Question: The US Social Security system provides an old-age benefit. Although the actual system is complicated, a simplified version of the system works as follows. Every

The US Social Security system provides an old-age benefit. Although the actual system is complicated, a simplified version of the system works as follows. Every dollar of earnings a worker earns (earnj ) at age j is taxed at the combined employee-employer rate of τ = .106, provided earnings are below the maximum taxable earnings. When a worker earns an extra dollar in a year this increases the worker’s average lifetime earnings and old-age benefits increase as a workers average lifetime earnings increases.

Answer questions (a) and (b) below. Present your calculations in the form of a graph plotting age against the marginal tax rate. Explain the logic of your

calculation.

(a) Calculate the marginal tax rate on earnings at every age j between 23 and 64 for a worker whose average lifetime earnings is forecasted to be beyond the ”first bendpoint” but not beyond the ”second bendpoint”?

(b) Calculate the marginal tax rate on earnings at every age j between 23 and 64 for a worker whose average lifetime earnings is forecasted to be beyond the ”second bendpoint”?

Critical Extra Information:

1. Interest rate r = .04

2. Demographics: a worker works from age 23-64, retires at age 65 and lives to age 80 and then dies.

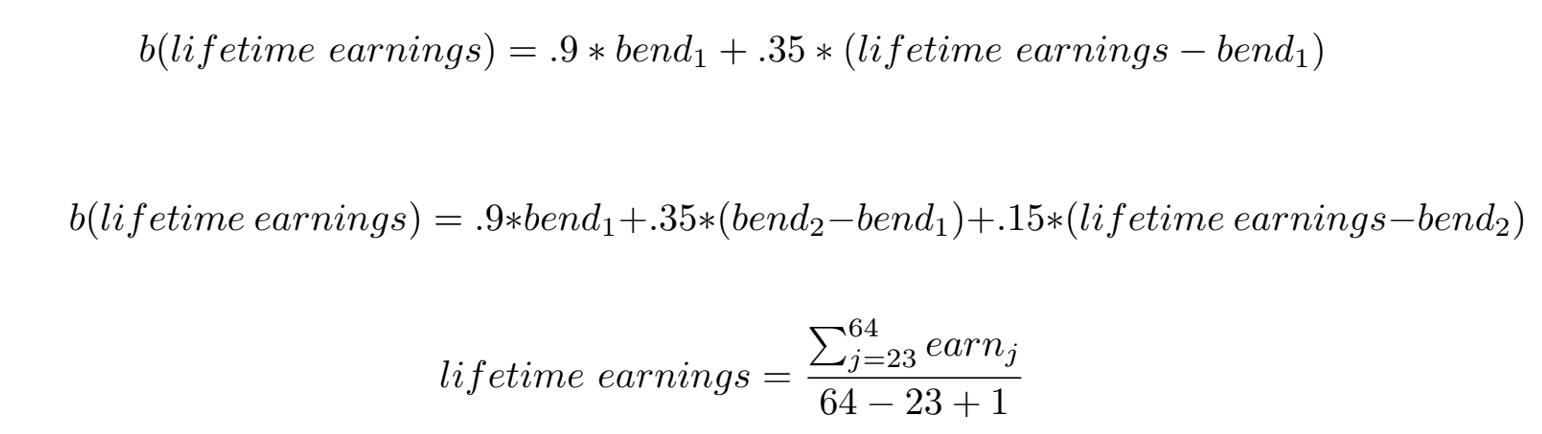

3. In retirement a worker receives an old-age benefit governed by the formulas below. The first formula holds for an individual with lifetime earnings greater than the ”first bendpoint” level bend1 but less than the second bend-point bend2. The second formula holds for an individual with lifetime earnings beyond the ”second bendpoint”.

b(lifetime earnings) = .9 * bend + .35 * (lifetime earnings - bend) b(lifetime earnings) = .9*bend+.35* (bend2-bend)+.15* (lifetime earnings-bend2) lifetime earnings = 64 j=23 earnj 64 23 +1 -

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Answer to a Logic of Calculation The marginal tax rate is the percentage of each additional dollar earned that is paid in taxesTo calculate the marginal tax rate at each age for a worker whose average ... View full answer

Get step-by-step solutions from verified subject matter experts