Question: The Case: Greg and Jessica Smith Note: paper cases have significant limitations as they are simply black ink on white paper and not based on

The Case: Greg and Jessica Smith

Note: paper cases have significant limitations as they are simply black ink on white paper and not based on actual people. This case will attempt to give you a sense of who these people are, but you will still needtomakesomeassumptionsas youworktowardanoverallretirementsolutionforthisfamily.

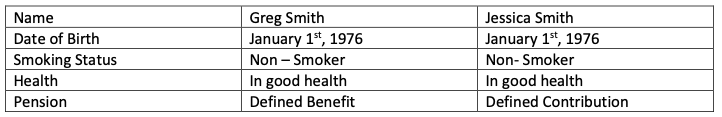

Personal Information - As at 31 December 2020

Employment

Greg is a nurse at Victoria Hospital in London. Greg started his current job on January 1st 2021 and expects to continue in this role until his retirement. His current salary is $82,000 per year. Greg is a member of the HOOP pension plan and joined the pension when he started at Victoria Hospital.

Jessica works for London Life in an office administration role. Jessica has been employed by London Life ever since she graduated from the University of Waterloo in 1998. Jessica is a member of their defined contribution pension. Her current salary is $65,000 per year.

Health

Greg and Jessica have always been quite healthy. However, last month Greg had his annual physical and it was discovered that he has moderately high blood pressure. His doctor was quite concerned as Gregs family has a history of high blood pressure. His doctor has suggested that medication is not required right now; instead he has advised Greg to begin an exercise program, at 3 times per week and to pay close attention to his eating and sleeping habits to reduce stress from his life. He is currently 6 feet tall and weighs 190 pounds. Greg and Jessica consider themselves non-smokers as Jessica only occasionally smokes a cigarette during a girls-weekend away in Las Vegas twice a year.

Major Assets

Greg and Jessica jointly own a home in London, Ontario that was purchased for $450,000. The house is currently valued at $675,000. They have no intentions of moving and have a mortgage remaining of $310,000, that they expect to pay off over the next 15 years.

Greg and Jessica saved very little in retirement, as they believe the pensions they have through work will be enough to meet their retirement needs. See Appendix for asset values.

Pension Plans

Greg is a member of his employers mandatory defined benefit pension plan. The plan is based on the average of the last 5 years of employment and will pay Greg a 1.5% credit per year of service up to the YMPE and a 2% credit on the amount above the YMPE. The pension is indexed to inflation. The pension has a maximum of 35 years of service. The pension plan provides survivor benefits to Jessica in the event of Gregs death. Jessica will be entitled to a spousal pension worth 60% of Gregs pension at the time of his death.

Jessica is a member of a Defined Contribution Pension Plan. She contributes 3% of her salary to the pension plan and her employer matches. Jessica also makes optional contributions of 1%, that the employer does not match. The plan is invested with a balanced mandate. Greg and Jessica both have a moderate risk tolerance.

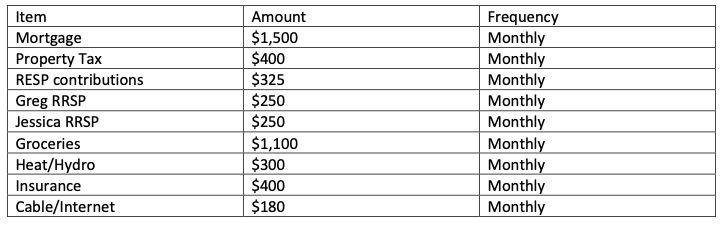

Expenditures

Please see appendix for a list of expenditures that Greg and Jessica have provided.

Future

Greg and Jessica have had some discussions with family members who have told them they need to complete a retirement plan. They have decided they want to retire at age 60 and have provided you with a retirement budget in todays dollars.

See the following pages for appendices.

Appendix 1 Greg and Jessicas expenses

Greg and Jessica have not historically tracked their expenses well. They have provided details on specific items below but are looking for your assistance on what living expenses amount to for their rest of their current lifestyle. They have provided you with their gross salaries above.

Appendix 2 - Greg and Jessicas Assets

House $375,000 Greg RRSP - $18,000 Jessica RRSP - $21,000 Jessica DC Pension - $45,000

Savings - $1,400 Cars - $23,000 RRSP Carry Forward Room 2020

Greg - $139,000 Jessica - $98,000

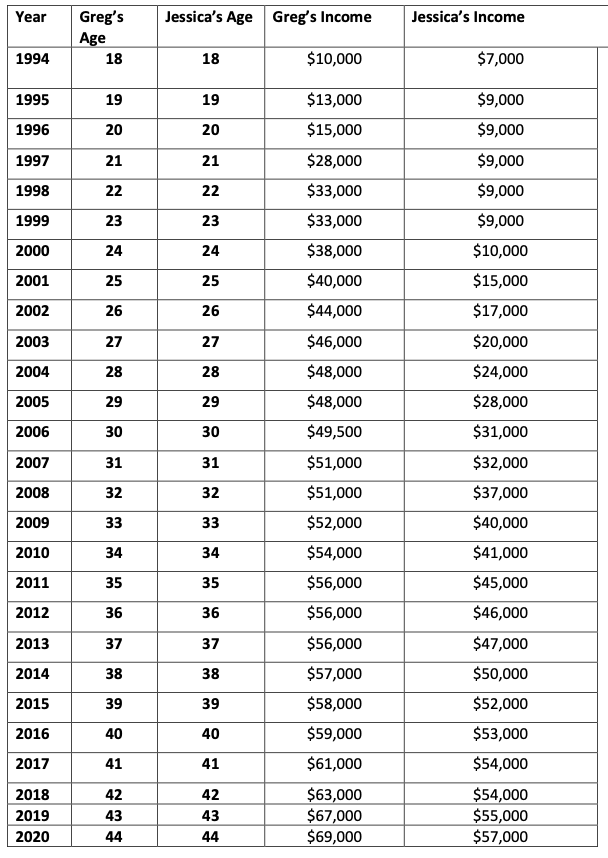

Appendix 3 Historical Incomes

Appendix 4 Monthly Retirement Expenditures (in todays dollars)

Housing Maintenance - $350

Groceries - $925 Dining Out - $500 Hydro - $250

Heating - $120

Internet/Cable - $225 Gas - $270 Automobile Insurance - $235

Entertainment - $200

Vacation - $500 Memberships - $275 Gifts - $250 Home Insurance - $75

Property Tax - $400 Cell Phones - $120 Vehicle Maintenance - $275

Personal Care - 200

Medical - $300

Miscellaneous - $200

---------------------------------------

Your role is as that of a retirement planner. Your objective is to help your clients organize themselves in order to do some financial planning. In the real world, you would do so with clear step by step communication. Details on their income, expenses, assets and liabilities are provided in appendices. Clearly state what assumptions you need to make to complete your assignment.

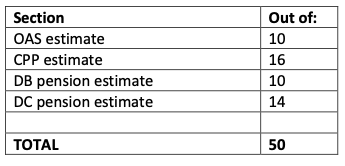

a- Estimate the CPP benefits that Greg and Jessica will receive when they are 60, (calculate the ratio of earnings to YMPE) and the OAS benefits they will receive at age 65, in future dollars. Showyourcalculationsandlistanyassumptionsyouaremaking. Hint:youwillneedtomake an assumption on future salary increases. You will also need to use the historical YMPE/YBE figures to complete.

b- Determine the RPP annual pension income that Greg will receive from his pension when he retires at age 60.

Hint: remember to base the benefits on the future salary.

c- Estimate the value of Jessicas DCP plan when she retires. Be sure to state your assumptions.

d- please share screen shots of the excel sheets.

Name Jessica Smith Date of Birth January 1st, 1976 Smoking Status Health Greg Smith January 1st, 1976 Non-Smoker In good health Defined Benefit Non-Smoker In good health Defined Contribution Pension Item Amount Mortgage Property Tax RESP contributions Greg RRSP Jessica RRSP $1,500 $400 $325 $250 $250 $1,100 $300 $400 $180 Frequency Monthly Monthly Monthly Monthly Monthly Monthly Monthly Monthly Monthly Groceries Heat/Hydro Insurance Cable/Internet Year Jessica's Age Greg's Income Jessica's Income Greg's Age 18 1994 18 $10,000 $7,000 1995 19 19 $13,000 $9,000 1996 20 20 $15,000 $9,000 1997 21 21 $28,000 $9,000 1998 22 22 $33,000 $9,000 1999 23 23 $33,000 $9,000 2000 24 24 $38,000 $10,000 2001 25 25 $40,000 $15,000 2002 26 26 $44,000 $17,000 2003 27 27 $46,000 $20,000 2004 28 28 $48,000 $24,000 2005 29 29 $48,000 $28,000 2006 30 30 $49,500 $31,000 2007 31 31 $51,000 $32,000 2008 32 32 $51,000 $37,000 2009 33 33 $52,000 $40,000 2010 34 34 $54,000 $41,000 2011 35 35 $56,000 $45,000 2012 36 36 $56,000 $46,000 2013 37 37 $56,000 $ 47,000 2014 38 38 $57,000 $50,000 2015 39 39 $58,000 $52,000 2016 40 40 $59,000 $53,000 2017 41 41 $61,000 $54,000 2018 42 42 2019 43 43 $63,000 $67,000 $69,000 $54,000 $55,000 $57,000 2020 44 44 Section Out of: OAS estimate 10 16 CPP estimate DB pension estimate DC pension estimate 10 14 TOTAL 50 Name Jessica Smith Date of Birth January 1st, 1976 Smoking Status Health Greg Smith January 1st, 1976 Non-Smoker In good health Defined Benefit Non-Smoker In good health Defined Contribution Pension Item Amount Mortgage Property Tax RESP contributions Greg RRSP Jessica RRSP $1,500 $400 $325 $250 $250 $1,100 $300 $400 $180 Frequency Monthly Monthly Monthly Monthly Monthly Monthly Monthly Monthly Monthly Groceries Heat/Hydro Insurance Cable/Internet Year Jessica's Age Greg's Income Jessica's Income Greg's Age 18 1994 18 $10,000 $7,000 1995 19 19 $13,000 $9,000 1996 20 20 $15,000 $9,000 1997 21 21 $28,000 $9,000 1998 22 22 $33,000 $9,000 1999 23 23 $33,000 $9,000 2000 24 24 $38,000 $10,000 2001 25 25 $40,000 $15,000 2002 26 26 $44,000 $17,000 2003 27 27 $46,000 $20,000 2004 28 28 $48,000 $24,000 2005 29 29 $48,000 $28,000 2006 30 30 $49,500 $31,000 2007 31 31 $51,000 $32,000 2008 32 32 $51,000 $37,000 2009 33 33 $52,000 $40,000 2010 34 34 $54,000 $41,000 2011 35 35 $56,000 $45,000 2012 36 36 $56,000 $46,000 2013 37 37 $56,000 $ 47,000 2014 38 38 $57,000 $50,000 2015 39 39 $58,000 $52,000 2016 40 40 $59,000 $53,000 2017 41 41 $61,000 $54,000 2018 42 42 2019 43 43 $63,000 $67,000 $69,000 $54,000 $55,000 $57,000 2020 44 44 Section Out of: OAS estimate 10 16 CPP estimate DB pension estimate DC pension estimate 10 14 TOTAL 50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts