Question: The term book value has several uses. It can refer to a single asset or the company as a whole. When referring to an individual

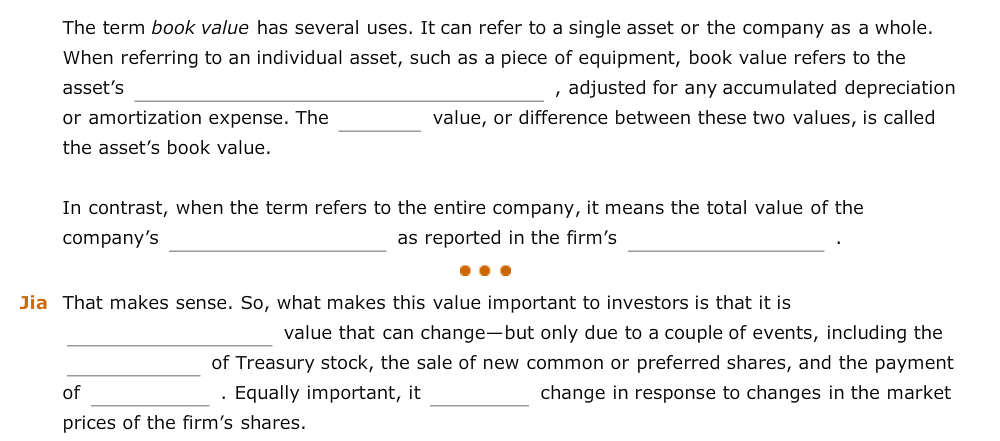

The term book value has several uses. It can refer to a single asset or the company as a whole. When referring to an individual asset, such as a piece of equipment, book value refers to the asset's or amortization expense. The the asset's book value. , adjusted for any accumulated depreciation value, or difference between these two values, is called In contrast, when the term refers to the entire company, it means the total value of the company's as reported in the firm's Jia That makes sense. So, what makes this value important to investors is that it is value that can change-but only due to a couple of events, including the of Treasury stock, the sale of new common or preferred shares, and the payment change in response to changes in the market of Equally important, it prices of the firm's shares. The term book value has several uses. It can refer to a single asset or the company as a whole. When referring to an individual asset, such as a piece of equipment, book value refers to the asset's or amortization expense. The the asset's book value. , adjusted for any accumulated depreciation value, or difference between these two values, is called In contrast, when the term refers to the entire company, it means the total value of the company's as reported in the firm's Jia That makes sense. So, what makes this value important to investors is that it is value that can change-but only due to a couple of events, including the of Treasury stock, the sale of new common or preferred shares, and the payment change in response to changes in the market of Equally important, it prices of the firm's shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts