Question: The following table lists three different loans with their pricing, risk, and maturity profile. The current risk-free rate on a one-year loan is estimated to

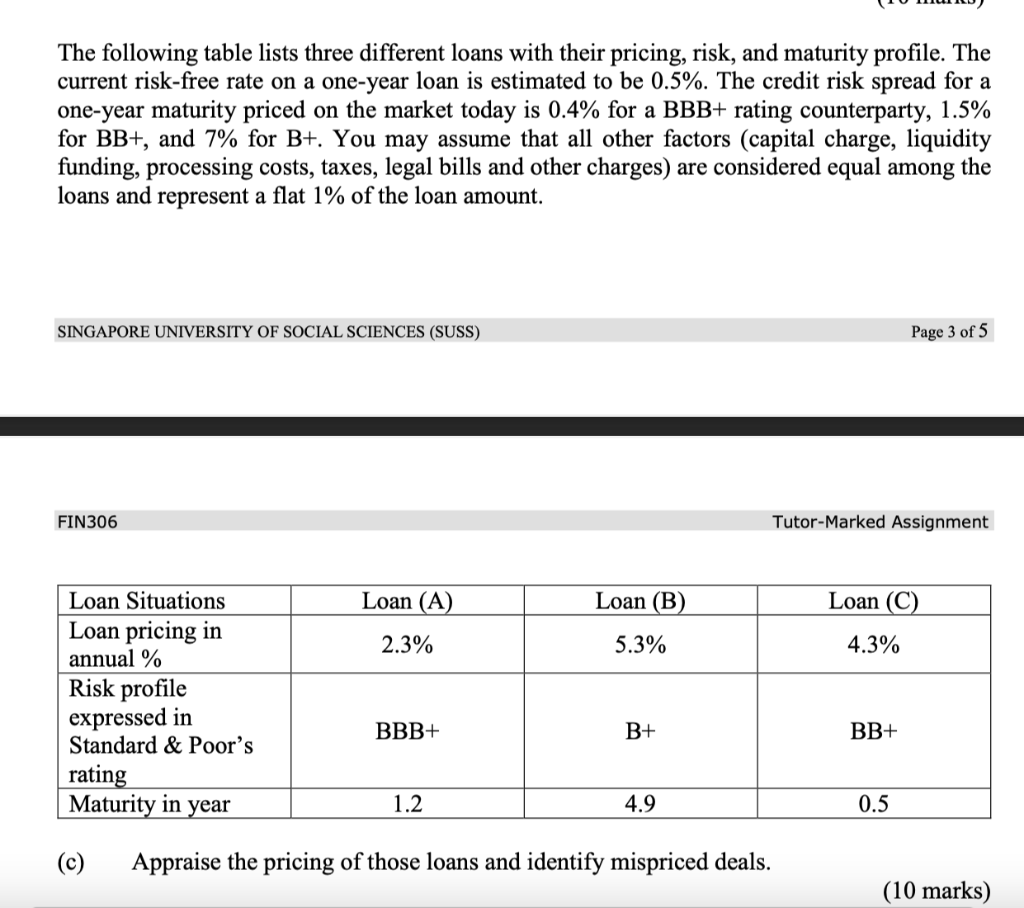

The following table lists three different loans with their pricing, risk, and maturity profile. The current risk-free rate on a one-year loan is estimated to be 0.5%. The credit risk spread for a one-year maturity priced on the market today is 0.4% for a BBB+ rating counterparty, 1.5% for BB+, and 7% for B+. You may assume that all other factors (capital charge, liquidity funding, processing costs, taxes, legal bills and other charges) are considered equal among the loans and represent a flat 1% of the loan amount. SINGAPORE UNIVERSITY OF SOCIAL SCIENCES (SUSS) Page 3 of 5 FIN306 Tutor-Marked Assignment Loan (A) Loan (B) Loan (C) 2.3% 5.3% 4.3% Loan Situations Loan pricing in annual % Risk profile expressed in Standard & Poor's rating Maturity in year BBB+ B+ BB+ 1.2 4.9 0.5 (c) Appraise the pricing of those loans and identify mispriced deals. (10 marks) The following table lists three different loans with their pricing, risk, and maturity profile. The current risk-free rate on a one-year loan is estimated to be 0.5%. The credit risk spread for a one-year maturity priced on the market today is 0.4% for a BBB+ rating counterparty, 1.5% for BB+, and 7% for B+. You may assume that all other factors (capital charge, liquidity funding, processing costs, taxes, legal bills and other charges) are considered equal among the loans and represent a flat 1% of the loan amount. SINGAPORE UNIVERSITY OF SOCIAL SCIENCES (SUSS) Page 3 of 5 FIN306 Tutor-Marked Assignment Loan (A) Loan (B) Loan (C) 2.3% 5.3% 4.3% Loan Situations Loan pricing in annual % Risk profile expressed in Standard & Poor's rating Maturity in year BBB+ B+ BB+ 1.2 4.9 0.5 (c) Appraise the pricing of those loans and identify mispriced deals. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts