Question: This is all the information I have for this question. What more would you need in order to help me solve this? Thank you so

This is all the information I have for this question. What more would you need in order to help me solve this? Thank you so much for at least looking at it!

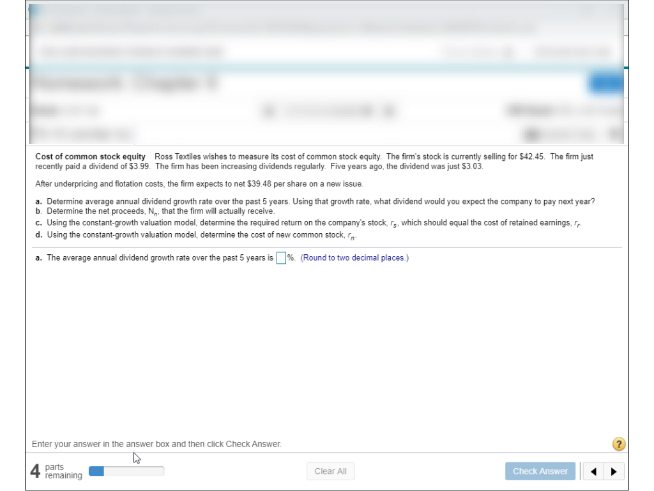

Cost of common stock equity Ross Textiles wishes to measure its cost of common stock equity. The firm's stock is currently selling for 542.45. The firm just recently paid a dividend of 53.99. The firm has been increasing dividends regularly. Five years ago, the dividend was just 53.03. After underpricing and flotation costs, the firm expects to net $39.48 per share on a new issus. a. Determine average annual dividend growth rate over the past 5 years. Using that growth rate, what dividend would you expect the company to pay next year? b. Determine the net proceeds, N., that the firm will actually receive. c. Using the constant-growth valuation model, determine the required return on the company's stock, r, which should aqual the cost of retained earings, d. Using the constant-growth valuation model determine the cost of new common stock, a. The average annual dividend growth rate over the past 5 years is % (Round to two decimal places) Enter your answer in the answer box and then click Check Answer 4 parts Clear All Check Answer remaining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts