Question: this is a question from a Canadian college. please do use canadian tax law. please help me to solve this assignment. please make sure the

this is a question from a Canadian college. please do use canadian tax law. please help me to solve this assignment. please make sure the solve is correct. thank you so much :)

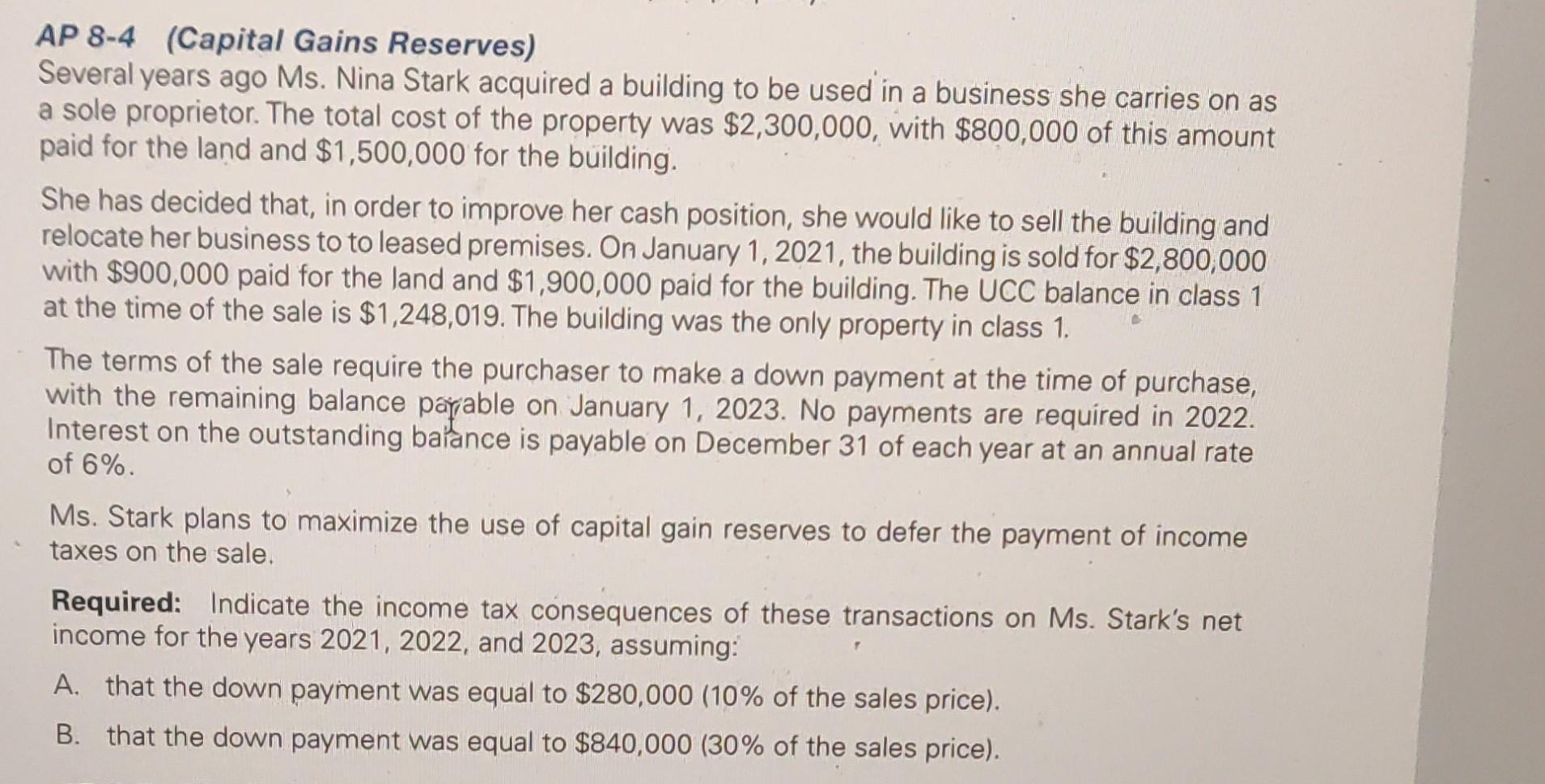

AP 8-4 (Capital Gains Reserves) Several years ago Ms. Nina Stark acquired a building to be used in a business she carries on as a sole proprietor. The total cost of the property was $2,300,000, with $800,000 of this amount paid for the land and $1,500,000 for the building. She has decided that, in order to improve her cash position, she would like to sell the building and relocate her business to to leased premises. On January 1, 2021, the building is sold for $2,800,000 with $900,000 paid for the land and $1,900,000 paid for the building. The UCC balance in class 1 at the time of the sale is $1,248,019. The building was the only property in class 1. The terms of the sale require the purchaser to make a down payment at the time of purchase, with the remaining balance payable on January 1, 2023. No payments are required in 2022. Interest on the outstanding balance is payable on December 31 of each year at an annual rate of 6%. Ms. Stark plans to maximize the use of capital gain reserves to defer the payment of income taxes on the sale. Required: Indicate the income tax consequences of these transactions on Ms. Stark's net income for the years 2021, 2022, and 2023, assuming: A. that the down payment was equal to $280,000 (10% of the sales price). B. that the down payment was equal to $840,000 (30% of the sales price). a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts