Question: This homework is about the banking system and interest rate transmission. 1. Assume there is a single commercial bank with the following consolidated balance sheet:

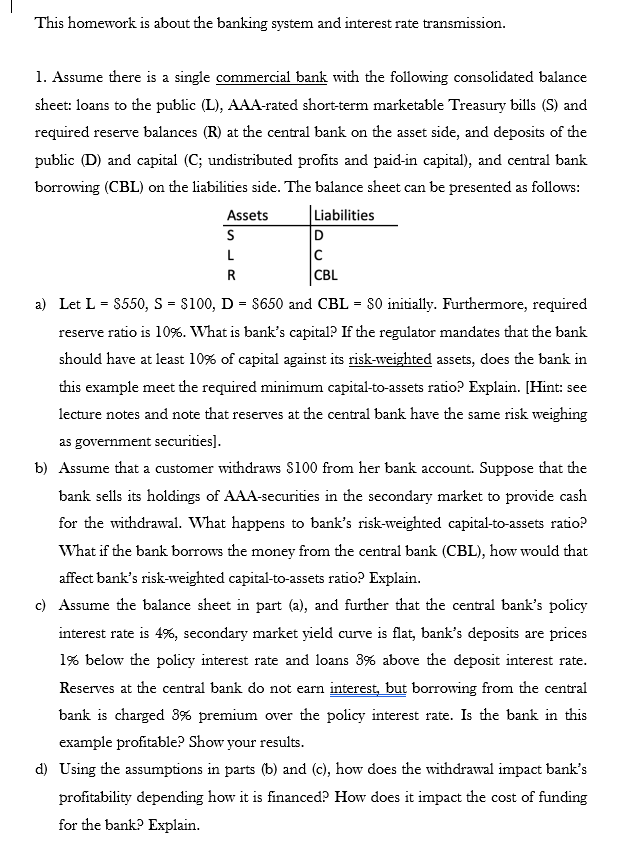

This homework is about the banking system and interest rate transmission. 1. Assume there is a single commercial bank with the following consolidated balance sheet: loans to the public (L), AAA-rated short-term marketable Treasury bills (S) and required reserve balances (R) at the central bank on the asset side, and deposits of the public (D) and capital (C; undistributed profits and paid-in capital), and central bank borrowing (CBL) on the liabilities side. The balance sheet can be presented as follows: Assets Liabilities S D L C R CBL a) Let L = $550, S = $100, D = $650 and CBL = $0 initially. Furthermore, required reserve ratio is 10%. What is bank's capital? If the regulator mandates that the bank should have at least 10% of capital against its risk-weighted assets, does the bank in this example meet the required minimum capital-to-assets ratio? Explain. (Hint: see lecture notes and note that reserves at the central bank have the same risk weighing as government securities). b) Assume that a customer withdraws $100 from her bank account. Suppose that the bank sells its holdings of AAA-securities in the secondary market to provide cash for the withdrawal. What happens to bank's risk-weighted capital-to-assets ratio? What if the bank borrows the money from the central bank (CBL), how would that affect bank's risk-weighted capital-to-assets ratio? Explain. c) Assume the balance sheet in part (a), and further that the central bank's policy interest rate is 4%, secondary market yield curve is flat, bank's deposits are prices 1% below the policy interest rate and loans 3% above the deposit interest rate. Reserves at the central bank do not earn interest, but borrowing from the central bank is charged 3% premium over the policy interest rate. Is the bank in this example profitable? Show your results. d) Using the assumptions in parts (b) and (c), how does the withdrawal impact bank's profitability depending how it is financed? How does it impact the cost of funding for the bank? Explain. This homework is about the banking system and interest rate transmission. 1. Assume there is a single commercial bank with the following consolidated balance sheet: loans to the public (L), AAA-rated short-term marketable Treasury bills (S) and required reserve balances (R) at the central bank on the asset side, and deposits of the public (D) and capital (C; undistributed profits and paid-in capital), and central bank borrowing (CBL) on the liabilities side. The balance sheet can be presented as follows: Assets Liabilities S D L C R CBL a) Let L = $550, S = $100, D = $650 and CBL = $0 initially. Furthermore, required reserve ratio is 10%. What is bank's capital? If the regulator mandates that the bank should have at least 10% of capital against its risk-weighted assets, does the bank in this example meet the required minimum capital-to-assets ratio? Explain. (Hint: see lecture notes and note that reserves at the central bank have the same risk weighing as government securities). b) Assume that a customer withdraws $100 from her bank account. Suppose that the bank sells its holdings of AAA-securities in the secondary market to provide cash for the withdrawal. What happens to bank's risk-weighted capital-to-assets ratio? What if the bank borrows the money from the central bank (CBL), how would that affect bank's risk-weighted capital-to-assets ratio? Explain. c) Assume the balance sheet in part (a), and further that the central bank's policy interest rate is 4%, secondary market yield curve is flat, bank's deposits are prices 1% below the policy interest rate and loans 3% above the deposit interest rate. Reserves at the central bank do not earn interest, but borrowing from the central bank is charged 3% premium over the policy interest rate. Is the bank in this example profitable? Show your results. d) Using the assumptions in parts (b) and (c), how does the withdrawal impact bank's profitability depending how it is financed? How does it impact the cost of funding for the bank? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts