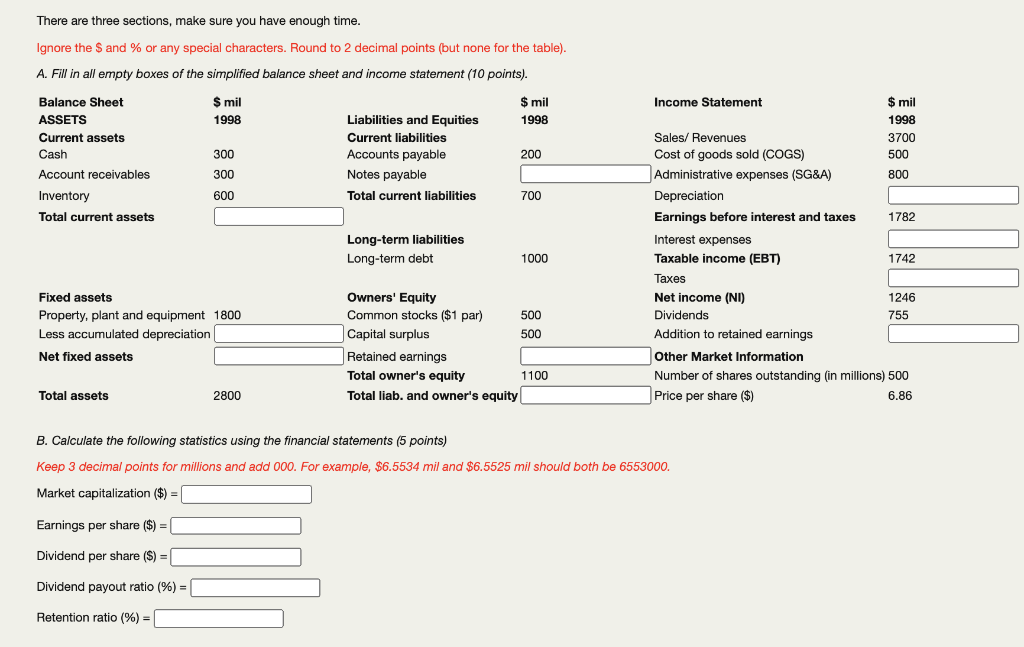

Question: There are three sections, make sure you have enough time. Ignore the $ and % or any special characters. Round to 2 decimal points (but

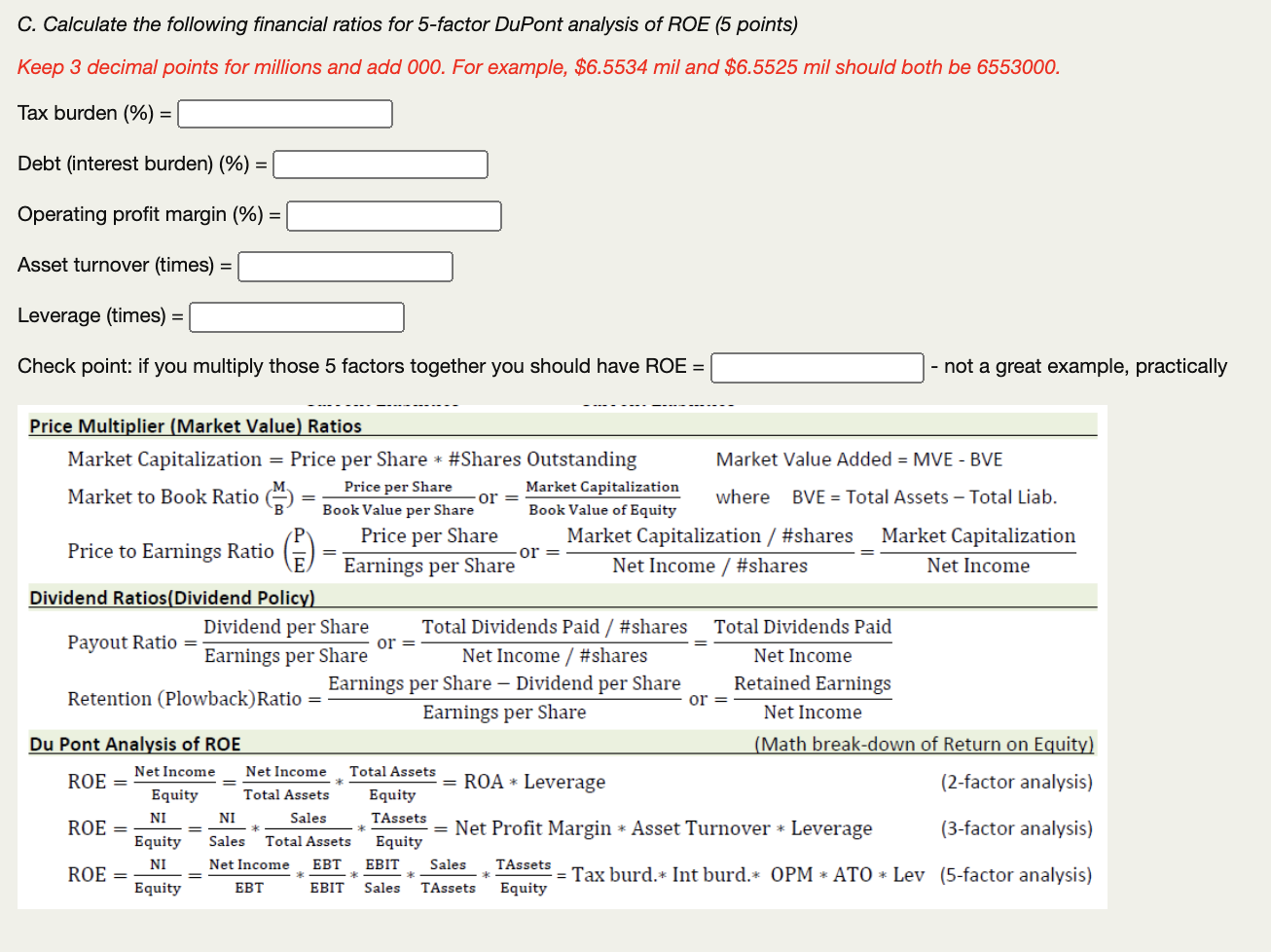

There are three sections, make sure you have enough time. Ignore the $ and % or any special characters. Round to 2 decimal points (but none for the table). A. Fill in all empty boxes of the simplified balance sheet and income statement (10 points) Balance Sheet $ mil $ mil ASSETS 1998 Liabilities and Equities 1998 Current assets Current liabilities Cash 300 Accounts payable 200 Account receivables 300 Notes payable Inventory 600 Total current liabilities 700 Total current assets Long-term liabilities Long-term debt 1000 Income Statement $ mil 1998 Sales/ Revenues 3700 Cost of goods sold (COGS) 500 Administrative expenses (SG&A) 800 Depreciation Earnings before interest and taxes 1782 Interest expenses Taxable income (EBT) 1742 Taxes Net income (NI) Dividends 755 Addition to retained earnings Other Market Information Number of shares outstanding (in millions) 500 Price per share ($) 6.86 1246 Fixed assets Property, plant and equipment 1800 Less accumulated depreciation Net fixed assets Owners' Equity Common stocks ($1 par) 500 Capital surplus 500 Retained earnings Total owner's equity 1100 Total liab. and owner's equity Total assets 2800 B. Calculate the following statistics using the financial statements (5 points) Keep 3 decimal points for millions and add 000. For example, $6.5534 mil and $6.5525 mil should both be 6553000. Market capitalization ($) = Earnings per share ($) = Dividend per share ($) = Dividend payout ratio (%) = Retention ratio (%) = C. Calculate the following financial ratios for 5-factor DuPont analysis of ROE (5 points) Keep 3 decimal points for millions and add 000. For example, $6.5534 mil and $6.5525 mil should both be 6553000. Tax burden (%) = Debt (interest burden) (%) = Operating profit margin (%) = Asset turnover (times) = Leverage (times) = Check point: if you multiply those 5 factors together you should have ROE = not a great example, practically Price Multiplier (Market Value) Ratios Market Capitalization = Price per Share * #Shares Outstanding Market Value Added = MVE-BVE Price per Share Market Capitalization Market to Book Ratio or = where BVE = Total Assets - Total Liab. Book Value per Share Book Value of Equity Price per Share Market Capitalization / #shares Market Capitalization Price to Earnings Ratio or = Earnings per Share Net Income / #shares Net Income Dividend Ratios Dividend Policy) Dividend per Share Total Dividends Paid / #shares Total Dividends Paid Payout Ratio or = Earnings per Share Net Income / #shares Net Income Earnings per Share - Dividend per Share Retained Earnings Retention (Plowback) Ratio or = Earnings per Share Net Income Du Pont Analysis of ROE (Math break-down of Return on Equity) Net Income Net Income Total Assets ROE = = ROA * Leverage (2-factor analysis) Equity Total Assets Equity NI NI Sales TAssets ROE = = Net Profit Margin * Asset Turnover * Leverage (3-factor analysis) Equity Sales Total Assets Equity NI Net Income EBT EBIT Sales ROE = TAssets = Tax burd.* Int burd.* OPM * ATO * Lev (5-factor analysis) Equity EBT EBIT Sales TAssets Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts