Question: This discussion is on Pink Chapter 12. Use the excel spreadsheet associated with this chapter in your response. Your response should have 500+ words, else

This discussion is on Pink Chapter 12. Use the excel spreadsheet associated with this chapter in your response. Your response should have 500+ words, else it will receive no credit. The submission should be a single document that includes screenshots of your excel formulas/calculations.

This discussion is on Pink Chapter 12. Use the excel spreadsheet associated with this chapter in your response. Your response should have 500+ words, else it will receive no credit. The submission should be a single document that includes screenshots of your excel formulas/calculations.

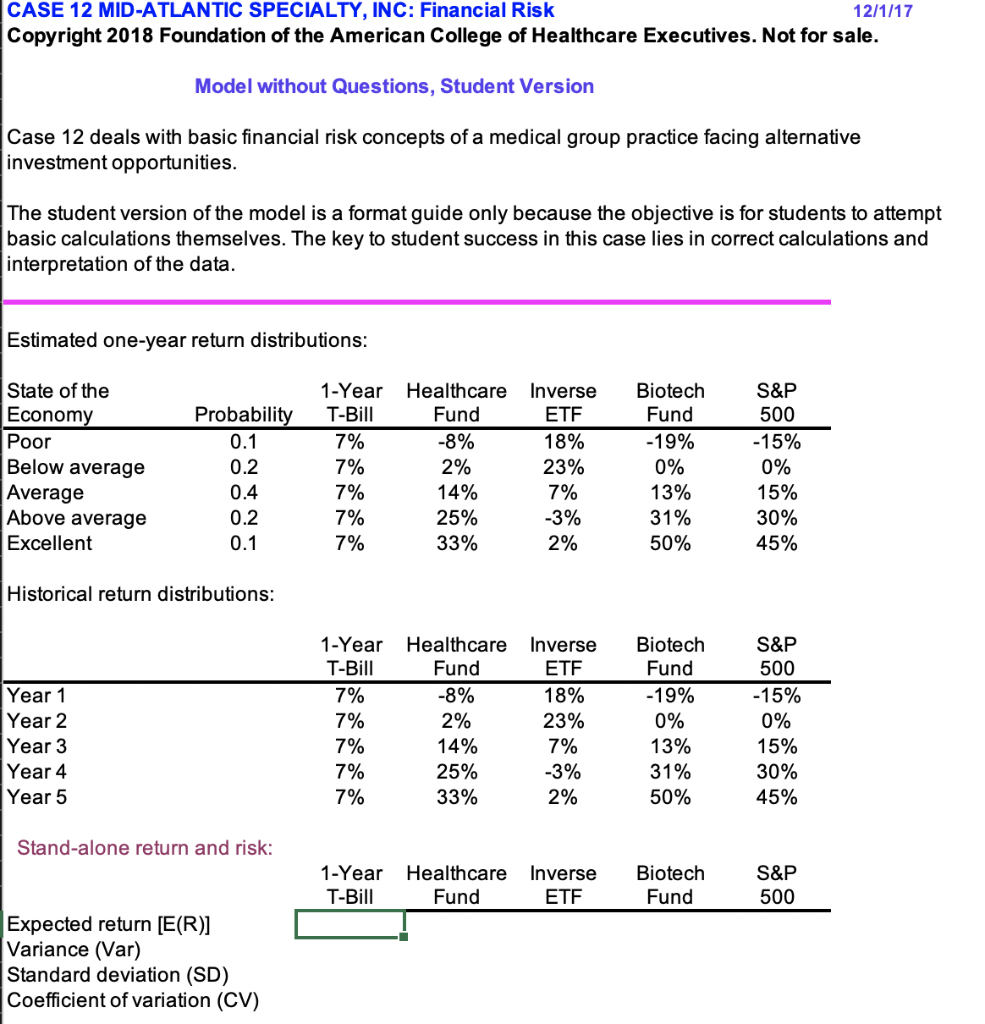

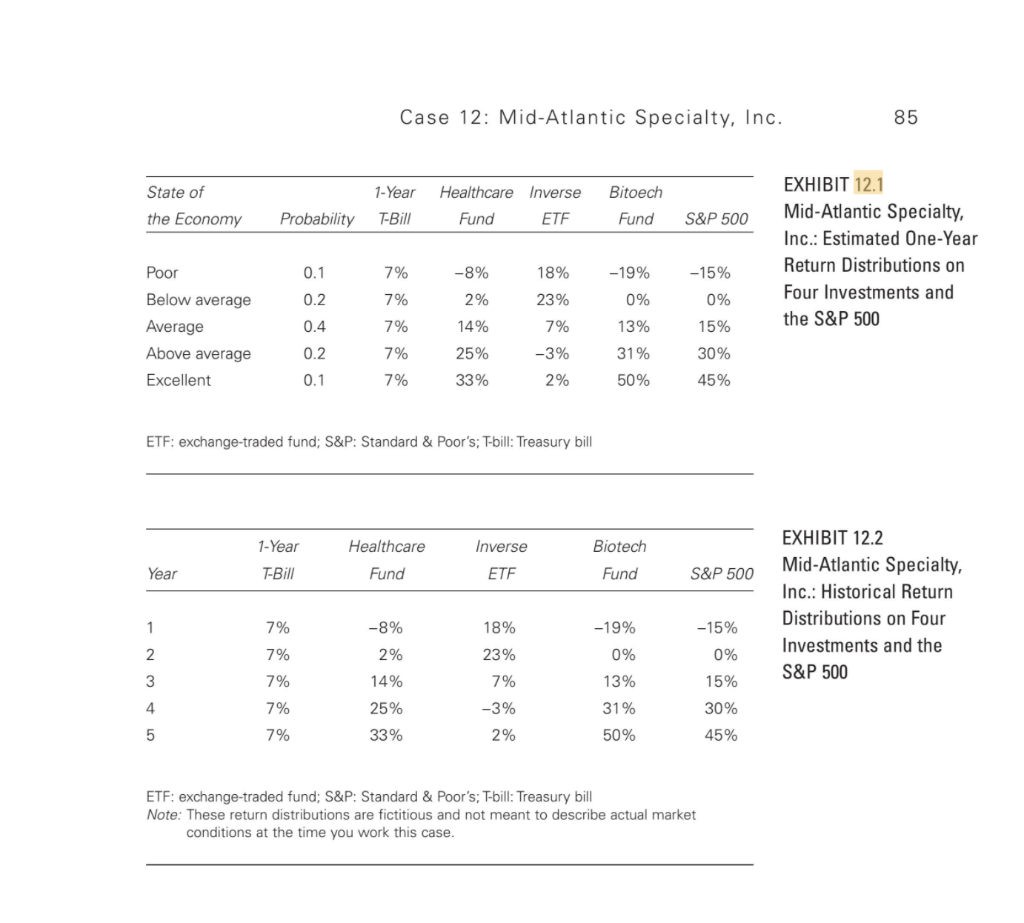

1. Compare the stand-alone risk/expected return of each of the four investments and the S&P 500 listed in exhibit 12.1.

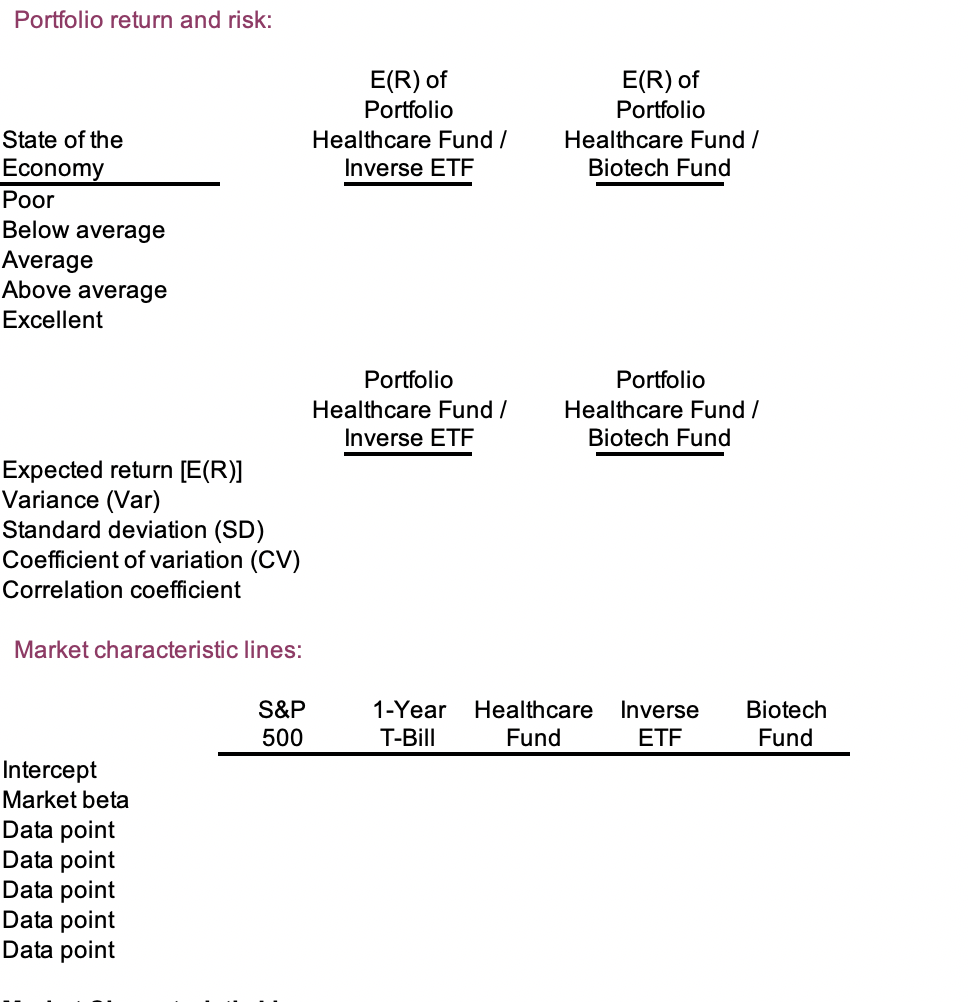

2. MSI is considering two investment strategies:- 50 percent in Healthcare Fund and 50 percent in Inverse ETF- 50 percent in Healthcare Fund and 50 percent in Biotech FundCompare the risk of the two portfolios. Why does the risk differ?

3.

- a. Use the historical returns in exhibit 12.2 to create a graph with market characteristic lines for a 1-year T-Bill, Healthcare Fund, Inverse ETF, and Biotech Fund. Compare the market risk of each of the four investments.

- b. What would happen to the overall risk of a well-diversified portfolio with an investment in a 1-Year T-Bill? Healthcare Fund? Inverse ETF? Biotech Fund?

4.

- a. Construct a Security Market Line graph and plot the expected return of each investment on the graph.

- b. If you were an individual investor with a well-diversified portfolio, which investment(s) in exhibit 12.1 would you buy? Why?

- c. What does the distance between the Security Market Line and the expected return of an investment indicate?

CASE 12 MID-ATLANTIC SPECIALTY, INC: Financial Risk 12/1/17 Copyright 2018 Foundation of the American College of Healthcare Executives. Not for sale. Model without Questions, Student Version Case 12 deals with basic financial risk concepts of a medical group practice facing alternative investment opportunities. The student version of the model is a format guide only because the objective is for students to attempt basic calculations themselves. The key to student success in this case lies in correct calculations and interpretation of the data. Estimated one-year return distributions: 1-Year T-Bill State of the Economy Poor Below average Average Above average Excellent Probability 0.1 0.2 7% Healthcare Fund -8% 2% 14% 25% 33% 7% 7% 7% 7% Inverse ETF 18% 23% 7% -3% 2% Biotech Fund -19% 0% 13% 31% 50% S&P 500 -15% 0% 15% 30% 45% 0.4 0.2 0.1 Historical return distributions: Year 1 Year 2 Year 3 Year 4 Year 5 1-Year T-Bill 7% 7% 7% 7% Healthcare Fund -8% 2% 14% 25% 33% Inverse ETF 18% 23% 7% -3% 2% Biotech Fund -19% 0% 13% 31% 50% S&P 500 -15% 0% 15% 30% 45% 7% Stand-alone return and risk: 1-Year T-Bill Healthcare Fund Inverse ETF Biotech Fund S&P 500 Expected return [E(R)] Variance (Var) Standard deviation (SD) Coefficient of variation (CV) Portfolio return and risk: E(R) of Portfolio Health care Fund / Inverse ETF E(R) of Portfolio Health care Fund / Biotech Fund State of the Economy Poor Below average Average Above average Excellent Portfolio Health care Fund / Inverse ETF Portfolio Healthcare Fund / Biotech Fund Expected return [E(R)] Variance (Var) Standard deviation (SD) Coefficient of variation (CV) Correlation coefficient Market characteristic lines: S&P 500 1-Year T-Bill Healthcare Fund Inverse ETE Biotech Fund Intercept Market beta Data point Data point Data point Data point Data point Market Characteristic Lines Security market line: 1-Year T-Bill Healthcare Fund Inverse ETF Biotech Fund Risk-free rate Required market return Market beta Investment required return Investment expected return Difference Security Market Line END Case 12: Mid-Atlantic Specialty, Inc. 85 State of the Economy 1-Year T-Bill Healthcare Inverse Fund ETF Bitoech Fund Probability S&P 500 EXHIBIT 12.1 Mid-Atlantic Specialty, Inc.: Estimated One-Year Return Distributions on Four Investments and the S&P 500 0.1 7% 18% -15% -8% 2% -19% 0% 0.2 7% 23% 0% Poor Below average Average Above average Excellent 0.4 7% 14% 7% 13% 15% 0.2 7% 31% 25% 33% -3% 2% 30% 45% 0.1 7% 50% ETF: exchange-traded fund; S&P: Standard & Poor's; T-bill: Treasury bill 1-Year Inverse Healthcare Fund Biotech Fund Year T-Bill ETF S&P 500 EXHIBIT 12.2 Mid-Atlantic Specialty, Inc.: Historical Return Distributions on Four Investments and the S&P 500 1 7% -8% 18% -19% -15% 2 0% 2% 14% 0% 13% 3 15% 7% 7% 7% 7% 23% 7% -3% 2% 4 25% 33% 31% 50% 30% 45% 5 ETF: exchange-traded fund; S&P: Standard & Poor's; T-bill: Treasury bill Note: These return distributions are fictitious and not meant to describe actual market conditions at the time you work this case. CASE 12 MID-ATLANTIC SPECIALTY, INC: Financial Risk 12/1/17 Copyright 2018 Foundation of the American College of Healthcare Executives. Not for sale. Model without Questions, Student Version Case 12 deals with basic financial risk concepts of a medical group practice facing alternative investment opportunities. The student version of the model is a format guide only because the objective is for students to attempt basic calculations themselves. The key to student success in this case lies in correct calculations and interpretation of the data. Estimated one-year return distributions: 1-Year T-Bill State of the Economy Poor Below average Average Above average Excellent Probability 0.1 0.2 7% Healthcare Fund -8% 2% 14% 25% 33% 7% 7% 7% 7% Inverse ETF 18% 23% 7% -3% 2% Biotech Fund -19% 0% 13% 31% 50% S&P 500 -15% 0% 15% 30% 45% 0.4 0.2 0.1 Historical return distributions: Year 1 Year 2 Year 3 Year 4 Year 5 1-Year T-Bill 7% 7% 7% 7% Healthcare Fund -8% 2% 14% 25% 33% Inverse ETF 18% 23% 7% -3% 2% Biotech Fund -19% 0% 13% 31% 50% S&P 500 -15% 0% 15% 30% 45% 7% Stand-alone return and risk: 1-Year T-Bill Healthcare Fund Inverse ETF Biotech Fund S&P 500 Expected return [E(R)] Variance (Var) Standard deviation (SD) Coefficient of variation (CV) Portfolio return and risk: E(R) of Portfolio Health care Fund / Inverse ETF E(R) of Portfolio Health care Fund / Biotech Fund State of the Economy Poor Below average Average Above average Excellent Portfolio Health care Fund / Inverse ETF Portfolio Healthcare Fund / Biotech Fund Expected return [E(R)] Variance (Var) Standard deviation (SD) Coefficient of variation (CV) Correlation coefficient Market characteristic lines: S&P 500 1-Year T-Bill Healthcare Fund Inverse ETE Biotech Fund Intercept Market beta Data point Data point Data point Data point Data point Market Characteristic Lines Security market line: 1-Year T-Bill Healthcare Fund Inverse ETF Biotech Fund Risk-free rate Required market return Market beta Investment required return Investment expected return Difference Security Market Line END Case 12: Mid-Atlantic Specialty, Inc. 85 State of the Economy 1-Year T-Bill Healthcare Inverse Fund ETF Bitoech Fund Probability S&P 500 EXHIBIT 12.1 Mid-Atlantic Specialty, Inc.: Estimated One-Year Return Distributions on Four Investments and the S&P 500 0.1 7% 18% -15% -8% 2% -19% 0% 0.2 7% 23% 0% Poor Below average Average Above average Excellent 0.4 7% 14% 7% 13% 15% 0.2 7% 31% 25% 33% -3% 2% 30% 45% 0.1 7% 50% ETF: exchange-traded fund; S&P: Standard & Poor's; T-bill: Treasury bill 1-Year Inverse Healthcare Fund Biotech Fund Year T-Bill ETF S&P 500 EXHIBIT 12.2 Mid-Atlantic Specialty, Inc.: Historical Return Distributions on Four Investments and the S&P 500 1 7% -8% 18% -19% -15% 2 0% 2% 14% 0% 13% 3 15% 7% 7% 7% 7% 23% 7% -3% 2% 4 25% 33% 31% 50% 30% 45% 5 ETF: exchange-traded fund; S&P: Standard & Poor's; T-bill: Treasury bill Note: These return distributions are fictitious and not meant to describe actual market conditions at the time you work this case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts