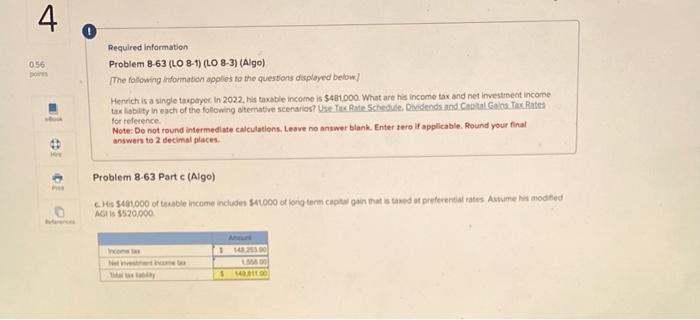

Question: the first part is wrong the second part is correct. I've already tried the numbers 133,903.00, 127,753.00, and 148,253.00 Please ignore any markings on the

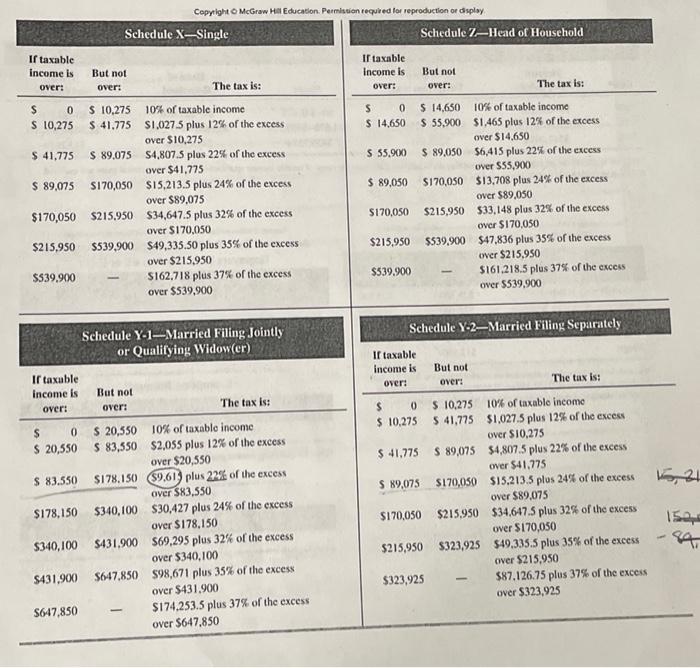

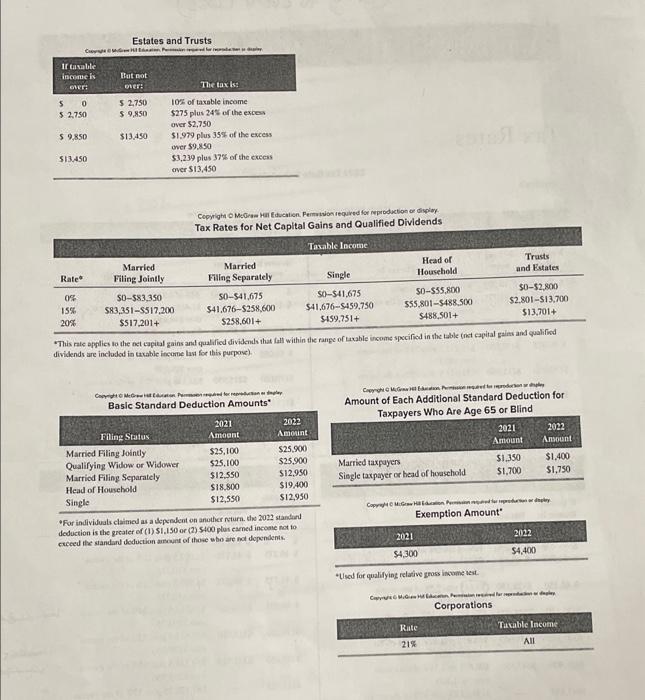

Required information Problem 8-63 (LO 8-1) (LO 8-3) (Algo) (The folowing information apples to the questions disployed beliowel Henrich is a single tapayes in 2022, his tawabie income is $481,000. What are his income tax and net investeect income tax Labity in esch of the following attemative scenarios? Uae Tic Rate 5chedule, Plyidends and Capial Gaios Tire Rates for relerence. Note: Do not round intermediate calculations. Leave no antwer blank. Enter tero If applicable. Pound your finat answars to 2 decimal places. Problem 8-63 Part c (Algo) MGt is 5520,900 . Cepytight O McGraw Hall Educasion. Permistion requited for reproduction of displyy. Estates and Trusts Tax Rates for Net Capital Gains and Qualified Dividends "This rate apgilict lo the net tapital gains and qualified dividends that fall within the range of taxable income specified in the table tict capiral game ains seammer dividends are inclodod in taxable iteone last for this purpose). Amount of Each Additional Standard Deduction for Basic Standard Deduction Amounts* Taxpayers Who Are Age 65 or Blind -For individuals claimed as a slependent on anuther return. the 2022 standind Exemption Amount" deduction is the grater of (1) 51.150 or (2) S400 plas eaned incone not to ciceed tiee standand deduction arsount of those wbo are not dopendents. "Llsol for qualifying relative gross inkwene vest. Corporations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts