Question: This is a question from Bus 190 that I don't get 3. David's rich aunt died and left him a sizable inheritance. He thought about

This is a question from Bus 190 that I don't get

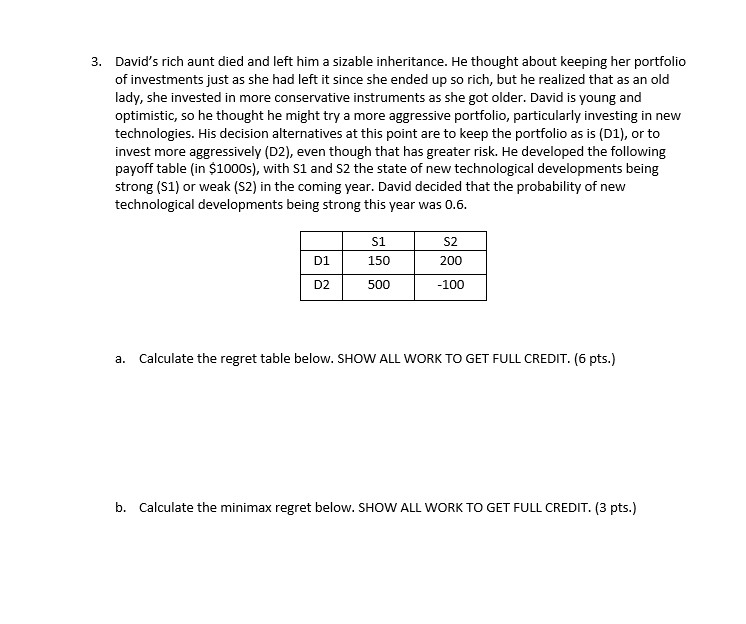

3. David's rich aunt died and left him a sizable inheritance. He thought about keeping her portfolio of investments just as she had left it since she ended up so rich, but he realized that as an old lady, she invested in more conservative instruments as she got older. David is young and optimistic, so he thought he might try a more aggressive portfolio, particularly investing in new technologies. His decision alternatives at this point are to keep the portfolio as is (D1), or to invest more aggressively (D2), even though that has greater risk. He developed the following payoff table (in $1000s), with $1 and $2 the state of new technological developments being strong ($1) or weak ($2) in the coming year. David decided that the probability of new technological developments being strong this year was 0.6. 51 52 D1 150 200 D2 500 -100 a. Calculate the regret table below. SHOW ALL WORK TO GET FULL CREDIT. (6 pts.) b. Calculate the minimax regret below. SHOW ALL WORK TO GET FULL CREDIT. (3 pts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts