Question: This is a multiple part question that I am really struggling on. I could really use your help, please and thank you! I will make

This is a multiple part question that I am really struggling on. I could really use your help, please and thank you! I will make sure to give good feedback!

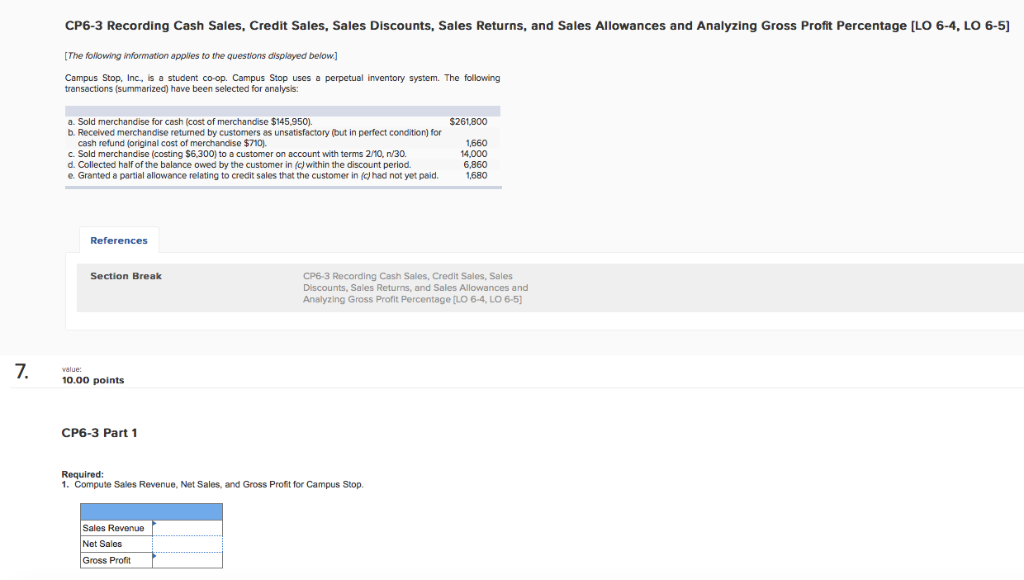

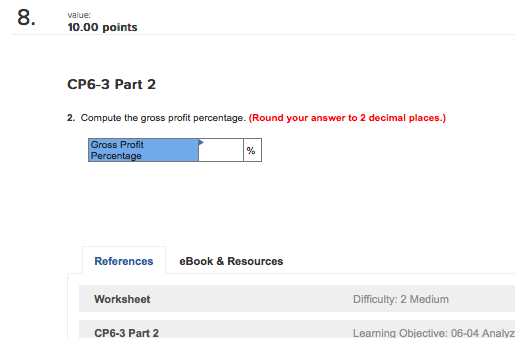

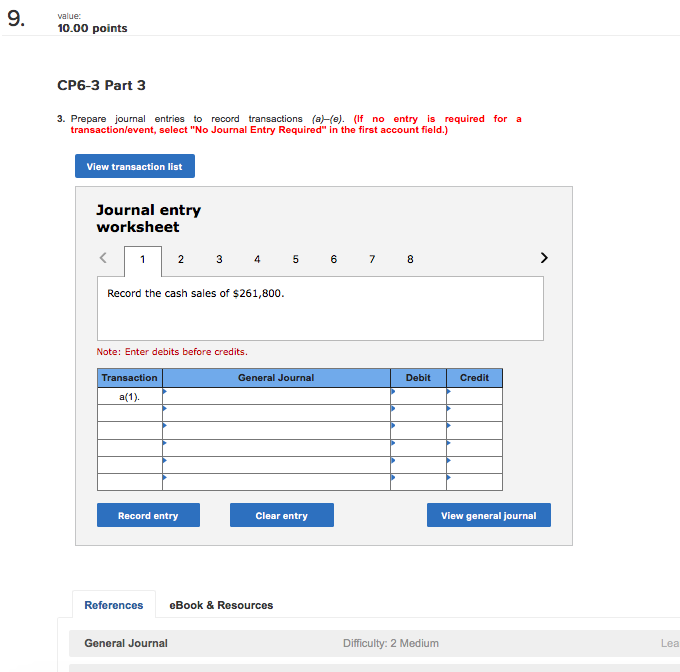

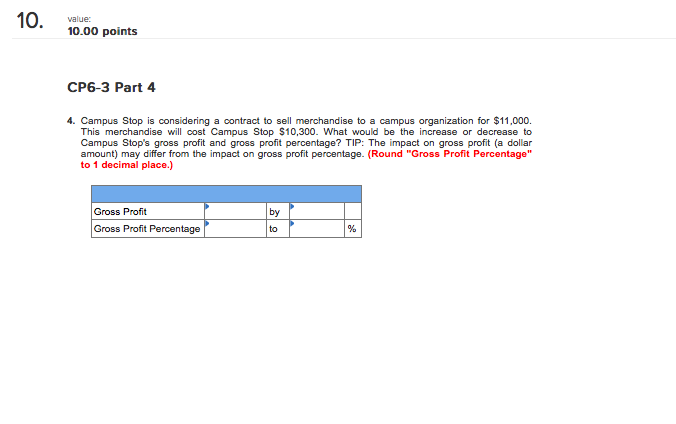

CP6-3 Recording Cash Sales, Credit Sales, Sales Discounts, Sales Returns, and Sales Allowances and Analyzing Gross Profit Percentage [LO 6-4, LO 6-5] The following information applies to the questions displayed below] Campus Stop, Inc, is a student co-op. Campus Stop uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $145,950) b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for $261,800 cash refund (original cost of merchandise $710. c. Sold merchandise (costing $6,300) to a customer on account with terms 2/10, /30. d. Collected half of the balance owed by the customer in (c)within the discount period 1,660 14,000 6,860 e. Granted a partial allowance relating to credit sales that the customer in (c)had not yet paid.1,680 References Section Brea CP6-3 Recording Cash Sales, Credit Sales, Sales Discounts, Sales Returns, and Sales Allowances and Analyzing Gross Profit Percentage [LO 6-4, LO 6-5 10.00 points CP6-3 Part1 1. Compute Sales Revenue, Net Sales, and Gross Profit for Campus Stop Sales Revenue Net Sales Gross Profit 0.00 points CP6-3 Part 2 2. Compute the gross profit percentage. (Round your answer to 2 decimal places.) Gross Profit Percentage References eBook &Resources Difficulty 2 Medium Worksheet CP6-3 Part 2 Learning Objective: 06-04 Analyz value: 10.00 points CP6-3 Part 3 3. Prepare journal entries to record transactions (ae). (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the cash sales of $261,800 Note: Enter debits before credits. General Journal Debit Credit Record entry Clear entry View general journal References eBook & Resources General Journal Difficulty: 2 Medium Lea

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts