Question: there are 5 possible answers the first one is keep orginal text second one is delete text is a picture for possible answers for each

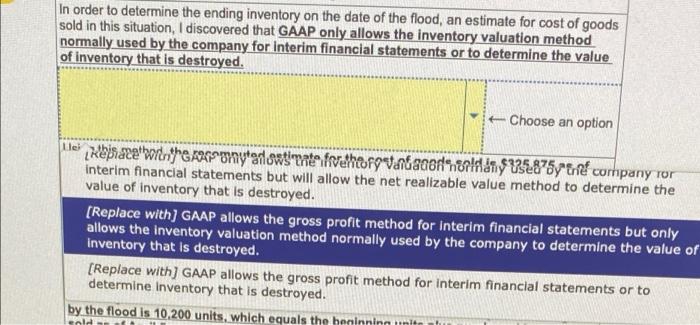

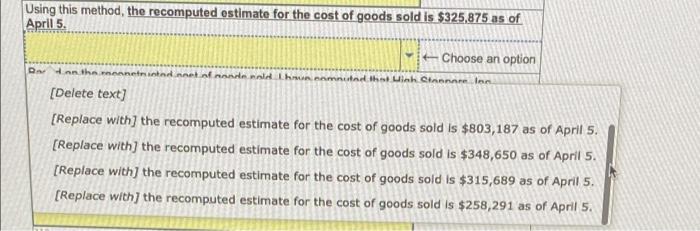

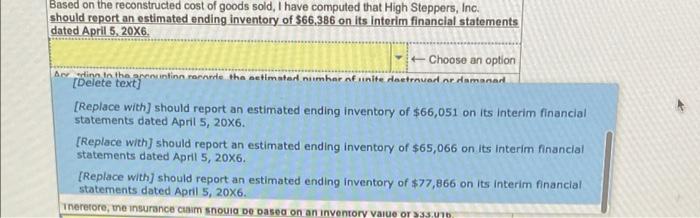

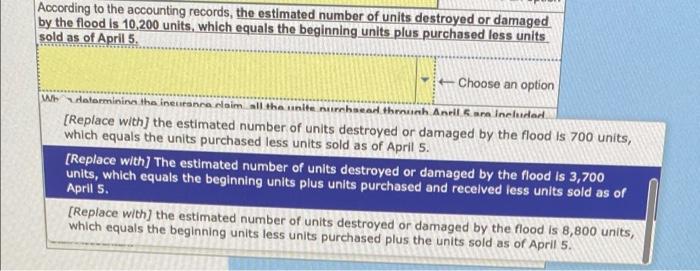

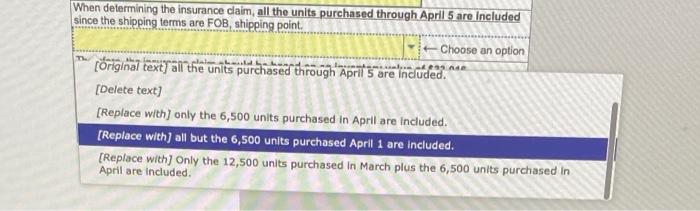

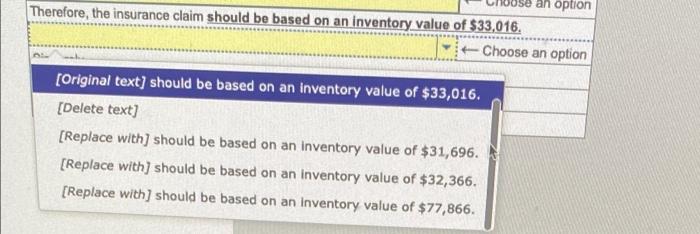

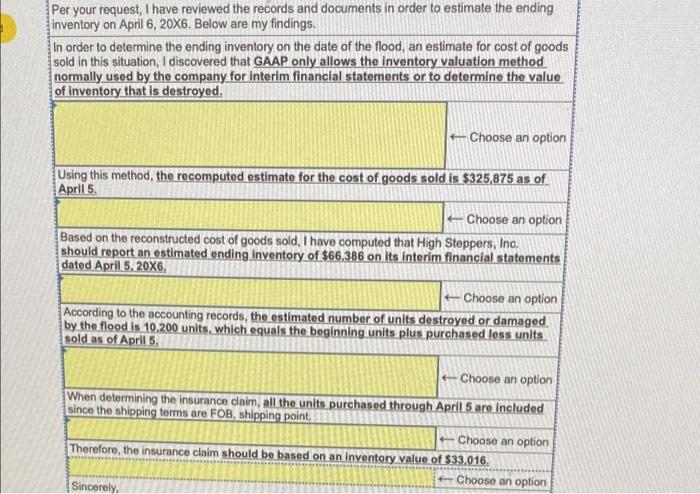

In order to determine the ending inventory on the date of the flood, an estimate for cost of goods sold in this situation, I discovered that GAAP only allows the inventory valuation method normally used by the company for interim financial statements or to determine the value of inventory that is destroyed. Choose an option llei 326874 Keisazet wordeste proytanowtimate fethergantaconnorldny 45.875yrret company ror interim financial statements but will allow the net realizable value method to determine the value of inventory that is destroyed. (Replace with) GAAP allows the gross profit method for interim financial statements but only allows the inventory valuation method normally used by the company to determine the value of Inventory that is destroyed. [Replace with) GAAP allows the gross profit method for interim financial statements or to determine Inventory that is destroyed. by the flood is 10.200 units, which equals the hepinninn unit old Using this method, the recomputed estimate for the cost of goods sold is $325,875 as of April 5. Choose an option Dw on the mannetuistad.net onde ad han come to Minh Cinnar Inn [Delete text] [Replace with] the recomputed estimate for the cost of goods sold is $803,187 as of April 5. [Replace with the recomputed estimate for the cost of goods sold is $348,650 as of April 5. [Replace with the recomputed estimate for the cost of goods sold is $315,689 as of April 5. [Replace with the recomputed estimate for the cost of goods sold is $258,291 as of April 5. Based on the reconstructed cost of goods sold, I have computed that High Steppers, Inc. should report an estimated ending inventory of $66,386 on its interim financial statements dated April 5, 20X6. Choose an option Acording to the pronuntinn arande the setimated number of interactuar nr demanar [Delete text) [Replace with) should report an estimated ending inventory of $66,051 on its interim financial statements dated April 5, 20X6. [Replace with should report an estimated ending inventory of $65,066 on its interim financial statements dated April 5, 20X6. [Replace with) should report an estimated ending inventory of $77,866 on its interim financial statements dated April 5, 20X6. Therefore, the insurance Cum soci de based on an inventory value or According to the accounting records, the estimated number of units destroyed or damaged by the flood is 10,200 units, which equals the beginning units plus purchased less units sold as of April 5. Choose an option Wb dafarmining the instance claim all the inte nur hearthrounh Anell an includert [Replace with the estimated number of units destroyed or damaged by the flood is 700 units, which equals the units purchased less units sold as of April 5. [Replace with) The estimated number of units destroyed or damaged by the flood is 3,700 units, which equals the beginning units plus units purchased and received less units sold as of April 5. [Replace with the estimated number of units destroyed or damaged by the flood Is 8,800 units, which equals the beginning units less units purchased plus the units sold as of April 5. When determining the insurance claim all the units purchased through April 5 are included since the shipping terms are FOB, shipping point. Choose an option [original text] all the units purchased through April 5 are included. [Delete text) [Replace with) only the 6,500 units purchased in April are included. [Replace with all but the 6,500 units purchased April 1 are included. [Replace with) Only the 12,500 units purchased in March plus the 6,500 units purchased in April are included an option Therefore, the insurance claim should be based on an inventory value of $33,016. Choose an option (Original text) should be based on an inventory value of $33,016. [Delete text] [Replace with) should be based on an inventory value of $31,696. [Replace with) should be based on an inventory value of $32,366. [Replace with) should be based on an inventory value of $77,866. Per your request, I have reviewed the records and documents in order to estimate the ending inventory on April 6, 20X6. Below are my findings. In order to determine the ending inventory on the date of the flood, an estimate for cost of goods sold in this situation, I discovered that GAAP only allows the inventory valuation method normally used by the company for interim financial statements or to determine the value of inventory that is destroyed. - Choose an option Using this method, the recomputed estimate for the cost of goods sold is $325,875 as of April 5. Choose an option Based on the reconstructed cost of goods sold, I have computed that High Steppers, Inc. should report an estimated ending Inventory of $66,386 on its interim financial statements dated April 5, 20X6. Choose an option According to the accounting records, the estimated number of units destroyed or damaged by the flood is 10.200 units, which equals the beginning units plus purchased loss units sold as of April. Choose an option When determining the insurance daim, all the units purchased through April 5 are included since the shipping terms are FOB, shipping point. Choose an option Therefore, the insurance claim should be based on an Inventory value of $33,016, - Choose an option Sincerely. In order to determine the ending inventory on the date of the flood, an estimate for cost of goods sold in this situation, I discovered that GAAP only allows the inventory valuation method normally used by the company for interim financial statements or to determine the value of inventory that is destroyed. Choose an option llei 326874 Keisazet wordeste proytanowtimate fethergantaconnorldny 45.875yrret company ror interim financial statements but will allow the net realizable value method to determine the value of inventory that is destroyed. (Replace with) GAAP allows the gross profit method for interim financial statements but only allows the inventory valuation method normally used by the company to determine the value of Inventory that is destroyed. [Replace with) GAAP allows the gross profit method for interim financial statements or to determine Inventory that is destroyed. by the flood is 10.200 units, which equals the hepinninn unit old Using this method, the recomputed estimate for the cost of goods sold is $325,875 as of April 5. Choose an option Dw on the mannetuistad.net onde ad han come to Minh Cinnar Inn [Delete text] [Replace with] the recomputed estimate for the cost of goods sold is $803,187 as of April 5. [Replace with the recomputed estimate for the cost of goods sold is $348,650 as of April 5. [Replace with the recomputed estimate for the cost of goods sold is $315,689 as of April 5. [Replace with the recomputed estimate for the cost of goods sold is $258,291 as of April 5. Based on the reconstructed cost of goods sold, I have computed that High Steppers, Inc. should report an estimated ending inventory of $66,386 on its interim financial statements dated April 5, 20X6. Choose an option Acording to the pronuntinn arande the setimated number of interactuar nr demanar [Delete text) [Replace with) should report an estimated ending inventory of $66,051 on its interim financial statements dated April 5, 20X6. [Replace with should report an estimated ending inventory of $65,066 on its interim financial statements dated April 5, 20X6. [Replace with) should report an estimated ending inventory of $77,866 on its interim financial statements dated April 5, 20X6. Therefore, the insurance Cum soci de based on an inventory value or According to the accounting records, the estimated number of units destroyed or damaged by the flood is 10,200 units, which equals the beginning units plus purchased less units sold as of April 5. Choose an option Wb dafarmining the instance claim all the inte nur hearthrounh Anell an includert [Replace with the estimated number of units destroyed or damaged by the flood is 700 units, which equals the units purchased less units sold as of April 5. [Replace with) The estimated number of units destroyed or damaged by the flood is 3,700 units, which equals the beginning units plus units purchased and received less units sold as of April 5. [Replace with the estimated number of units destroyed or damaged by the flood Is 8,800 units, which equals the beginning units less units purchased plus the units sold as of April 5. When determining the insurance claim all the units purchased through April 5 are included since the shipping terms are FOB, shipping point. Choose an option [original text] all the units purchased through April 5 are included. [Delete text) [Replace with) only the 6,500 units purchased in April are included. [Replace with all but the 6,500 units purchased April 1 are included. [Replace with) Only the 12,500 units purchased in March plus the 6,500 units purchased in April are included an option Therefore, the insurance claim should be based on an inventory value of $33,016. Choose an option (Original text) should be based on an inventory value of $33,016. [Delete text] [Replace with) should be based on an inventory value of $31,696. [Replace with) should be based on an inventory value of $32,366. [Replace with) should be based on an inventory value of $77,866. Per your request, I have reviewed the records and documents in order to estimate the ending inventory on April 6, 20X6. Below are my findings. In order to determine the ending inventory on the date of the flood, an estimate for cost of goods sold in this situation, I discovered that GAAP only allows the inventory valuation method normally used by the company for interim financial statements or to determine the value of inventory that is destroyed. - Choose an option Using this method, the recomputed estimate for the cost of goods sold is $325,875 as of April 5. Choose an option Based on the reconstructed cost of goods sold, I have computed that High Steppers, Inc. should report an estimated ending Inventory of $66,386 on its interim financial statements dated April 5, 20X6. Choose an option According to the accounting records, the estimated number of units destroyed or damaged by the flood is 10.200 units, which equals the beginning units plus purchased loss units sold as of April. Choose an option When determining the insurance daim, all the units purchased through April 5 are included since the shipping terms are FOB, shipping point. Choose an option Therefore, the insurance claim should be based on an Inventory value of $33,016, - Choose an option Sincerely

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts