Question: There is another term that you will often encounter when performing time value of calculations: type. The type term used in Excel time value functions

There is another term that you will often encounter when performing time value of calculations: type.

The type term used in Excel time value functions is used to represent the

If the payment is made at the beginning of the year, the value of type will be ; if the payment is made at the end of the year, the value of type will be

Present value calculations

The present value or PV function in Excel is used to calculate the current value of future payments. Consider this example:

Suppose your uncle sends you a $ certificate of deposit in your name which will earn interest for the investment period. Under the terms of his gift, you can withdraw the funds after years on the day of your graduation. Use Excel functions to calculate the value of the amount your uncle deposited today to have $ after you graduate. Note: The certificate of deposit calculates and pays any earned interest at the beginning of each year.

Note: You must enter the future value as a negative number in order for the PV function to return a positive number.

Hint: The last two arguments to the PV function are optional, as denoted by the square brackets in the function definition. You do not need to enter these brackets into excel when plugging in values or cell references into the function.

A

B

C

D

E

F

Enter the given values here

Rate per period

Number of periods

Future Value

Type

Calculate present value PV PVrate nper, pmtfvtype

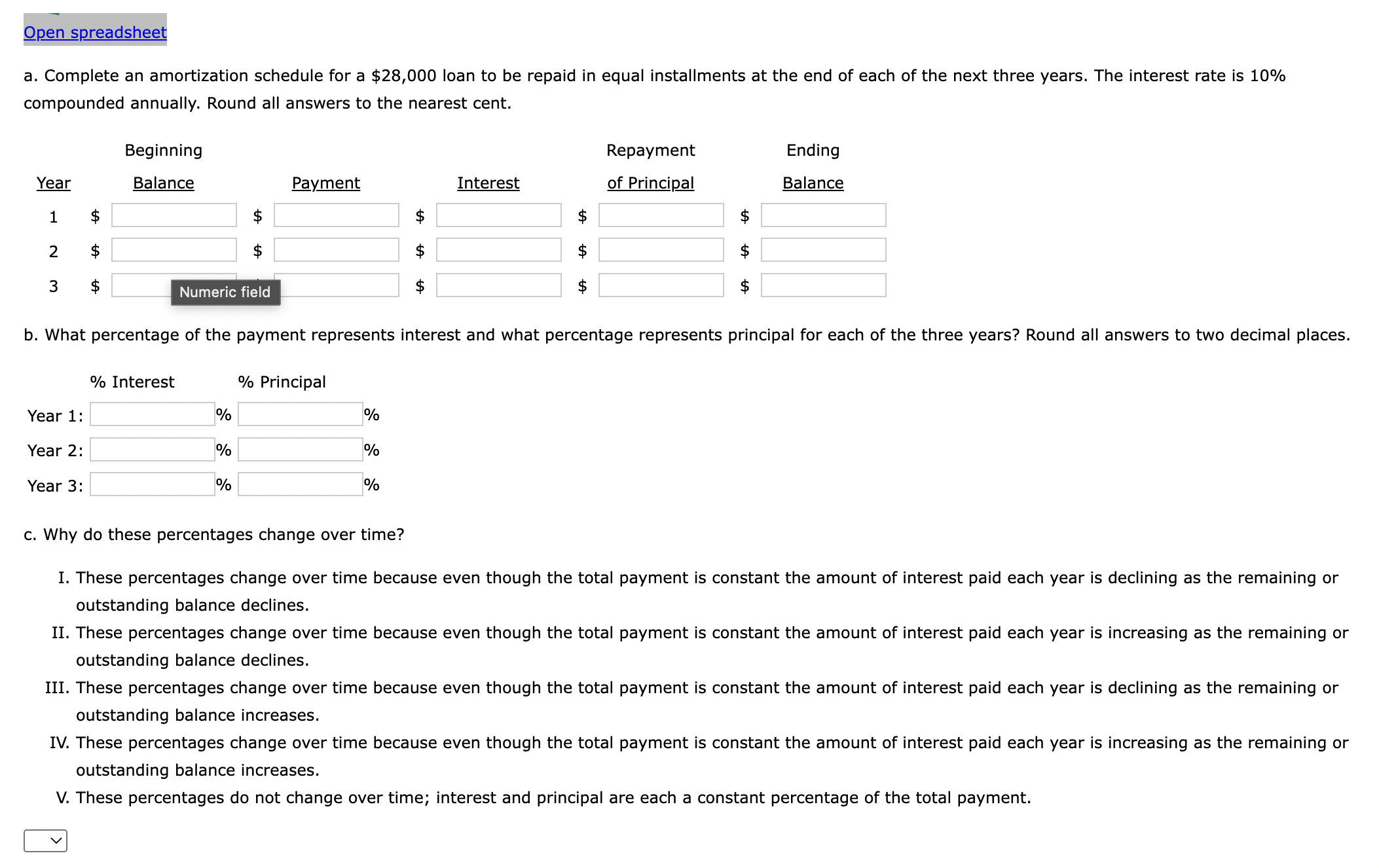

a Complete an amortization schedule for a $ loan to be repaid in equal installments at the end of each of the next three years. The interest rate is

compounded annually. Round all answers to the nearest cent.

b What percentage of the payment represents interest and what percentage represents principal for each of the three years? Round all answers to two decimal places.

c Why do these percentages change over time?

I. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the remaining or

outstanding balance declines.

II These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the remaining or

outstanding balance declines.

III. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the remaining or

outstanding balance increases.

IV These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the remaining or

outstanding balance increases.

V These percentages do not change over time; interest and principal are each a constant percentage of the total payment.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock