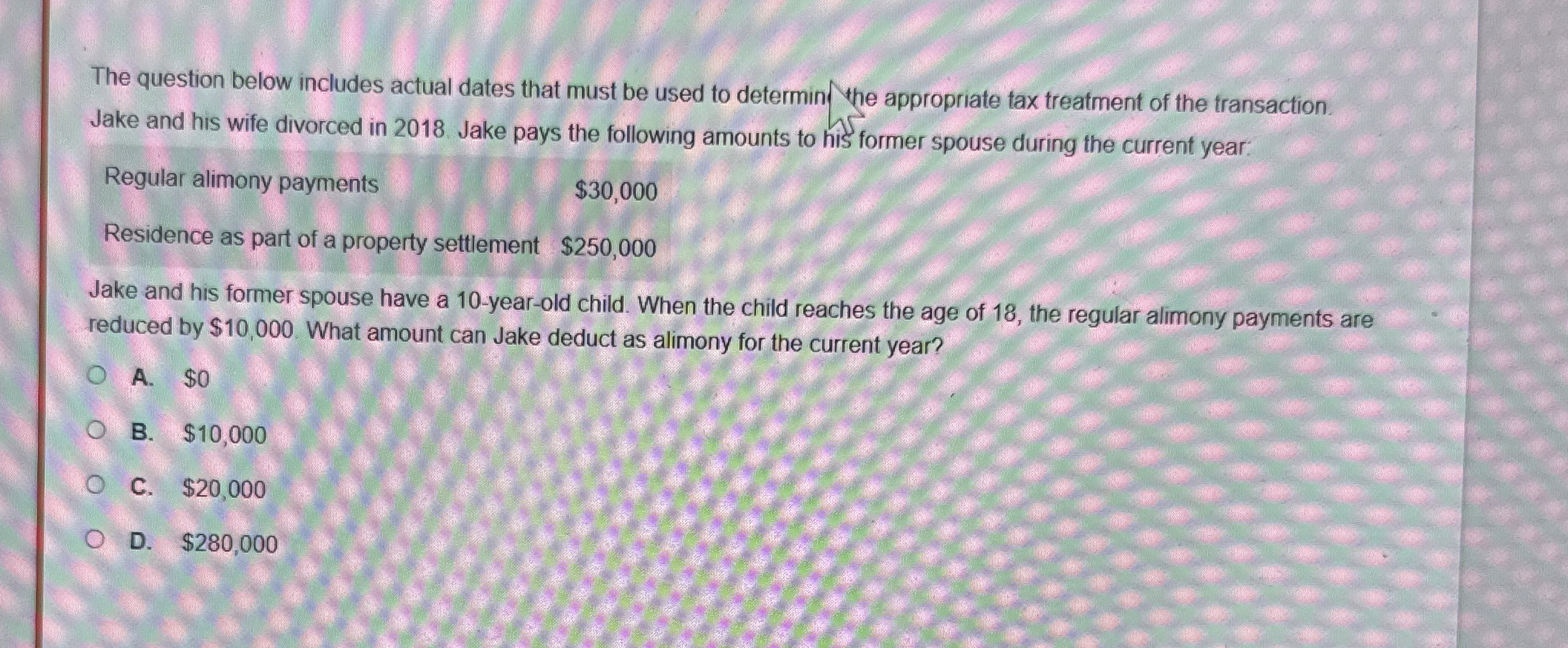

Question: The question below includes actual dates that must be used to determin the appropriate tax treatment of the fransaction. Jake and his wife divorced in

The question below includes actual dates that must be used to determin the appropriate tax treatment of the fransaction. Jake and his wife divorced in Jake pays the following amounts to his former spouse during the current year:

Regular alimony payments

$

Residence as part of a property settlement $

Jake and his former spouse have a yearold child. When the child reaches the age of the regular alimony payments are reduced by $ What amount can Jake deduct as alimony for the current year?

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock