Answered step by step

Verified Expert Solution

Question

1 Approved Answer

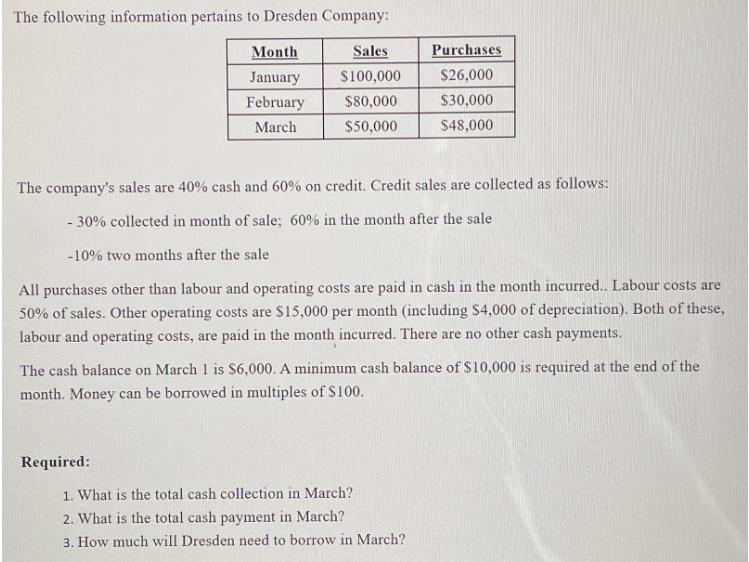

The following information pertains to Dresden Company: Month Sales Purchases January $100,000 $26,000 February $80,000 $30,000 March $50,000 $48,000 The company's sales are 40%

The following information pertains to Dresden Company: Month Sales Purchases January $100,000 $26,000 February $80,000 $30,000 March $50,000 $48,000 The company's sales are 40% cash and 60% on credit. Credit sales are collected as follows: -30% collected in month of sale; 60% in the month after the sale -10% two months after the sale All purchases other than labour and operating costs are paid in cash in the month incurred.. Labour costs are 50% of sales. Other operating costs are $15,000 per month (including $4,000 of depreciation). Both of these, labour and operating costs, are paid in the month incurred. There are no other cash payments. The cash balance on March 1 is $6,000. A minimum cash balance of $10,000 is required at the end of the month. Money can be borrowed in multiples of $100. Required: 1. What is the total cash collection in March? 2. What is the total cash payment in March? 3. How much will Dresden need to borrow in March?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the total cash collection total cash payment and the amount Dresden Company needs to bo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642bc429cf6a_975083.pdf

180 KBs PDF File

6642bc429cf6a_975083.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started