Question: -------------------------------- The equation below may be used to solve this problem -------------------------------------- Please give a step-by-step answer. Thanks! Currently the risk-free rate equals 3% and

--------------------------------

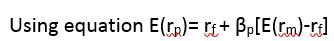

The equation below may be used to solve this problem

--------------------------------------

Please give a step-by-step answer. Thanks!

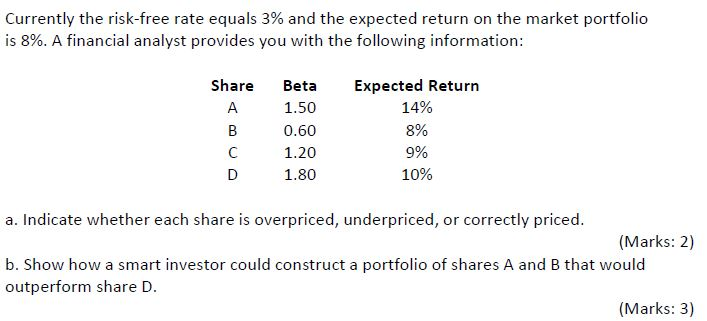

Currently the risk-free rate equals 3% and the expected return on the market portfolio is 8%. A financial analyst provides you with the following information Share Beta xpected Return A 1.50 B 0.60 C 1.20 D 1.80 14% 8% 9% 10% a. Indicate whether each share is overpriced, underpriced, or correctly priced (Marks: 2) b. Show how a smart investor could construct a portfolio of shares A and B that would outperform share D. (Marks: 3)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock