Question: The correct answer is B. Please explain how to solve. 5. Assume a firm has recently been paying a $1 per share regular cash dividend

The correct answer is B. Please explain how to solve.

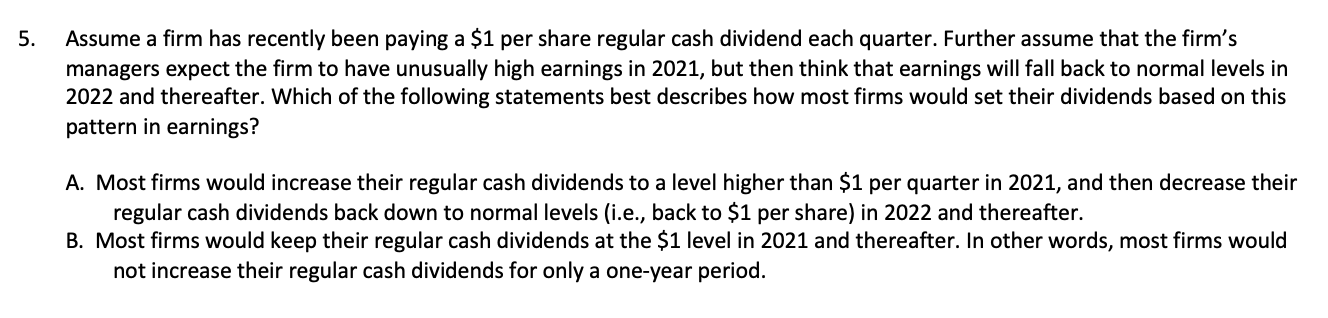

5. Assume a firm has recently been paying a $1 per share regular cash dividend each quarter. Further assume that the firm's managers expect the firm to have unusually high earnings in 2021, but then think that earnings will fall back to normal levels in 2022 and thereafter. Which of the following statements best describes how most firms would set their dividends based on this pattern in earnings? A. Most firms would increase their regular cash dividends to a level higher than $1 per quarter in 2021, and then decrease their regular cash dividends back down to normal levels (i.e., back to $1 per share) in 2022 and thereafter. B. Most firms would keep their regular cash dividends at the $1 level in 2021 and thereafter. In other words, most firms would not increase their regular cash dividends for only a one-year period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts