Question: The real risivtre rate (r) is 2.8% and is expected to remain constant. Inflation is expected to be 6% per year for each of the

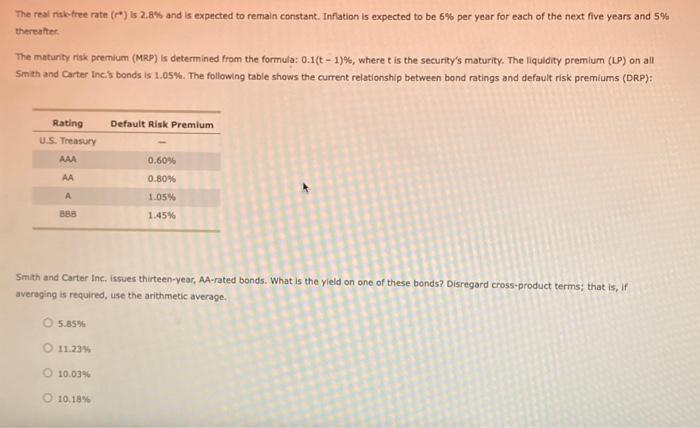

The real risivtre rate (r) is 2.8% and is expected to remain constant. Inflation is expected to be 6% per year for each of the next five years and 5% thereatier The maturity risk premium (MRP) is determined from the formula: 0.1(t1)%, where t is the security's maturity. The liquidity premium (IP) on all Smah and Carter Incis bonds is 1,05\%. The following table shows the current relationship between bond ratings and default risk premiums (DRP): Simith and Carter Inc., issues thirteen-year, AA-rated bonds. What is the yield on one of these bonds? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average. 5.85% 11.23% 10.0346 10,18%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts