Question: The topic is behavioral finance, could someone please answer question 1 and 2? 1. Question: Figure 2 (below) illustrates the difference between integration and segregation.

The topic is behavioral finance, could someone please answer question 1 and 2?

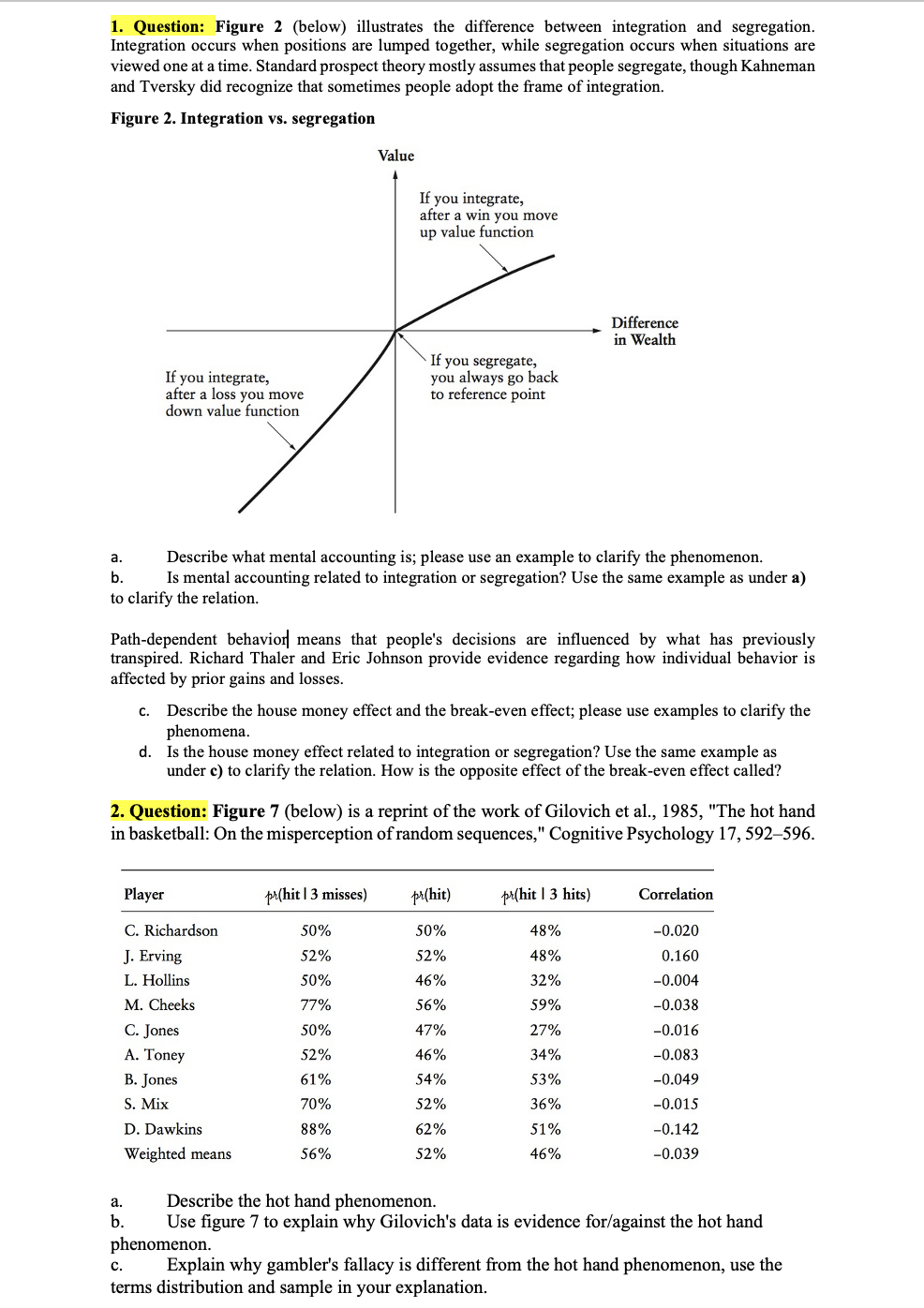

1. Question: Figure 2 (below) illustrates the difference between integration and segregation. Integration occurs when positions are lumped together, while segregation occurs when situations are viewed one at a time. Standard prospect theory mostly assumes that people segregate, though Kahneman and Tversky did recognize that sometimes people adopt the frame of integration. Figure 2. Integration vs. segregation a. Describe what mental accounting is; please use an example to clarify the phenomenon. b. Is mental accounting related to integration or segregation? Use the same example as under a) to clarify the relation. Path-dependent behavior means that people's decisions are influenced by what has previously transpired. Richard Thaler and Eric Johnson provide evidence regarding how individual behavior is affected by prior gains and losses. c. Describe the house money effect and the break-even effect; please use examples to clarify the phenomena. d. Is the house money effect related to integration or segregation? Use the same example as under c) to clarify the relation. How is the opposite effect of the break-even effect called? 2. Question: Figure 7 (below) is a reprint of the work of Gilovich et al., 1985, "The hot hand in basketball: On the misperception of random sequences," Cognitive Psychology 17, 592-596. a. Describe the hot hand phenomenon. b. Use figure 7 to explain why Gilovich's data is evidence for/against the hot hand phenomenon. c. Explain why gambler's fallacy is different from the hot hand phenomenon, use the terms distribution and sample in your explanation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts