Question: There are two different answers for the same question on Chegg. Please redo. Ondjobo Limited is a company that was incorporated on 1 April 2010

There are two different answers for the same question on Chegg. Please redo.

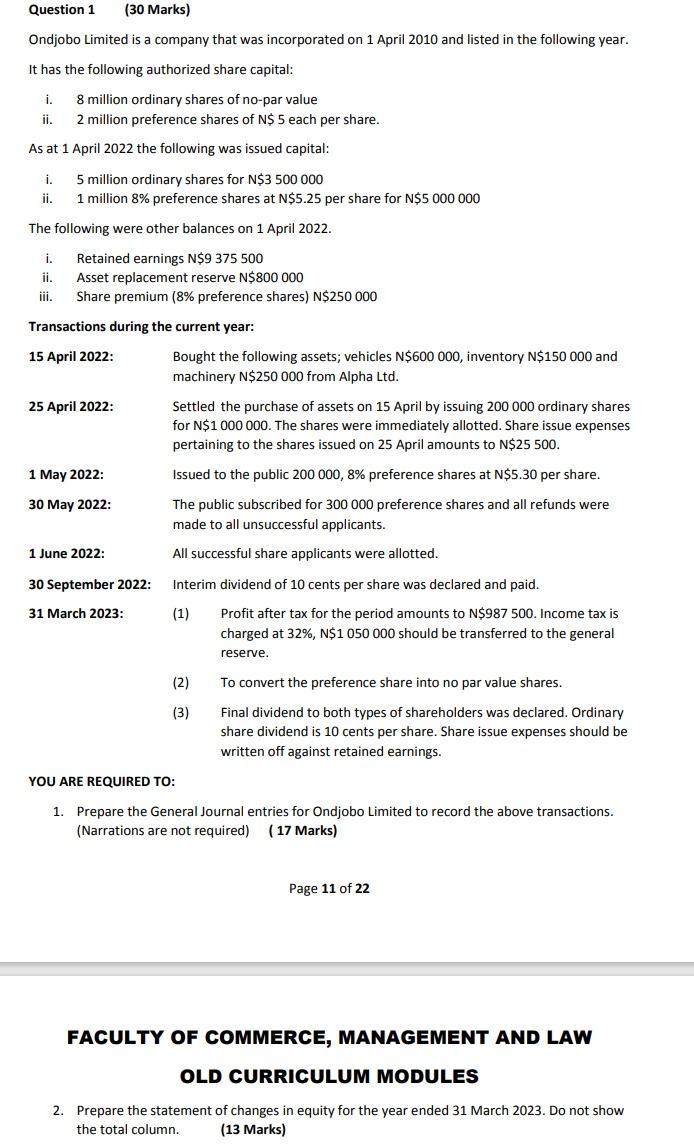

Ondjobo Limited is a company that was incorporated on 1 April 2010 and listed in the following year. It has the following authorized share capital: i. 8 million ordinary shares of no-par value ii. 2 million preference shares of N5 each per share. As at 1 April 2022 the following was issued capital: i. 5 million ordinary shares for N$300000 ii. 1 million 8% preference shares at N$5.25 per share for N$5000000 The following were other balances on 1 April 2022. i. Retained earnings N\$9 375500 ii. Asset replacement reserve N$800000 iii. Share premium ( 8% preference shares) N $250000 Transactions during the current year: 15 April 2022: Bought the following assets; vehicles N$600000, inventory N$150000 and machinery N $250000 from Alpha Ltd. 25 April 2022: Settled the purchase of assets on 15 April by issuing 200000 ordinary shares for N$1000000. The shares were immediately allotted. Share issue expenses pertaining to the shares issued on 25 April amounts to N$2500. 1 May 2022: IIssued to the public 200000,8% preference shares at N$5.30 per share. 30 May 2022: The public subscribed for 300000 preference shares and all refunds were made to all unsuccessful applicants. 1 June 2022: All successful share applicants were allotted. 30 September 2022: I Interim dividend of 10 cents per share was declared and paid. 31 March 2023: (1) Profit after tax for the period amounts to N$987500. Income tax is charged at 32%,N$1050000 should be transferred to the general reserve. (2) To convert the preference share into no par value shares. (3) Final dividend to both types of shareholders was declared. Ordinary share dividend is 10 cents per share. Share issue expenses should be written off against retained earnings. YOU ARE REQUIRED TO: 1. Prepare the General Journal entries for Ondjobo Limited to record the above transactions. (Narrations are not required) (17 Marks) Page 11 of 22 FACULTY OF COMMERCE, MANAGEMENT AND LAW OLD CURRICULUM MODULES 2. Prepare the statement of changes in equity for the year ended 31 March 2023. Do not show the total column. (13 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts