Question: This is an engineering economics problem. I am currently having a problem with net cash flow, Net present value, annual worth and present value of

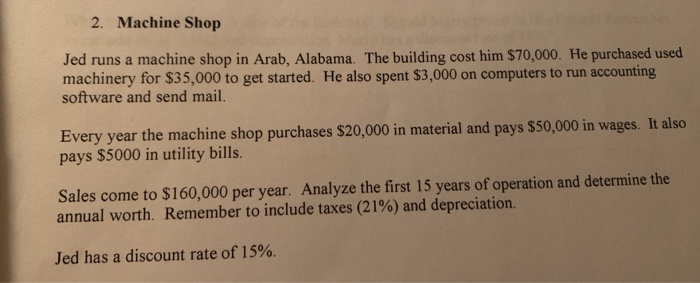

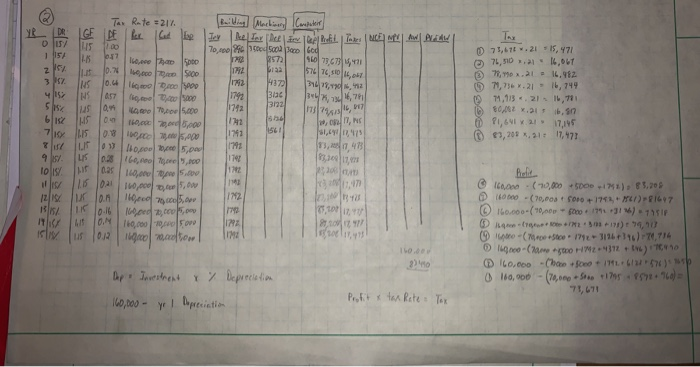

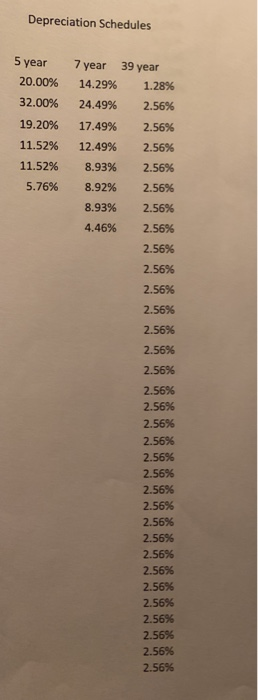

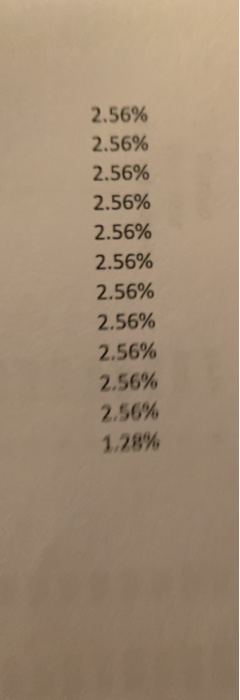

2. Machine Shop Jed runs a machine shop in Arab, Alabama. The building cost him $70,000. He purchased used machinery for $35,000 to get started. He also spent $3,000 on computers to run accounting software and send mail. Every year the machine shop purchases $20,000 in material and pays $50,000 in wages. It also pays $5000 in utility bills. Sales come to $160,000 per year. Analyze the first 15 years of operation and determine the annual worth. Remember to include taxes (21%) and depreciation. Jed has a discount rate of 15%. Rate=217. A DA Building Machinery Consulent Jey Re Tex M ex BFL TARNCE 70, 4000 Cocoa Beted 440 73.073 44 376 , 3 16,70 17513,7 won, SI, 57416, 5 16,047 71,671.21 15,471 76,510 ,7 16,067 3) 7 .212 71,736.21 - 16,749 197 ,113 .21 16,711 80,12 ,1 bsn 91,641 21 17,145 47,203 * 21. 11,477 160,000 1000 15000 0.7 9.000 SCO 101005000 4577 .605000 KARO TO.CO 5.000 042 5 .000 00 1 5 .40 01 . , 5. 0:28 16. 5.100 0.25 140.000 1 160,000 ,00 1 7 ,000,00 M ed 2,000.00 160,000000 012 600 otow sos 100 115 In . 1628 2013 C Belt . (0,000 5000 -171) 85,70 % 0 -70.00foro 174 167 160.000-(70,000 - 2000 1711 +3!*) 1951F 2. 3 17174,90 o - C aste 311116) 74,714 co-Cane HW312+)60 160.000 - Choco + 1117 a 160,000 -(70,000+5000 105 950 960)= 71.11 Ohhio Dop Investment & % Depreciation 160,000 - y Depreciation Profit & tax Rete Tox Depreciation Schedules 5 year 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 7 year 14.29% 24.49% 17.49% 12.49% 8.93% 8.92% 8.93% 4.46% 39 year 1.28% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.5696 2.5696 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 256%, 20%, 1.24%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts