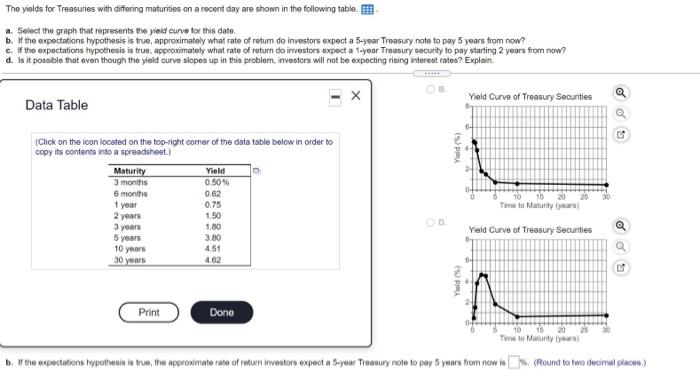

Question: The yields for Treasuries with differing maturities on a recent day are shown in the following table. a. Select the graph that represents the yield

The yields for Treasuries with differing maturities on a recent day are shown in the following table. a. Select the graph that represents the yield curve for this date b. If the expectations hypothesis is true approximately what rate of retum do investors expect a 5-year Treasury note to pay 5 years from now? C. If the expectations hypothesis is true approximately what rate of return do investors expect a 1-year Treasury security to pay starting 2 years from now? d. Is it possible that even though the yield curve slopes up in this problem, investors will not be expecting rising interest rates? Explain Data Table Yield Curve of Treasury Securities (s) (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Maturity Yield 3 months 0.50% 6 months 0.62 1 year 0.75 2 years 1.80 5 years 3.80 4.51 30 years 4.62 10 20 Time to Maturity years 1.50 3 years Yield Curve of Treasury Securities 10 years os Yold) Print Done 25 10 15 20 Time to Maurity b. the expectations hypothesis is true, the approximato rate of ratun inwestors expect a Boyeur Treasury note to pay 5 years from now is (Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts