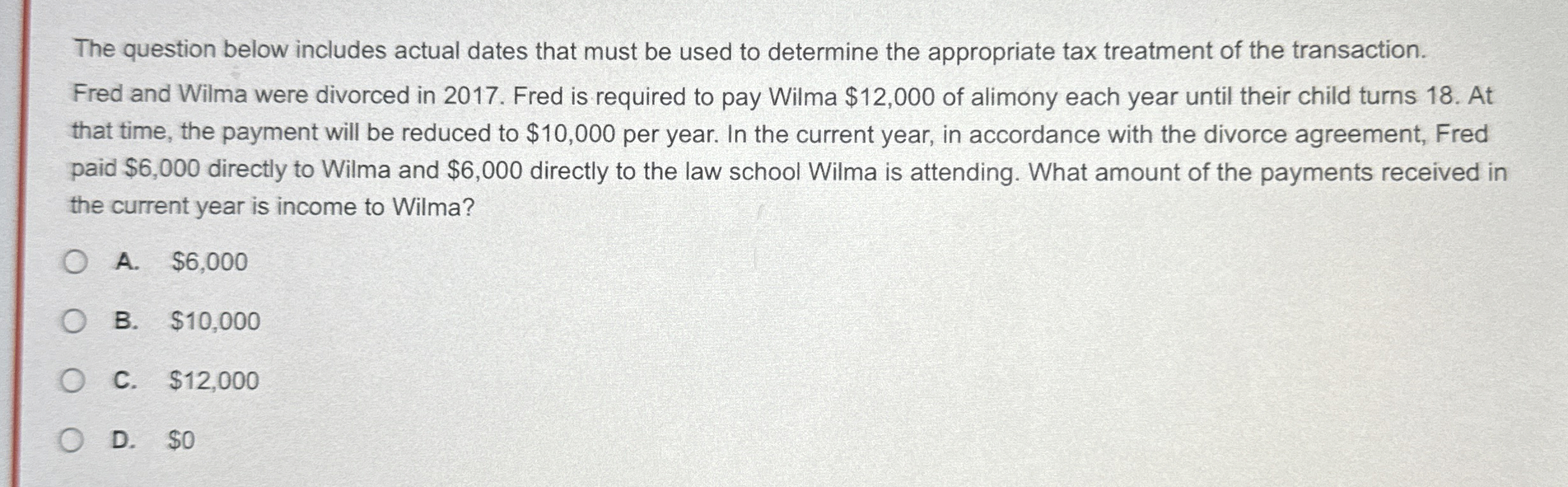

Question: The question below includes actual dates that must be used to determine the appropriate tax treatment of the transaction. Fred and Wilma were divorced in

The question below includes actual dates that must be used to determine the appropriate tax treatment of the transaction.

Fred and Wilma were divorced in Fred is required to pay Wilma $ of alimony each year until their child turns At

that time, the payment will be reduced to $ per year. In the current year, in accordance with the divorce agreement, Fred

paid $ directly to Wilma and $ directly to the law school Wilma is attending. What amount of the payments received in

the current year is income to Wilma?

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock