Question: The table below shows the call and put prices at various strike prices for the Australian dollar on February 2, 2015 for maturity in March

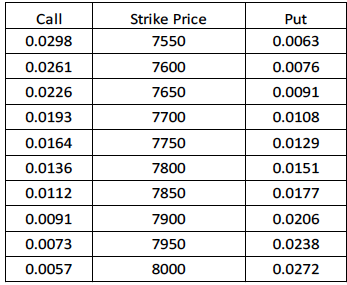

The table below shows the call and put prices at various strike prices for the Australian dollar on February 2, 2015 for maturity in March 2015 (The underlying asset is the Mar15 Australian futures contract, so it has the same maturity date as the Mar15 Australian dollar futures). The option contract size is AUD$100,000 per contract. The prices in the table are in dollars per AUD$ (for example, 0.0298 means $0.0298/AUD$). The strike price of 7550 should read as $0.7550/AUD$.

If you have to fulfill your debt obligation of AUD$1,000,000 in March 2015 (on the same date as the maturity date of the options), and you decide to use an option with a strike price of 7600 to hedge your position. What is the maximum potential cost per AUD$ when purchase AUD$ at maturity?

Your answer: $________________/AUD$

(Keep four decimals; Do not include currency symbols in your answer)

1 0-3-7 0_0_0_0_0_0_0_0_0_0 5 k-7_7_7 8 7 6-2-1-3-7 1 8-1-6-3 3 C-.0 0 | 0 | 0 | 0 | 0 | 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts