open an account. If you had $250 ten years ago, but did not open an account with AWSHX because of its 5.75% front-end sales charge, how much money did you give up in earnings? Amount not sent to the AWSHX fund $250 Front-end sales charge 5.75% Sales charge not deducted immeidately from account $14.38 Net amount not invested in AWSHX 235.63 Average return not earned over ten years 5.85% Years of lost earnings Future value given up Solution: $416.04 (Hint: -FV, Pmt = 0, Type = 1] Money lost from not investing Solution: $166.04 (Hint: subtract] Chapter Application S 10 8. If you had $3,000 to invest, how much more money would you have accumulated investing in VFINX with an average return over ten years of 6.9% compared to investing in AWSHX with an average return over ten years of 5.85%? Account for the fact that AWSHX has a 5.75% front-end sales charge. VFINX AWSHX -2 Gross amount invested $3,000 $3,000 3 Front-end sales charge 0% 5.75% 4 Amount of front-end sales charge Solution: $172.50 -5 Net amount invested $3,000.00 Solution: $2,827.50 6 Addition deposits (Pmt) $0.00 $0.00 7 Years net amount invested 8 Average returns over each of ten years 6.90% 5.85% 9 Future value accumulated (FV with Type =1) Solutions: $5,847 and $4,992 O More money using VFINX without sales charge Solution: $854 Lesson: Once you have the minimum amount to invest, avoiding sales charges can result in greater earnings because you start with a larger net amount invested. 10 10 0% 9. If you are concerned about the wide swings in value of stock mutual funds, you could invest in a bond mutual fund. The Vanguard Total Bond Market Index Fund (VBMFX) earned an average of 4.36% after expenses over the last ten years and requires a minimum of $3,000 to open an account. Calculate how much money you would have given up if you invested in VBMFX rather than VFINX, a stock index fund that earned an average of 6.9% over the last ten years and has the same 3 minimum to open an account. VFINX VBMFX 5 Gross amount invested $3,000 $3,000 6 Front-end sales charge 0.00% "7 Amount of front-end sales charge $0.00 8 Net amount invested $3,000.00 $3,000.00 9 Addition deposits (Pmt) $0.00 $0.00 Years net amount invested 10 1 Average returns over each of ten years 6.90% 4.36% 2 Future value accumulated (-FV with Type =1) Solutions: $5,847 and $4,597 3 Money given up (lost earnings) to invest in bond fund Solution: $1,250 4 Lesson: Fewer swings in the value of the bond fund has a price in lost earnings. co 10 10. If you invest in a mutual fund outside of a retirement account, you will be sent an IRS Form 1099 DIV, and be required to claim the dividends, capital gains, and interest you earned as taxable income. You will likley pay a 15 percent tax on these earnings. Calculate the accumulation for a $3,000 investment in a mutual within a retirement account compared to the return for a mutual fund investment outside of a retirement account for the VFINX fund that earned 6.9% after expenses on average for each of the last ten years. Note: using a retirement account means that tax is postponed because when you withdraw money from the account you pay tax on your withdrawal at your ordinary income rate, which could be higher or lower than 15 percent, and that is not included in this comparison. Assume you take money out of your taxable account each year to pay the taxes owed. VFINX Retirement VFINX Regular Amount invested (PV) $3,000 $3,000 Average rate earned per year 6.90% 6.90% Tax rate paid in current year 0% 15% Amount of return kept in account 100% Solution: 85% [Hint: subtract] Net return per year (Rate) 6.90% Solution: 5.87% [Hint: multiply] Years invested (Nper) 10 Accumulation (-FV, Type = 1) $5,847 Solution: $5,305 Lesson: Investing in the same mutual fund put into a retirement account will grow faster at any level of positive return. 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts