Question: The following data relates to a mining operation: Royalties are 12.5% of gross revenue, and the liquidation value (salvage value) is $0 at the end

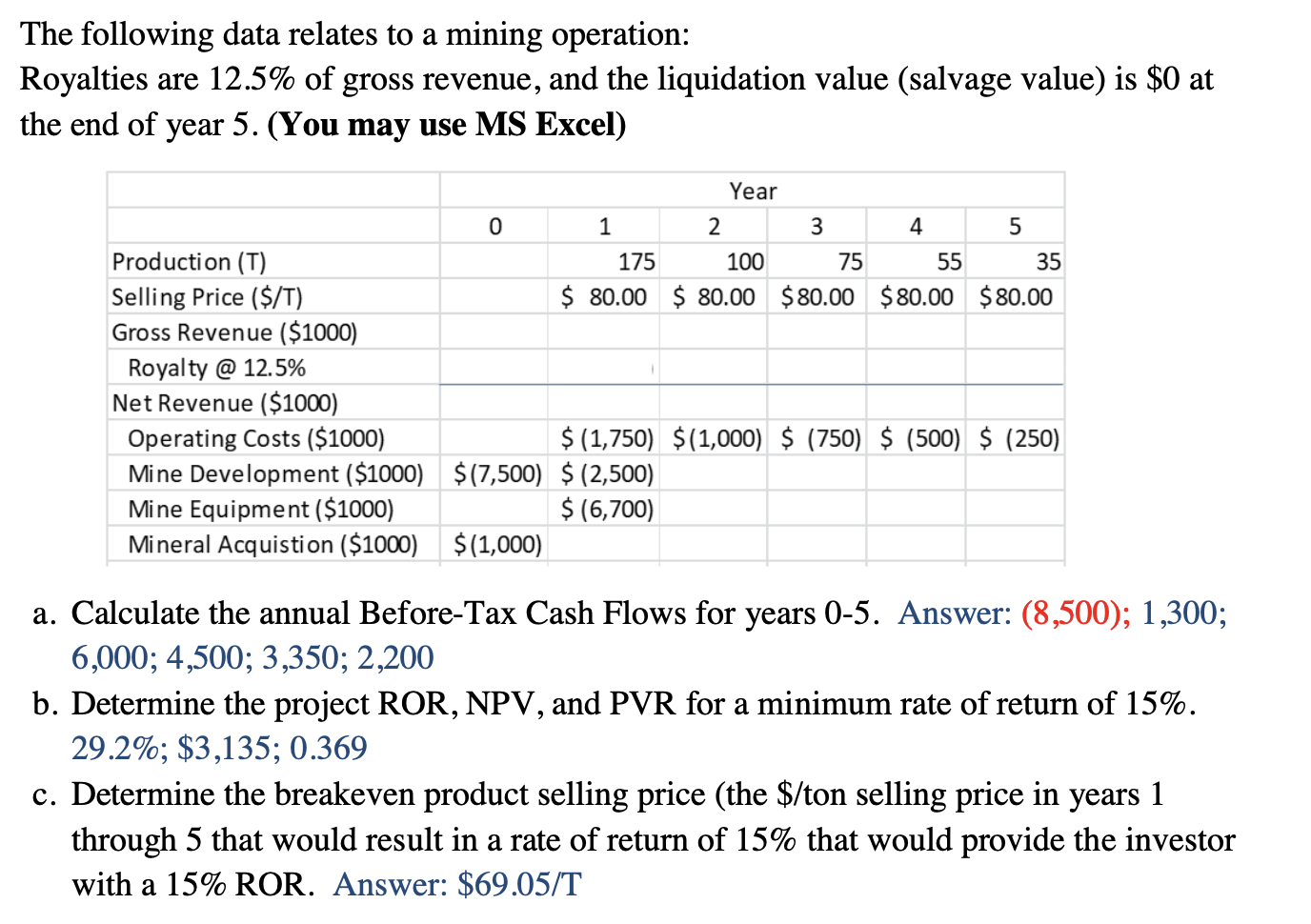

The following data relates to a mining operation: Royalties are 12.5% of gross revenue, and the liquidation value (salvage value) is $0 at the end of year 5. (You may use MS Excel) Year 0 3 4 1 2 5 Production (T) 175 100 75 55 35 Selling Price ($/T) $ 80.00 $ 80.00 $80.00 $80.00 $80.00 Gross Revenue ($1000) Royalty @ 12.5% Net Revenue ($1000) Operating Costs ($1000) $ (1,750) $(1,000) $ (750) $ (500) $ (250) Mine Development ($1000) $(7,500) $ (2,500) Mine Equipment ($1000) $ (6,700) Mineral Acquistion ($1000) $(1,000) a. Calculate the annual Before-Tax Cash Flows for years 0-5. Answer: (8,500); 1,300; 6,000; 4,500; 3,350; 2,200 b. Determine the project ROR, NPV, and PVR for a minimum rate of return of 15%. 29.2%; $3,135; 0.369 c. Determine the breakeven product selling price (the $/ton selling price in years 1 through 5 that would result in a rate of return of 15% that would provide the investor with a 15% ROR. Answer: $69.05/T The following data relates to a mining operation: Royalties are 12.5% of gross revenue, and the liquidation value (salvage value) is $0 at the end of year 5. (You may use MS Excel) Year 0 3 4 1 2 5 Production (T) 175 100 75 55 35 Selling Price ($/T) $ 80.00 $ 80.00 $80.00 $80.00 $80.00 Gross Revenue ($1000) Royalty @ 12.5% Net Revenue ($1000) Operating Costs ($1000) $ (1,750) $(1,000) $ (750) $ (500) $ (250) Mine Development ($1000) $(7,500) $ (2,500) Mine Equipment ($1000) $ (6,700) Mineral Acquistion ($1000) $(1,000) a. Calculate the annual Before-Tax Cash Flows for years 0-5. Answer: (8,500); 1,300; 6,000; 4,500; 3,350; 2,200 b. Determine the project ROR, NPV, and PVR for a minimum rate of return of 15%. 29.2%; $3,135; 0.369 c. Determine the breakeven product selling price (the $/ton selling price in years 1 through 5 that would result in a rate of return of 15% that would provide the investor with a 15% ROR. Answer: $69.05/T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts