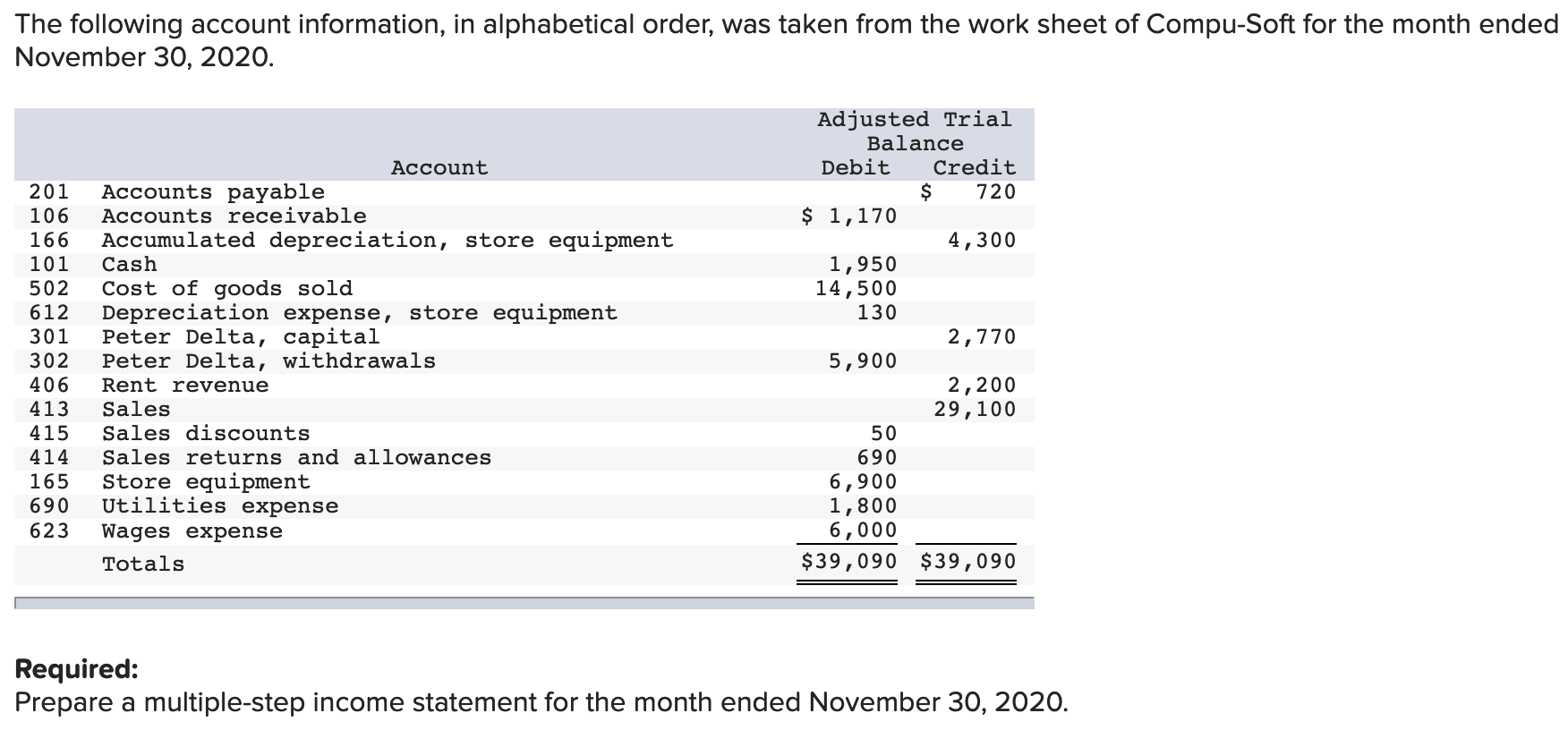

Question: The following account information, in alphabetical order, was taken from the work sheet of Compu-Soft for the month ended November 30, 2020. Adjusted Trial

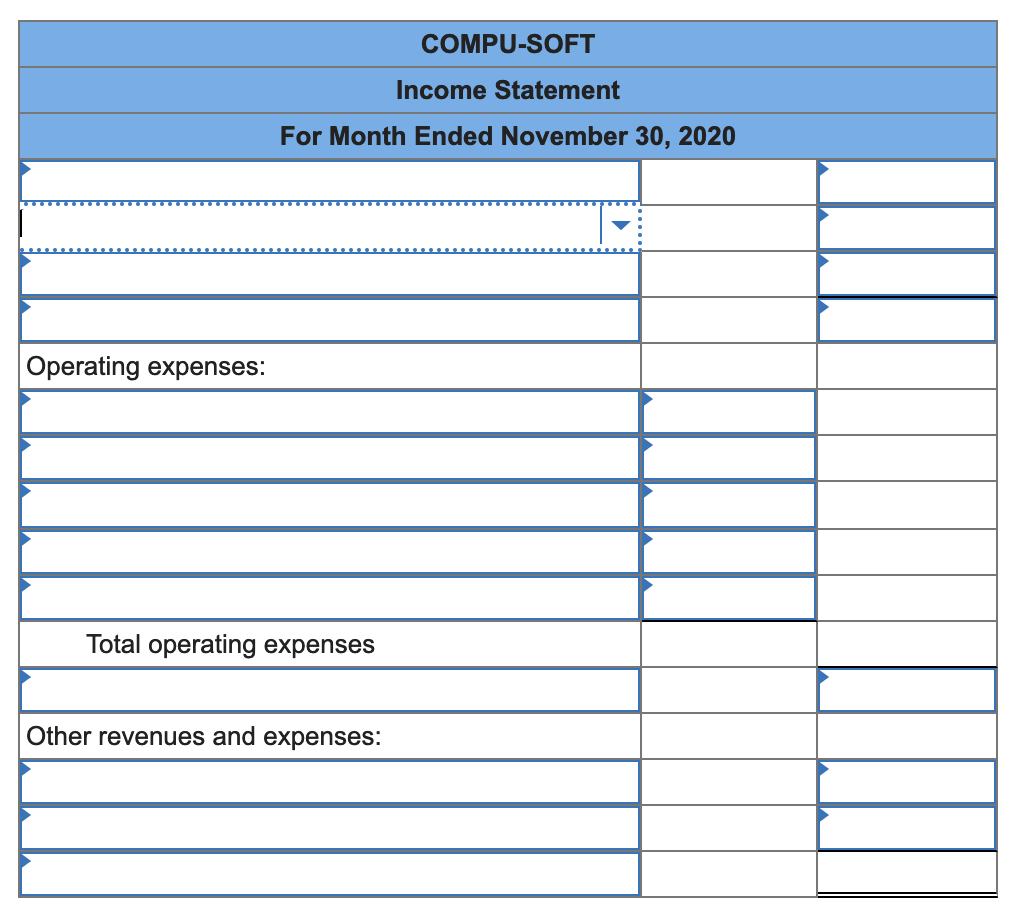

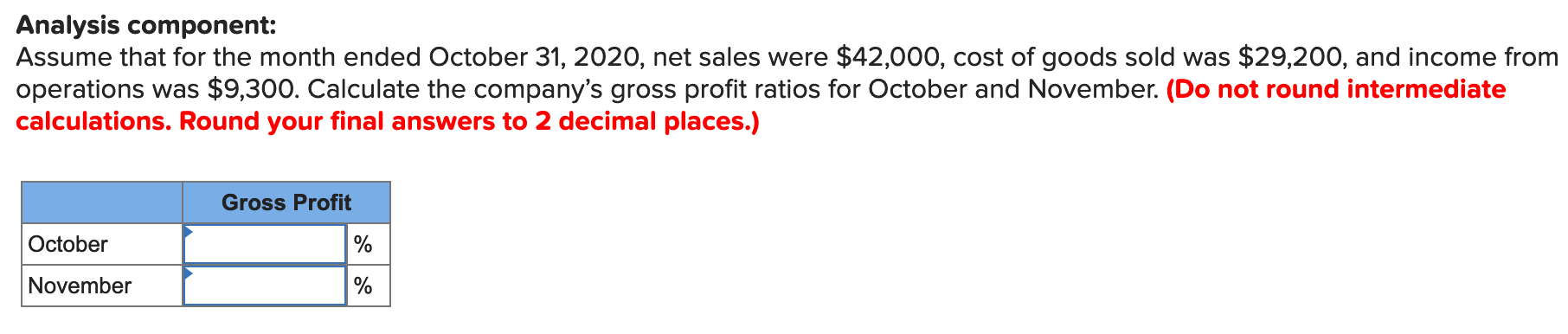

The following account information, in alphabetical order, was taken from the work sheet of Compu-Soft for the month ended November 30, 2020. Adjusted Trial Balance Account 201 Accounts payable Debit Credit $ 720 106 Accounts receivable $ 1,170 4,300 166 Accumulated depreciation, store equipment 101 Cash 1,950 502 Cost of goods sold 14,500 612 Depreciation expense, store equipment 130 301 Peter Delta, capital 2,770 302 Peter Delta, withdrawals 5,900 406 Rent revenue 2,200 413 Sales 29,100 415 Sales discounts 50 414 Sales returns and allowances 690 165 Store equipment 6,900 690 Utilities expense 1,800 623 Wages expense 6,000 Totals $39,090 $39,090 Required: Prepare a multiple-step income statement for the month ended November 30, 2020. Operating expenses: COMPU-SOFT Income Statement For Month Ended November 30, 2020 Total operating expenses Other revenues and expenses: Analysis component: Assume that for the month ended October 31, 2020, net sales were $42,000, cost of goods sold was $29,200, and income from operations was $9,300. Calculate the company's gross profit ratios for October and November. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Gross Profit October November % %

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Calculation of Gross Profit ratio for October and November ... View full answer

Get step-by-step solutions from verified subject matter experts