Question: The premium on a put option is primarily a function of the difference in spot price relative to the strike price X, the time until

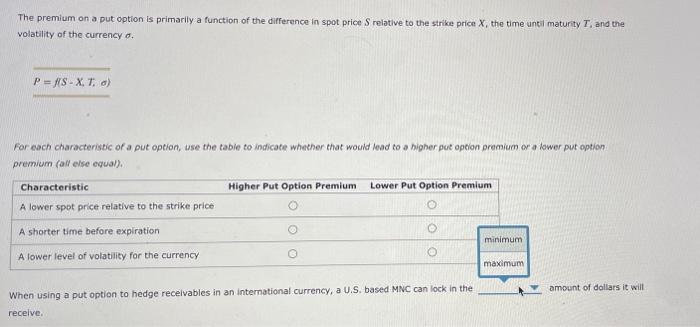

The premium on a put option is primarily a function of the difference in spot price relative to the strike price X, the time until maturity T, and the volatility of the currency . P = S-X. T. o) For each characteristic of a put option, use the table co indicate whether that would lead to a higher put option premium or a lower put option premium (all else equal). Characteristic Higher Put Option Premium Lower Put Option Premium A lower spot price relative to the strike price A shorter time before expiration minimum A lower level of volatility for the currency maximum amount of dollars it will When using a put option to hedge receivables in an international currency, a U.S. based MNC can lock in the receive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts