Question: This is a financial reporting question. I do not understand why they accounted for 4 months for the interest expense in part A and why

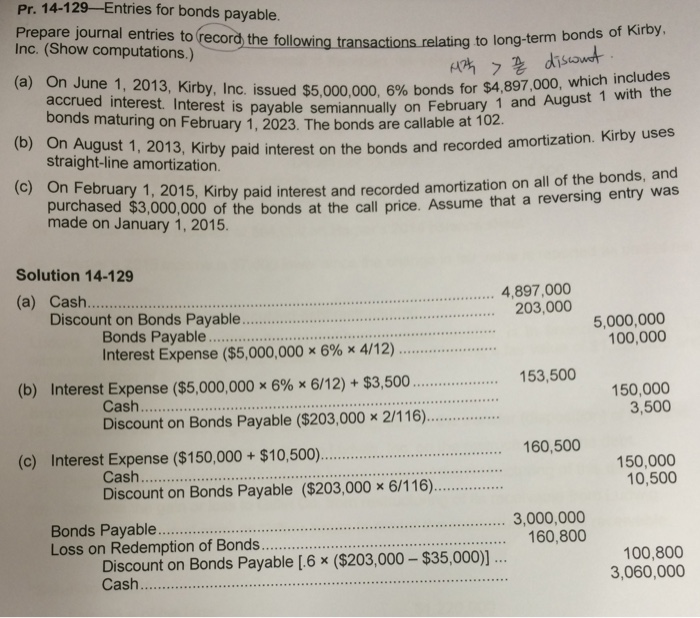

14-129- Entries for bonds payable. Pr. Prepare journal entries to record the following transactions Inc. (Show computations.) sactions relating to long-term bonds of Kirby, > nc. issued $5,000,000, 6% bonds for $4,897,000, which includes payable semiannually on February 1 and August 1 with the February 1,2023. The bangualye on Februay 1 and August 1 with the 3, Kirby paid interest on the bonds and recorded amortization. Kirby uses (a) On June 1, 2013, Kirby, I accrued interest. Interest is bonds maturing on February 1, 2023. The bonds are callable straight-line amortization purchased $3,000,000 of the (b ) On August 1, 201 amortization on all of the bonds, and bonds at the call price. Assume that a reversing entry was (c) On February 1, 2015, Kirby paid interest and recorded made on January 1, 2015 Solution 14-129 (a) Cash. 4,897,000 .. 203,000 5,000,000 100,000 Discount on Bonds Payable.. Bonds Payable . Interest Expense ($5,000,000 6% 4/12) ....153,500 50,000 3,500 (b) Interest Expense ($5,000,000 6% x6/12) + $3,500 Discount on Bonds Payable ($203,000 x 2/116 10,500) (c) Interest Expense ($150,000+ $10,500) 160,500 150,000 10,500 Cash... Discount on Bonds Payable ($203,000 x 6/116). 3,000,000 Bonds Paya b Loss on Redemption of Bonds Discount on Bonds Payable [.6 ($203,000-$35,000 Cash.... 100,800 3,060,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts