There were no other non-current assets acquisitions or disposals. A dividend of 150m was paid on ordinary

Fantastic news! We've Found the answer you've been seeking!

Question:

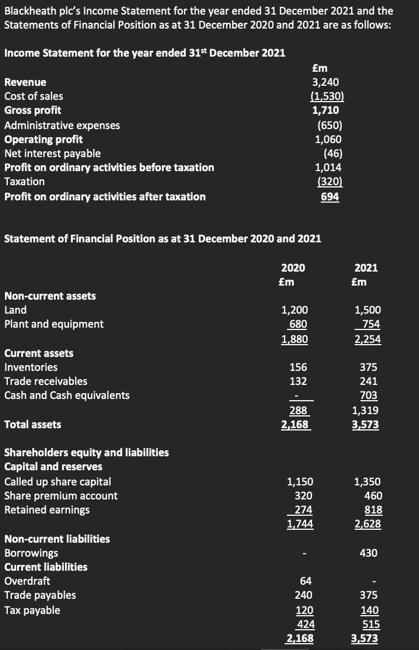

There were no other non-current assets acquisitions or disposals. A dividend of £150m was paid on ordinary shares during the year.

Required

a) Prepare a cash flow statement for Blackheath plc for the year ended 31st December 2021.

b) Make any relevant comments about Blackheath's plc's cash flow statement which you feel should be drawn to the attention of its management.

Related Book For

Accounting for Governmental and Nonprofit Entities

ISBN: 978-1259917059

18th edition

Authors: Jacqueline L. Reck, James E. Rooks, Suzanne Lowensohn, Daniel Neely

Posted Date: