Question: This is a short - answer type question . Students should provide their analyses , Justifications and logics to support your answers in order to

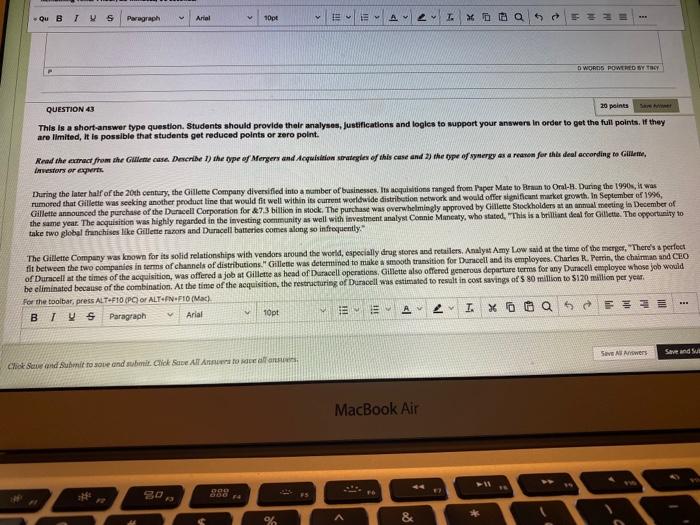

This is a short - answer type question . Students should provide their analyses , Justifications and logics to support your answers in order to get the full points . If they are limited , it is possible that students get reduced points or zero point . Read the extract from the Gillette case Describe 1 ) the type of Mergers and Acquisition strategies of this case and 2 ) the type of synergy as a reason for this deal according to Gillette , investors or experts During the later half of the 20th century , the Gillette Company diversified into a number of businesses . Its acquisitions ranged from Paper Mate to Braun to Oral - B . During the 1990s , it was rumored that Gillette was seeking another product line that would fit well within its current worldwide distribution network and would offer significant market growth . In September of 1996 , Gillette announced the purchase of the Duracell Corporation for & 7.3 billion in stock . The purchase was overwhelmingly approved by Gillette Stockholders at an annual meeting in December of the same year . The acquisition was highly regarded in the investing community as well with investment analyst Connie Maneaty , who stated , " This is a brilliant deal for Gillette . The opportunity to take two global franchises like Gillette razors and Duracell batteries comes along so infrequently . " The Gillette Company was known for its solid relationships with vendors around the world , especially drug stores and retailers . Analyst Amy Low said at the time of the merger , There's a perfect it between the two companies in terms of channels of distributions . " Gillette was determined to make a smooth transition for Duracell and its employees . Charles R. Perrin , the chairman and CEO f Duracell at the times of the acquisition , was offered a job at Gillette as head of Duracell operations . Gillette also offered generous departure terms for any Duracell employee whose job would eliminated because of the combination . At the time of the acquisition , the restructuring of Duracell was estimated to result in cost savings of 80 million to $ 120 million per year .

Ou BTS Paragraph Artal y 10pt LEM A 2 T X6DT O 6 2 D WORDS POWERED BY Sre QUESTION 43 20 points This is a short-answer type question. Students should provide their analyses, justifications and logics to support your answers in order to get the full points. If they are limited, it is possible that students get reduced points or zero point. Read the extract from the Gillette case. Describe 1) the type of Mergers and Acquisition strategies of this case and 2) the type of synergy as a reason for the deal according to Gillette investors or agus During the Inter half of the 20th century, the Gillette Company diversified into a number of businesses. Its acquisitions ranged from PaperMate to run to Oral-B. During the 1990s, it was rumored that Gillette was seeking another product line that would fit well within its current worldwide distribution network and would offer significant market growth. In September of 1996, Gillette announced the purchase of the Dracell Corporation for &7.3 billion in stock. The purchase was overwhelmingly approved by Gillette Stockholders at an annual meeting in December of the same year. The acquisition was highly regarded in the investing community as well with investment analyst Connie Maneaty, who stated. This is a brilliant deal for Gilete. The opportunity to take two global franchises like Gillette razors and Duracell batteries comes along so infrequently The Gillette Company was known for its solid relationships with vendors around the world, especially drugstores and retailers. Analyst Amy Low said at the time of the merger, "There's a perfect fit between the two companies in terms of channels of distributions.Gillette was determined to make a smooth transition for Dunicell and its employees. Charles R. Perrin, the chairman and CEO of Duracell at the times of the acquisition was offered a job at Gillette as head of Duracell operations Gillette also offered generous departure terms for any Duracell employee whose job would be eliminated because of the combination. At the time of the acquisition, the restructuring of Duracell was estimated to result in cost savings of S 80 million to $120 million per year For the toolbar, press ALT=FIO ( Por ALT PN.F10 (Mac) B TVS Paragraph Arial 10pt HE A T. X 0 6F11 Save As rowers Save and Cho See and Submit to one and submit Click Save ATA to see MacBook Air 4 4700 90 19 F %

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock