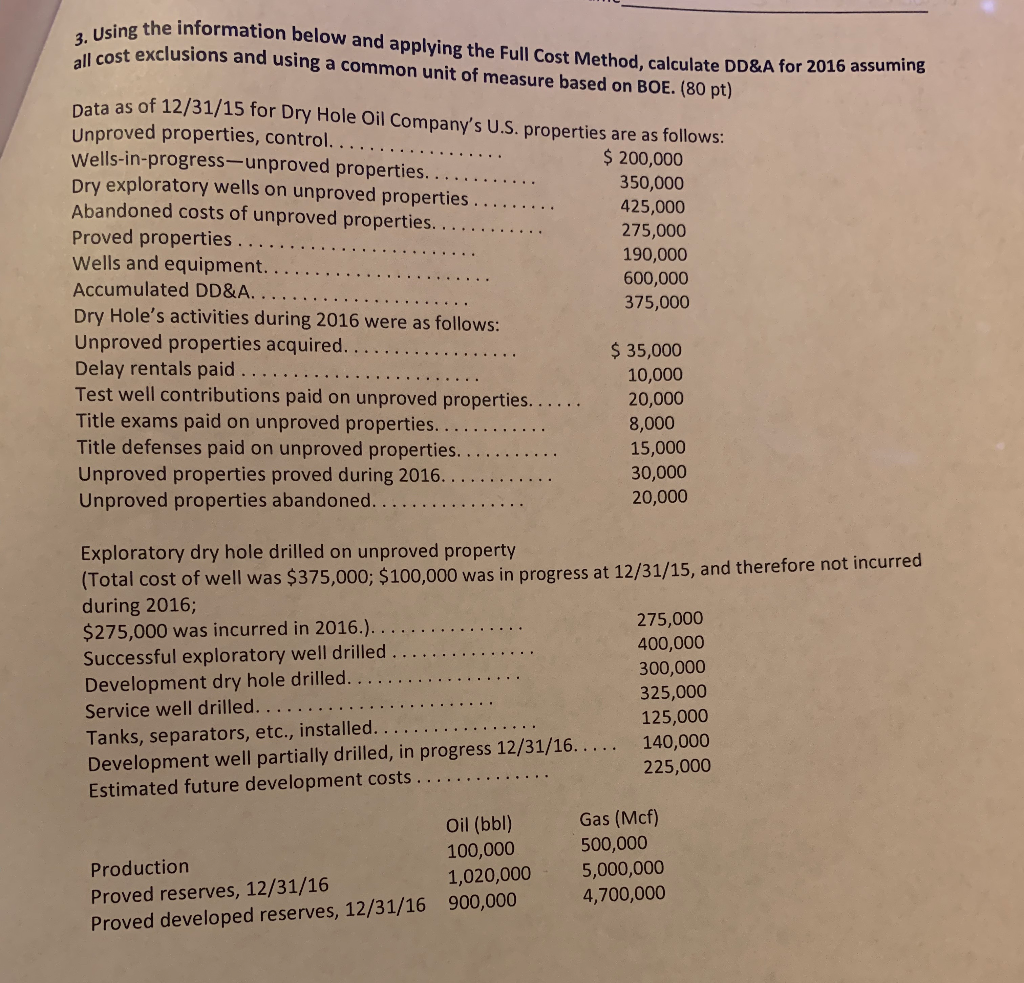

Question: the information below and applying the Full Cost Method, calculate DD& Siostexclusions and using a common unit of measure based on BOE. (80 pt) all

the information below and applying the Full Cost Method, calculate DD& Siostexclusions and using a common unit of measure based on BOE. (80 pt) all cost exclusions and using A for 2016 assuming a as of 12/31/15 for Dry Hole Oil Company's U.S. properties are as follows: Unproved properties, control.. 200,000 350,000 425,000 275,000 190,000 600,000 375,000 Dry exploratory wells on unproved properties . Dry Hole's activities during 2016 were as follows: $35,000 10,000 20,000 Delay rentals paid . .. Test well contributions paid on unproved properties. Title exams paid on unproved properties. Title defenses paid on unproved properties. . Unproved properties proved during 2016. . . 8,000 15,000 30,000 20,000 Exploratory dry hole drilled on unproved property (Total cost of well was $375,000; $100,000 was in progress at during 2016; $275,000 was incurred in 2016.). Successful exploratory well drilled . . Development dry hole drilled. Service well drilled. Tanks, separators, etc., installed. Development well partially drilled, in progress 12/31/16. Estimated future development costs . . . . 12/31/15, and therefore not incurred 275,000 400,000 300,000 325,000 125,000 .. 140,000 225,000 Gas (Mcf) 500,000 5,000,000 Oil (bbl) 100,000 1,020,000 Production Proved reserves, 12/31/16 Proved developed reserves, 12/31/16 4,700,000 900,000 the information below and applying the Full Cost Method, calculate DD& Siostexclusions and using a common unit of measure based on BOE. (80 pt) all cost exclusions and using A for 2016 assuming a as of 12/31/15 for Dry Hole Oil Company's U.S. properties are as follows: Unproved properties, control.. 200,000 350,000 425,000 275,000 190,000 600,000 375,000 Dry exploratory wells on unproved properties . Dry Hole's activities during 2016 were as follows: $35,000 10,000 20,000 Delay rentals paid . .. Test well contributions paid on unproved properties. Title exams paid on unproved properties. Title defenses paid on unproved properties. . Unproved properties proved during 2016. . . 8,000 15,000 30,000 20,000 Exploratory dry hole drilled on unproved property (Total cost of well was $375,000; $100,000 was in progress at during 2016; $275,000 was incurred in 2016.). Successful exploratory well drilled . . Development dry hole drilled. Service well drilled. Tanks, separators, etc., installed. Development well partially drilled, in progress 12/31/16. Estimated future development costs . . . . 12/31/15, and therefore not incurred 275,000 400,000 300,000 325,000 125,000 .. 140,000 225,000 Gas (Mcf) 500,000 5,000,000 Oil (bbl) 100,000 1,020,000 Production Proved reserves, 12/31/16 Proved developed reserves, 12/31/16 4,700,000 900,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts