Question: The first step in the appraisal process is Problem Identification. This discussion is concerned with the identification of the client, and the definition of value

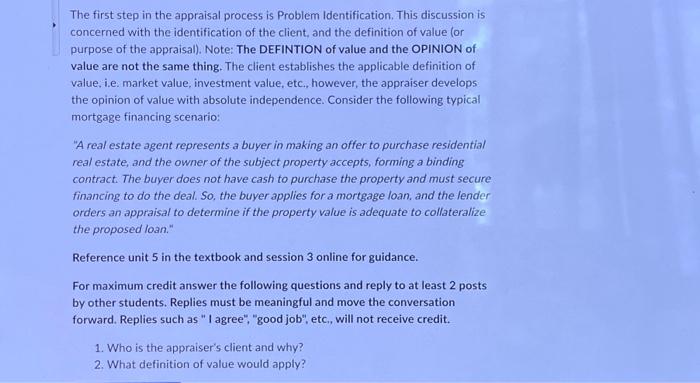

The first step in the appraisal process is Problem Identification. This discussion is concerned with the identification of the client, and the definition of value (or purpose of the appraisal). Note: The DEFINTION of value and the OPINION of value are not the same thing. The client establishes the applicable definition of value, i.e. market value, investment value, etc., however, the appraiser develops the opinion of value with absolute independence. Consider the following typical mortgage financing scenario: "A real estate agent represents a buyer in making an offer to purchase residential real estate, and the owner of the subject property accepts, forming a binding contract. The buyer does not have cash to purchase the property and must secure financing to do the deal. So, the buyer applies for a mortgage loan, and the lender orders an appraisal to determine if the property value is adequate to collateralize the proposed loan." Reference unit 5 in the textbook and session 3 online for guidance. For maximum credit answer the following questions and reply to at least 2 posts by other students. Replies must be meaningful and move the conversation forward. Replies such as "I agree", "good job", etc., will not receive credit. 1. Who is the appraiser's client and why? 2. What definition of value would apply

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts