Question: There are FIVE questions, can someone please answer all? Thank you Puffin Corporation has two divisions, North and South. Puffin's total company sales are $500,000,

There are FIVE questions, can someone please answer all?

Thank you

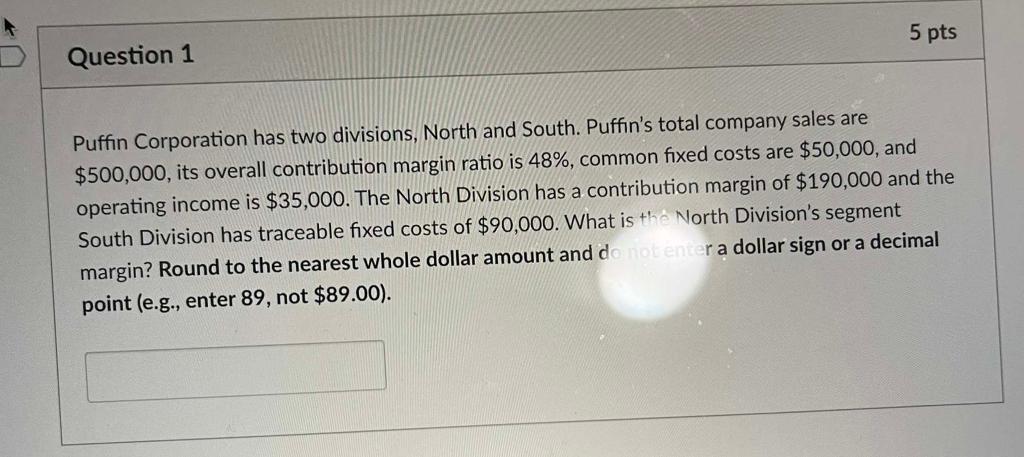

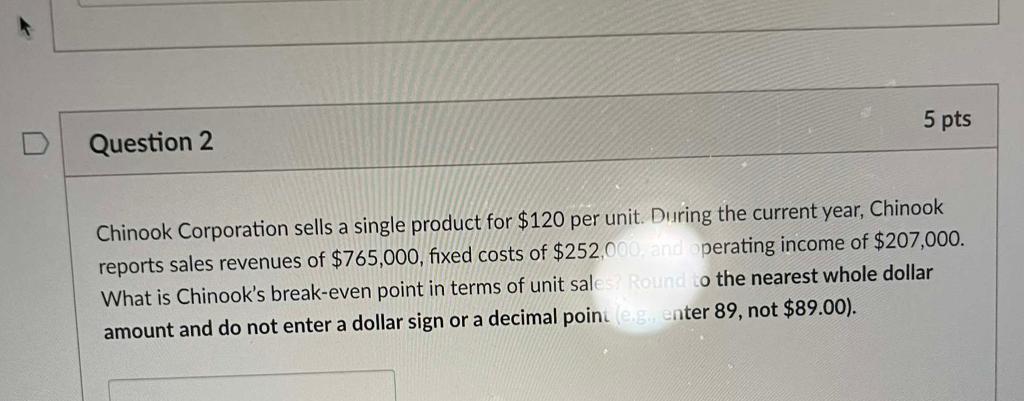

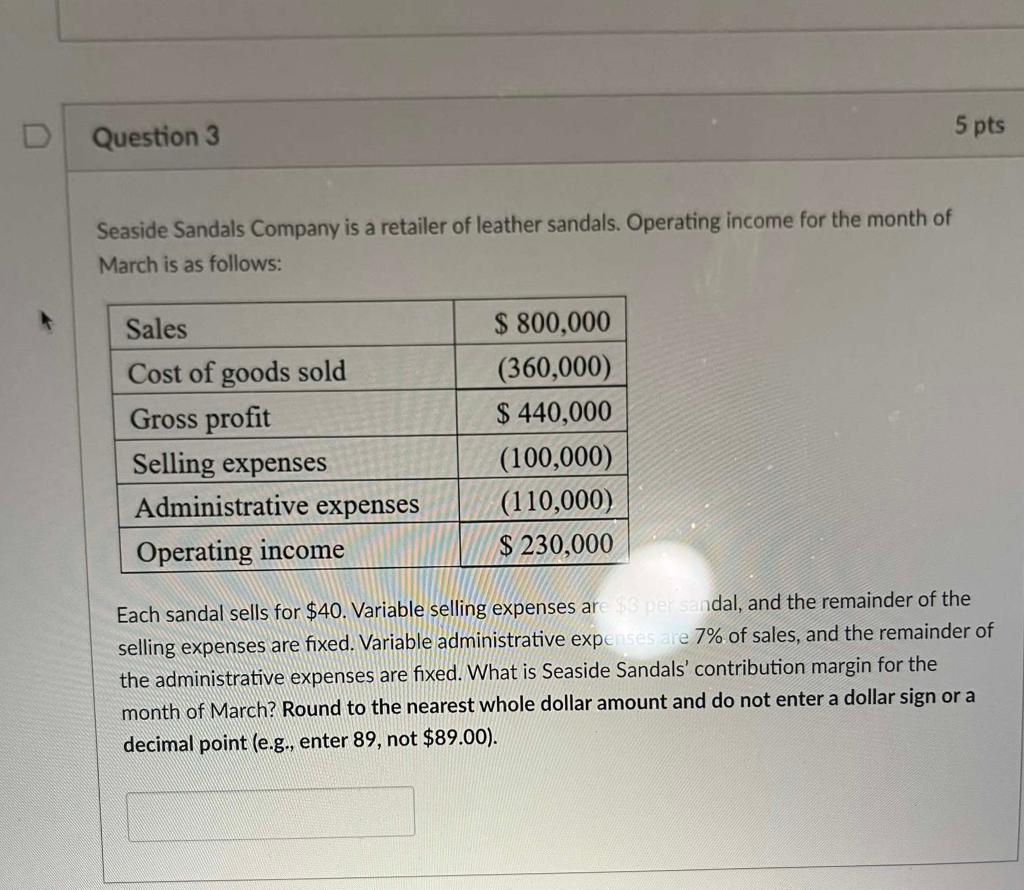

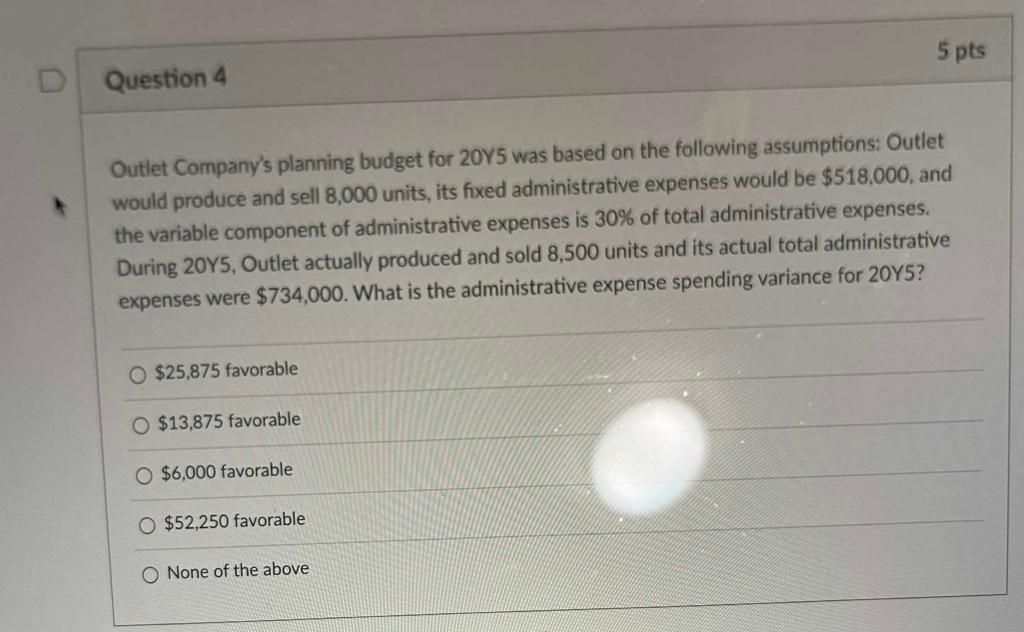

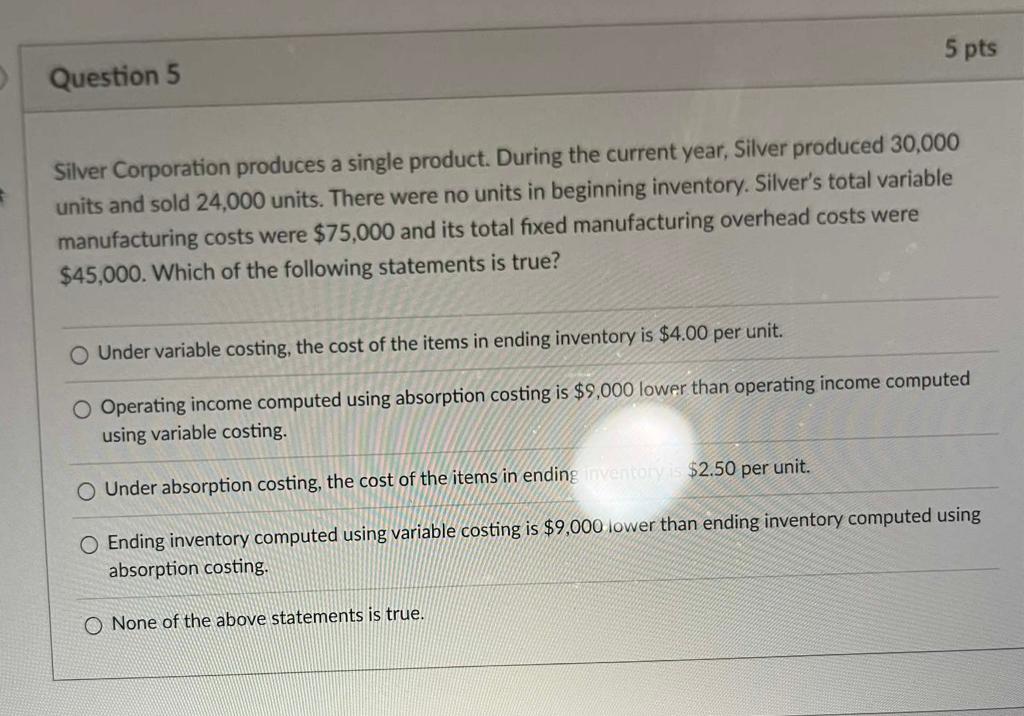

Puffin Corporation has two divisions, North and South. Puffin's total company sales are $500,000, its overall contribution margin ratio is 48%, common fixed costs are $50,000, and operating income is $35,000. The North Division has a contribution margin of $190,000 and the South Division has traceable fixed costs of $90,000. What is the North Division's segment margin? Round to the nearest whole dollar amount and d r a dollar sign or a decimal point (e.g., enter 89 , not $89.00 ). Chinook Corporation sells a single product for $120 per unit. During the current year, Chinook reports sales revenues of $765,000, fixed costs of $252,0 perating income of $207,000. What is Chinook's break-even point in terms of unit sale o the nearest whole dollar amount and do not enter a dollar sign or a decimal poini ( enter 89, not $89.00 ). Seaside Sandals Company is a retailer of leather sandals. Operating income for the month of March is as follows: Each sandal sells for $40. Variable selling expenses ar Idal, and the remainder of the selling expenses are fixed. Variable administrative expe 7% of sales, and the remainder of the administrative expenses are fixed. What is Seaside Sandals' contribution margin for the month of March? Round to the nearest whole dollar amount and do not enter a dollar sign or a decimal point (e.g., enter 89, not $89.00 ). Outlet Company's planning budget for 20 Y 5 was based on the following assumptions: Outlet would produce and sell 8,000 units, its fixed administrative expenses would be $518,000, and the variable component of administrative expenses is 30% of total administrative expenses. During 20Y5, Outlet actually produced and sold 8,500 units and its actual total administrative expenses were $734,000. What is the administrative expense spending variance for 20Y5 ? $25,875 favorable $13,875 favorable $6,000 favorable $52,250 favorable None of the above Silver Corporation produces a single product. During the current year, Silver produced 30,000 units and sold 24,000 units. There were no units in beginning inventory. Silver's total variable manufacturing costs were $75,000 and its total fixed manufacturing overhead costs were $45,000. Which of the following statements is true? Under variable costing, the cost of the items in ending inventory is $4.00 per unit. Operating income computed using absorption costing is $9,000 lower than operating income computed using variable costing. Under absorption costing, the cost of the items in ending $2.50 per unit. Ending inventory computed using variable costing is $9,000 iower than ending inventory computed using absorption costing. None of the above statements is true

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts