Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Jasper Wood Company produces two products. The two products are turpentine and methanol. The company uses a joint process which cost $240,000. The

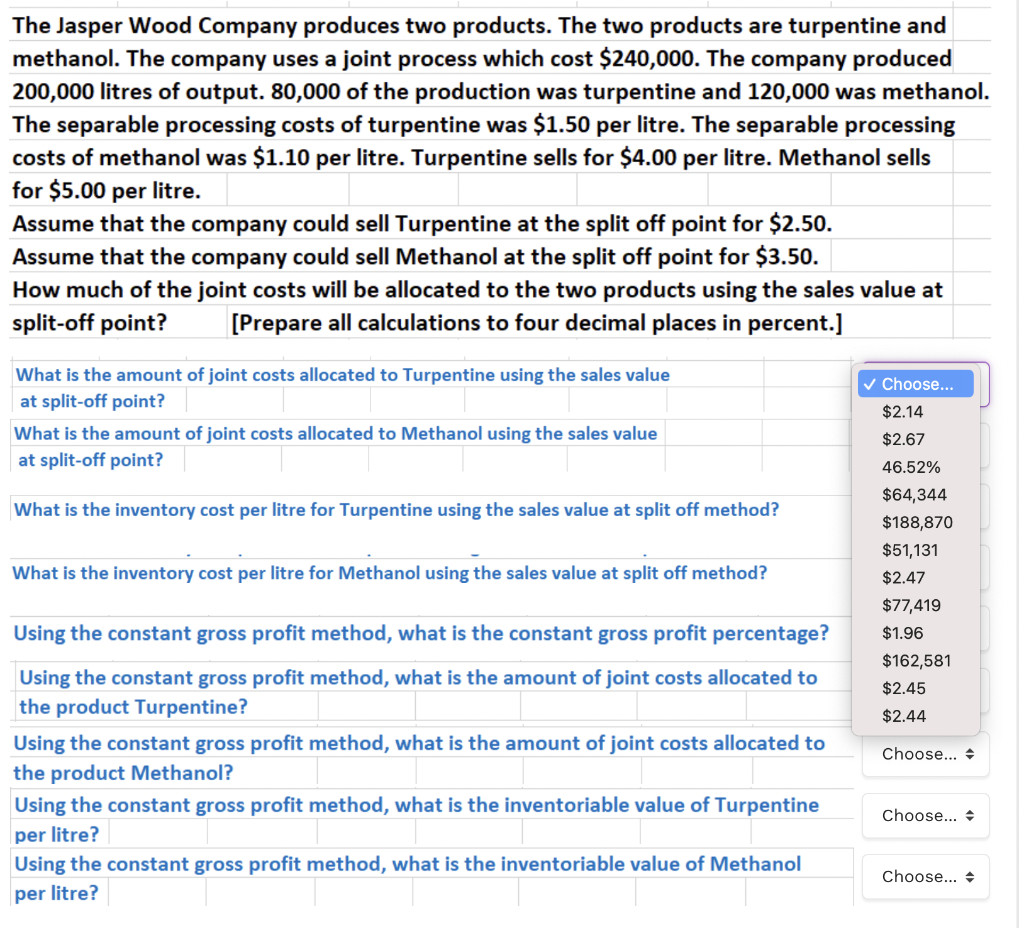

The Jasper Wood Company produces two products. The two products are turpentine and methanol. The company uses a joint process which cost $240,000. The company produced 200,000 litres of output. 80,000 of the production was turpentine and 120,000 was methanol. The separable processing costs of turpentine was $1.50 per litre. The separable processing costs of methanol was $1.10 per litre. Turpentine sells for $4.00 per litre. Methanol sells for $5.00 per litre. Assume that the company could sell Turpentine at the split off point for $2.50. Assume that the company could sell Methanol at the split off point for $3.50. How much of the joint costs will be allocated to the two products using the sales value at split-off point? [Prepare all calculations to four decimal places in percent.] What is the amount of joint costs allocated to Turpentine using the sales value at split-off point? What is the amount of joint costs allocated to Methanol using the sales value at split-off point? What is the inventory cost per litre for Turpentine using the sales value at split off method? What is the inventory cost per litre for Methanol using the sales value at split off method? Using the constant gross profit method, what is the constant gross profit percentage? Using the constant gross profit method, what is the amount of joint costs allocated to the product Turpentine? Using the constant gross profit method, what is the amount of joint costs allocated to the product Methanol? Using the constant gross profit method, what is the inventoriable value of Turpentine per litre? Using the constant gross profit method, what is the inventoriable value of Methanol per litre? Choose... $2.14 $2.67 46.52% $64,344 $188,870 $51,131 $2.47 $77,419 $1.96 $162,581 $2.45 $2.44 Choose... Choose... Choose...

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER Using the sales value at splitoff point method First calculate the total sales value at split...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started