Question: This is all the information that was given for the problem Consider a project of the Cornell Haul Moving Company, the timing and size of

This is all the information that was given for the problem

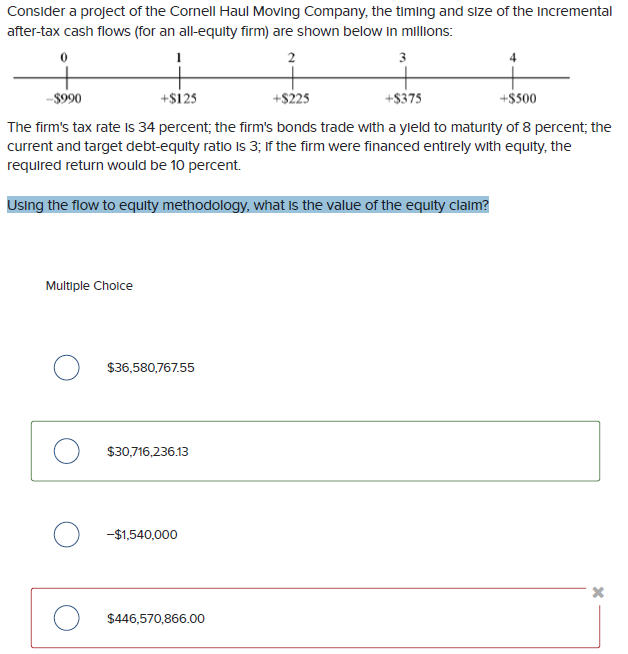

Consider a project of the Cornell Haul Moving Company, the timing and size of the incremental after-tax cash flows (for an all-equity firm) are shown below in millions: 0 1 2 3 -$990 +$125 +$225 +$375 +$500 The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent; the current and target debt-equity ratio is 3; If the firm were financed entirely with equity, the required return would be 10 percent. Using the flow to equity methodology, what is the value of the equity claim? Multiple Choice O $36,580,767.55 O $30,716,236.13 O -$1,540,000 O $446,570,866.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts