Question: The premium on a call option is primarily a function of the difference in spot price S relative to the strike price X, the length

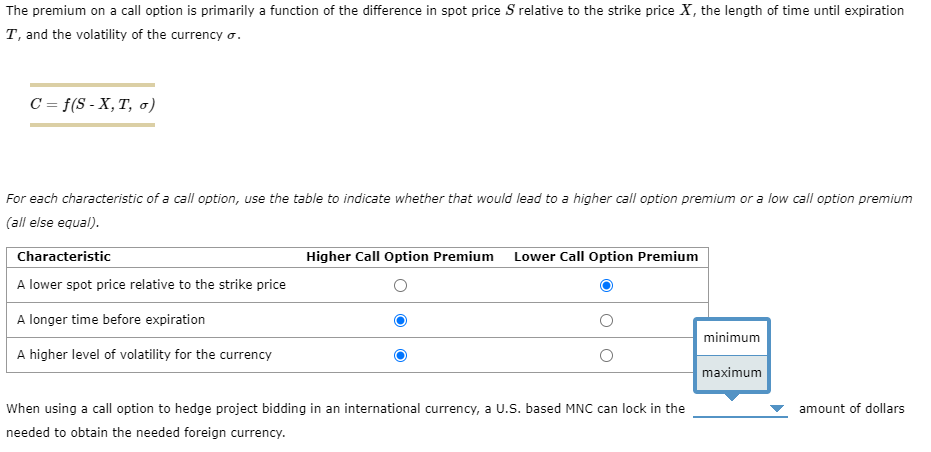

The premium on a call option is primarily a function of the difference in spot price S relative to the strike price X, the length of time until expiration T, and the volatility of the currency . C=f(S - X, T, ) For each characteristic of a call option, use the table to indicate whether that would lead to a higher call option premium or a low call option premium (all else equal). Characteristic Higher Call Option Premium Lower Call Option Premium A lower spot price relative to the strike price A longer time before expiration A higher level of volatility for the currency When using a call option to hedge project bidding in an international currency, a U.S. based MNC can lock in the amount of dollars needed to obtain the needed foreign currency.

The premium on a call option is primarily a function of the difference in spot price relative to the strike price X, the length of time until expiration T, and the volatility of the currency o. C = f(S - X,T, o) For each characteristic of a call option, use the table to indicate whether that would lead to a higher call option premium or a low call option premium (all else equal). Characteristic Higher Call Option Premium Lower Call Option Premium A lower spot price relative to the strike price A longer time before expiration minimum A higher level of volatility for the currency maximum amount of dollars When using a call option to hedge project bidding in an international currency, a U.S. based MNC can lock in the needed to obtain the needed foreign currency

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts