Question: The solution on this is incorrect. Please help 5. Asset Allocation (30Pts) Marcel Birch has just retired as a professional dart thrower and wants to

The solution on this is incorrect. Please help

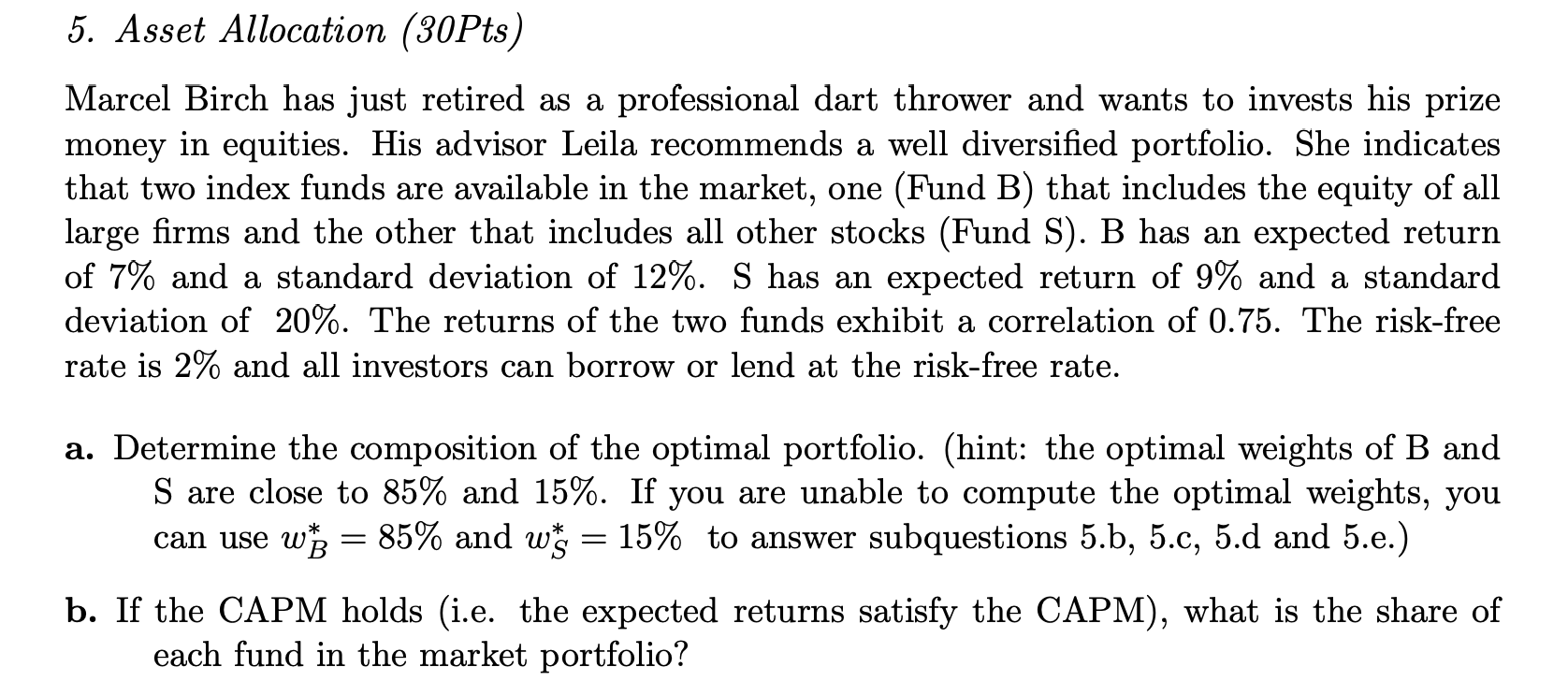

5. Asset Allocation (30Pts) Marcel Birch has just retired as a professional dart thrower and wants to invests his prize money in equities. His advisor Leila recommends a well diversified portfolio. She indicates that two index funds are available in the market, one (Fund B) that includes the equity of all large firms and the other that includes all other stocks (Fund S). B has an expected return of 7% and a standard deviation of 12%. S has an expected return of 9% and a standard deviation of 20%. The returns of the two funds exhibit a correlation of 0.75. The risk-free rate is 2% and all investors can borrow or lend at the risk-free rate. = a. Determine the composition of the optimal portfolio. (hint: the optimal weights of B and S are close to 85% and 15%. If you are unable to compute the optimal weights, you can use w = 85% and w 15% to answer subquestions 5.b, 5.c, 5.d and 5.e.) b. If the CAPM holds (i.e. the expected returns satisfy the CAPM), what is the share of each fund in the market portfolio? 5. Asset Allocation (30Pts) Marcel Birch has just retired as a professional dart thrower and wants to invests his prize money in equities. His advisor Leila recommends a well diversified portfolio. She indicates that two index funds are available in the market, one (Fund B) that includes the equity of all large firms and the other that includes all other stocks (Fund S). B has an expected return of 7% and a standard deviation of 12%. S has an expected return of 9% and a standard deviation of 20%. The returns of the two funds exhibit a correlation of 0.75. The risk-free rate is 2% and all investors can borrow or lend at the risk-free rate. = a. Determine the composition of the optimal portfolio. (hint: the optimal weights of B and S are close to 85% and 15%. If you are unable to compute the optimal weights, you can use w = 85% and w 15% to answer subquestions 5.b, 5.c, 5.d and 5.e.) b. If the CAPM holds (i.e. the expected returns satisfy the CAPM), what is the share of each fund in the market portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts