Question: this is a mcq question 1. The index model has been estimated for stock A and B using the monthly return data for the period

this is a mcq question

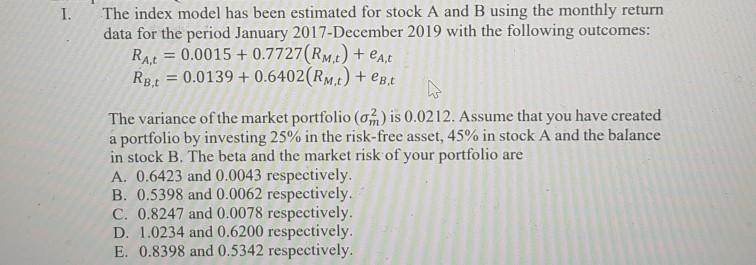

1. The index model has been estimated for stock A and B using the monthly return data for the period January 2017 December 2019 with the following outcomes: Rat = 0.0015 + 0.7727(Rmt) + est Rp.t = 0.0139 +0.6402(Rmt) + B.t The variance of the market portfolio (om) is 0.0212. Assume that you have created a portfolio by investing 25% in the risk-free asset, 45% in stock A and the balance in stock B. The beta and the market risk of your portfolio are A. 0.6423 and 0.0043 respectively. B. 0.5398 and 0.0062 respectively. C. 0.8247 and 0.0078 respectively. D. 1.0234 and 0.6200 respectively. E. 0.8398 and 0.5342 respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts