Question: The yields for Treasuries with differing maturities on a recent day are shown in the following table. ! a. Select the graph that represents the

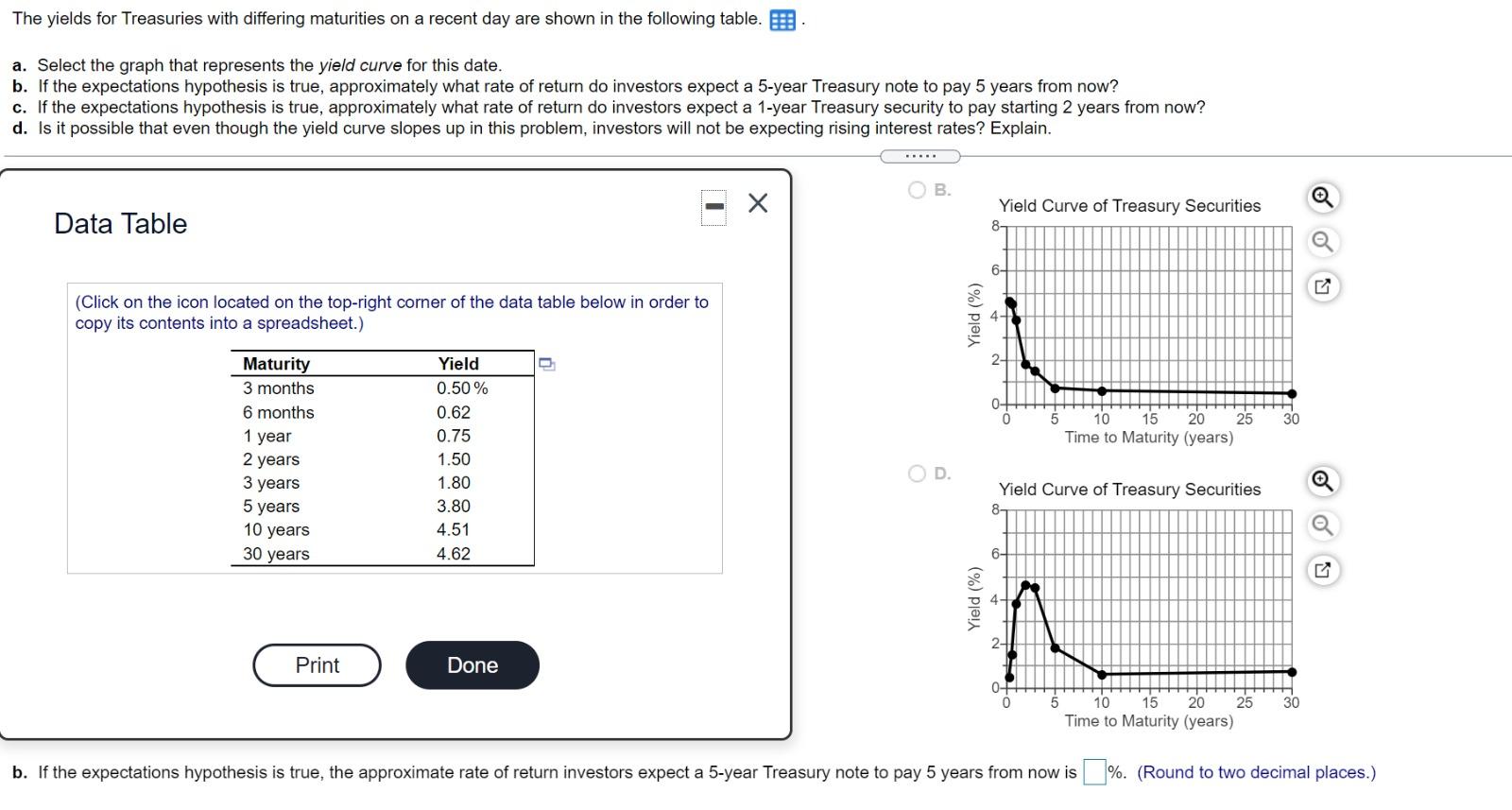

The yields for Treasuries with differing maturities on a recent day are shown in the following table. ! a. Select the graph that represents the yield curve for this date. b. If the expectations hypothesis is true, approximately what rate of return do investors expect a 5-year Treasury note to pay 5 years from now? c. If the expectations hypothesis is true, approximately what rate of return do investors expect a 1-year Treasury security to pay starting 2 years from now? d. Is it possible that even though the yield curve slopes up in this problem, investors will not be expecting rising interest rates? Explain. B. 1 Yield Curve of Treasury Securities Data Table 8 6- (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) (%) pje! 30 5 10 15 20 25 Time to Maturity (years) Maturity 3 months 6 months 1 year 2 years 3 years 5 years 10 years 30 years Yield 0.50 % 0.62 0.75 1.50 1.80 3.80 4.51 4.62 D. Yield Curve of Treasury Securities 8 6- Yield (%) 2- Print Done O-FH 0 30 5 10 15 20 25 Time to Maturity (years) b. If the expectations hypothesis is true, the approximate rate of return investors expect a 5-year Treasury note to pay 5 years from now is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts