Question: This is a financial reporting question. For question 14-127 in part b I do not understand why they used 10% for the interest expense calculations

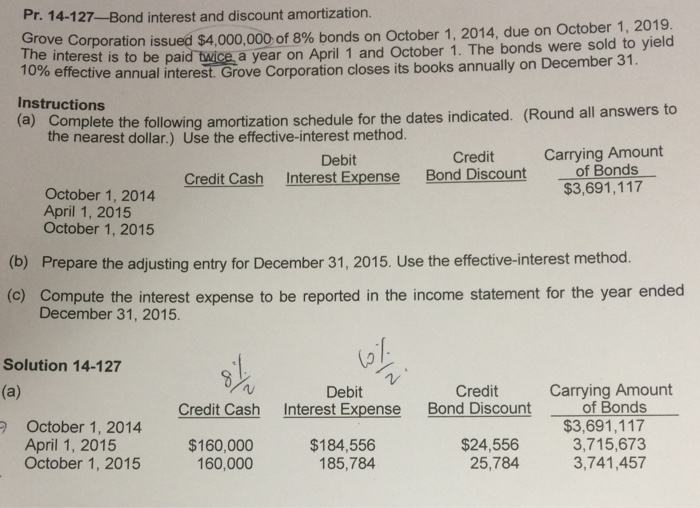

Pr. 14-127-Bond interest and discount amortization. Grove he interest is to be paid tWice a year on April 1 and October 1. The bonds were sold to yield Corporation issued $4,000,000 of 8% bonds on October 1, 2014, due on October 1, 2019 o effective annual interest. Grove Corporation closes its books annually on December 31. Instructions (a) Complete the following 10% effective annual amortization schedule for the dates indicated. (Round all answers to the nearest dollar.) Use the effective-interest method. Debit Interest Expense Credit Bond Discount Carrying Amount of Bonds Credit Cash $3,691,117 October 1, 2014 April 1, 2015 October 1, 2015 (b) Prepare the adjusting entry for December 31, 2015. Use the effective-interest method (c) Compute the interest expense to be reported in the income statement for the year ended December 31, 2015. Solution 14-127 Credit Bond Discount Carrying Amount of Bonds $3,691,117 3,715,673 3,741,457 Debit Interest Expense Credit Cash October 1, 2014 April 1, 2015 October 1, 2015 $160,000 160,000 $184,556 185,784 $24,556 25,784

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts