Question: The table below contains the Return on Assets (ROA) and the growth in sales for two publicly traded hospitality firms - one restaurant and

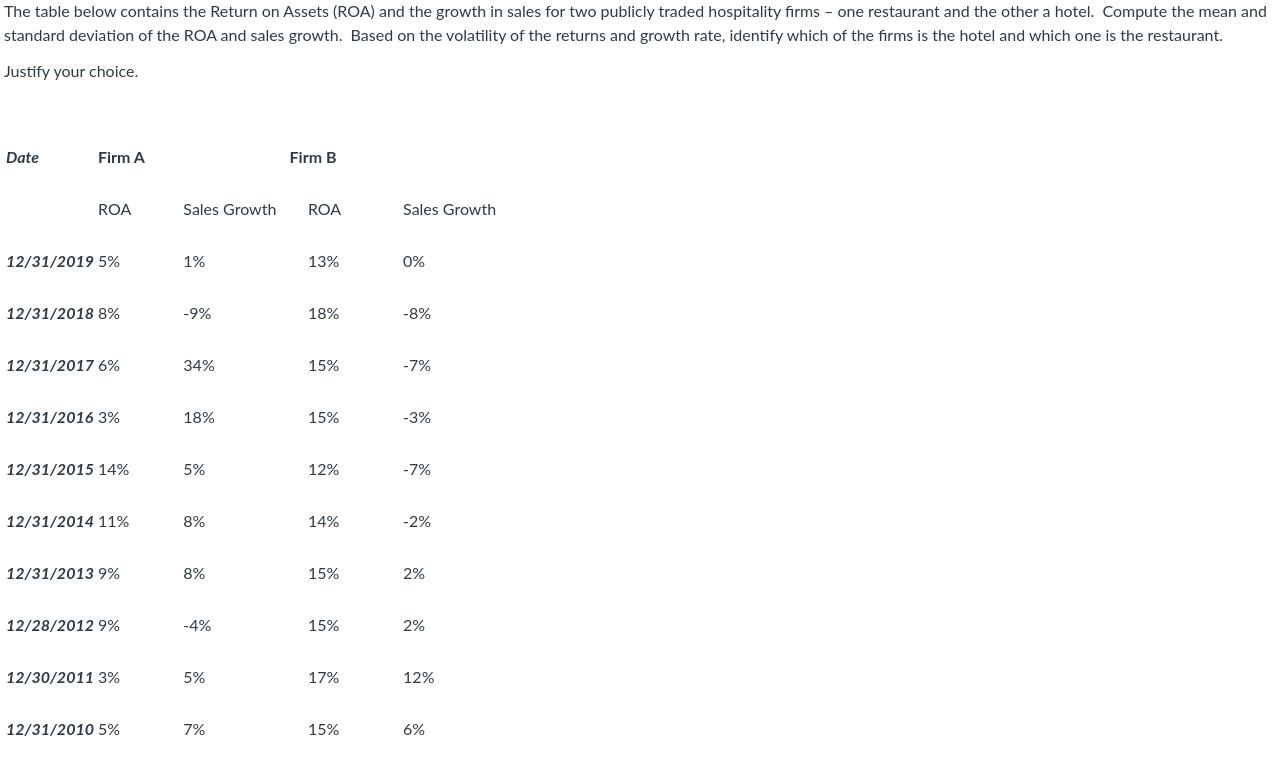

The table below contains the Return on Assets (ROA) and the growth in sales for two publicly traded hospitality firms - one restaurant and the other a hotel. Compute the mean and standard deviation of the ROA and sales growth. Based on the volatility of the returns and growth rate, identify which of the firms is the hotel and which one is the restaurant. Justify your choice. Date Firm A ROA 12/31/2019 5% 12/31/2018 8% 12/31/2017 6% 12/31/2016 3% 12/31/2015 14% 12/31/2014 11% 12/31/2013 9% 12/28/2012 9% 12/30/2011 3% 12/31/2010 5% Sales Growth 1% -9% 34% 18% 5% 8% 8% -4% 5% 7% Firm B ROA 13% 18% 15% 15% 12% 14% 15% 15% 17% 15% Sales Growth 0% -8% -7% -3% -7% -2% 2% 2% 12% 6%

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Mean average sum of values number of values Standard Deviation square root of sum of value mean2 num... View full answer

Get step-by-step solutions from verified subject matter experts