Question: the covariance is - 5.46 please also explain the caculation of covariance,do we have to convert covariance into corr with this formula corr = covariance/standard

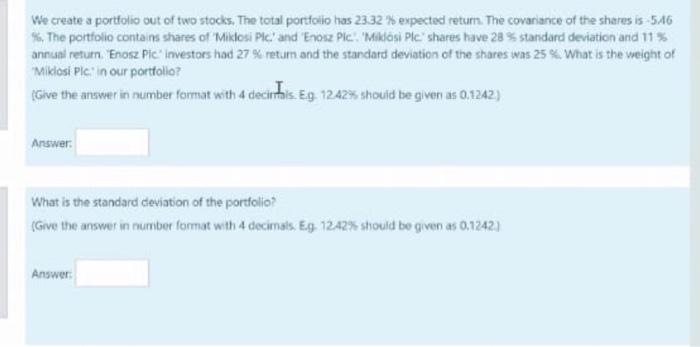

We create a portfolio out of two stocks. The total portfolio has 2332 % expected retum. The covariance of the shares is 5A6 The portfolio contains shares of "Miklosi Plc and Enosz Plc. Mikasi Ple shares have 28% standard deviation and 11% annuni return. Enosz Pic" investors had 27% retum and the standard deviation of the shares was 25 %. What is the weight of "Miklosi Plc in our portfolio? (Give the answer in number format with 4 decirthis. Eg 1242% should be given as 0.1242) Answer: What is the standard deviation of the portfolio (Give the answer in number format with 4 decimals. Eg. 1242% should be given as 0.1242.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts