Question: This is an old test we took and I would just like some clarification on what the answers were and why. thanks! (Also to eliminate

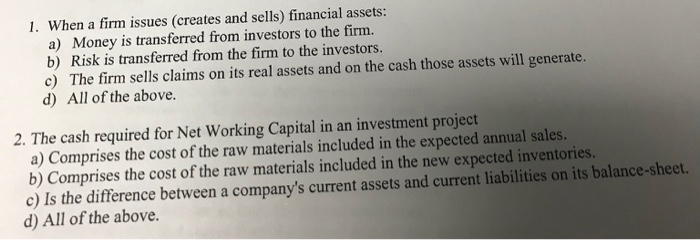

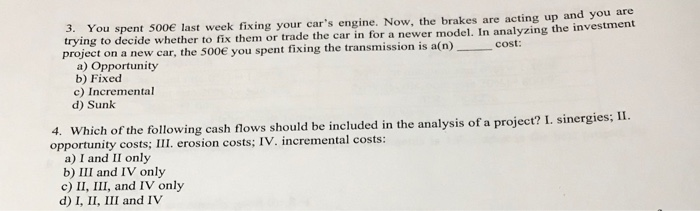

1. When a firm issues (creates and sells) financial assets: a) Money is transferred from investors to the firm. b) Risk is transferred from the firm to the investors. c) The firm sells claims on its real assets and on the cash those assets will generate. d) All of the above. 2. The cash required for Net Working Capital in an investment project a) Comprises the cost of the raw materials included in the expected annual sales. b) Comprises the cost of the raw materials included in the new expected inventories. c) Is the difference between a company's current assets and current liabilities on its balance-sheet. d) All of the above. You spent 500 last week fixing your car's engine. Now, the brakes are acting up and you are trying to decide whether to fix them or trade the car in for a newer model. In analyzing the investment project on a new car, the 500e you spent fixing the transmission is a(n) a) Opportunity b) Fixed c) Incremental d) Sunk 3. cost: project? I. sinergies; II 4. Which of the following cash flows should be included in the analysis of a opportunity costs; III. erosion costs; IV. incremental costs: a) I and II only b) III and IV only c) II, III, and IV only d) I, II, III and IV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts