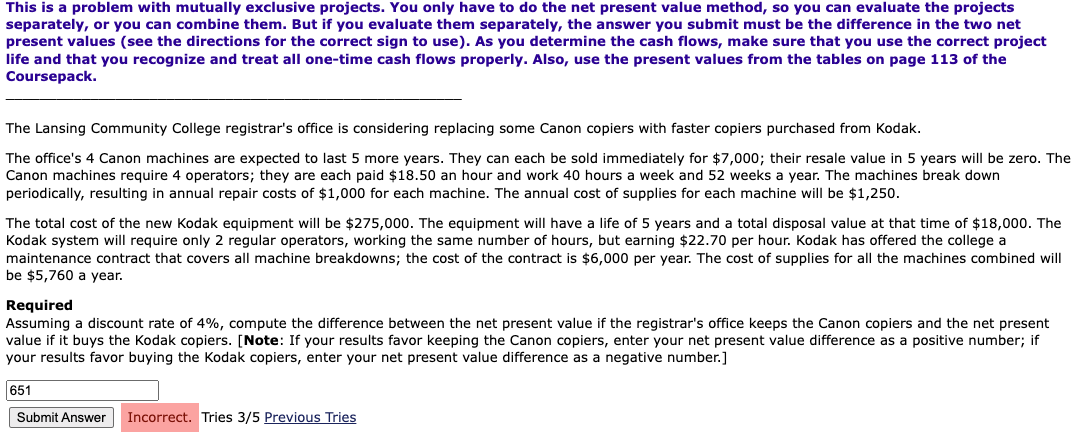

Question: This is a problem with mutually exclusive projects. You only have to do the net present value method, so you can evaluate the projects separately,

This is a problem with mutually exclusive projects. You only have to do the net present value method, so you can evaluate the projects separately, or you can combine them. But if you evaluate them separately, the answer you submit must be the difference in the two net life and that you recognize and treat all one-time cash flows properly. Also, use the present 113 of the Coursepack. The office's 4 Canon machines are expected to last 5 more years. They can each be sold immediately for $7,000; their resale periodically, resulting in annual repair costs of $1,000 for each machine. The annual cost of supplies for mach $1,250. The total cost of the new Kodak equipment will be $275,000. The equipment will have a life of 5 years and a to that disposal $18,000. The maintenance contract that covers all machine breakdowns; the cost of the contract is $6,000 per year. The cost of supplies for all be $5,760 a year. Required your results favor buying the Kodak copiers, enter your net present value difference as a negative number.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts