Question: The staff of Rey Rabago Company before closing reported a profit of P2,645,700 for the year ended Dec. 31, 2014. Upon review by the

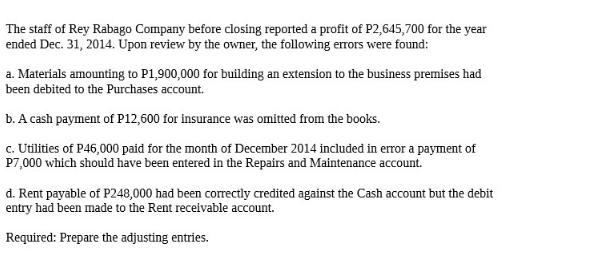

The staff of Rey Rabago Company before closing reported a profit of P2,645,700 for the year ended Dec. 31, 2014. Upon review by the owner, the following errors were found: a. Materials amounting to P1,900,000 for building an extension to the business premises had been debited to the Purchases account. b. A cash payment of P12,600 for insurance was omitted from the books. c. Utilities of P46,000 paid for the month of December 2014 included in error a payment of P7,000 which should have been entered in the Repairs and Maintenance account. d. Rent payable of P248,000 had been correctly credited against the Cash account but the debit entry had been made to the Rent receivable account. Required: Prepare the adjusting entries.

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

To correct the errors mentioned we need to make the necessary ad... View full answer

Get step-by-step solutions from verified subject matter experts