Question: This is an old test we took and I would just like some clarification on what the answers were and why. thanks! (Also to eliminate

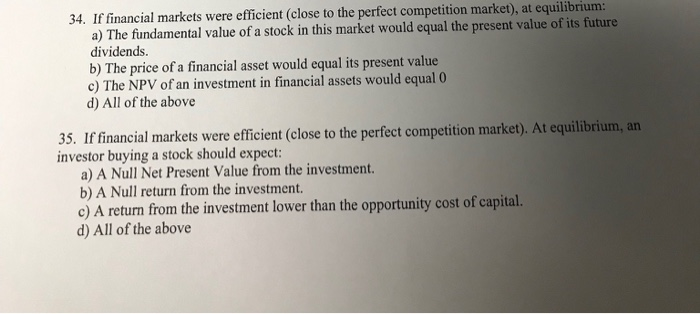

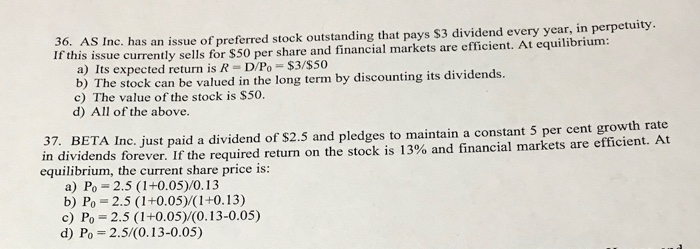

34. If financial markets were efficient (close to the perfect competition market), at equilibrium: a) The fundamental value of a stock in this market would equal the present value of its future dividends b) The price of a financial asset would equal its present value c) The NPV of an investment in financial assets would equal 0 d) All of the above 35. If financial markets were efficient (close to the perfect competition market). At equilibrium, a investor buying a stock should expect: a) A Null Net Present Value from the investment. b) A Null return from the investment. c) A return from the investment lower than the opportunity cost of capital. d) All of the above 36. AS Inc. has an issue of preferred stock outstanding that pays $3 dividend every year, in perpetuity If this issue currently sells for $50 per share and financial markets are efficient. At equilibrium: a) Its expected return is R =D/Po $3/$50 b) The stock can be valued in the long term by discounting its dividends c) The value of the stock is $50. d) All of the above. to maintain a constant 5 per cent growth rate 37. BETA Inc. just paid a dividend of $2.5 and pledges in dividends forever. If the required return on the stock is 13% and financial markets are efficient. At equilibrium, the current share price is: a) Po 2.5 (1+0.05)/0.13 b) Po 2.5 (1+0.05)/(1+0.13) c) Po 2.5 (1+0.05)/(0.13-0.05) d) Po 2.5/(0.13-0.05)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts