Question: this is my third time posting this question. the first two responses i got were wrong Forest Products, Incorporated manufactures three products (FP-10, FP-20, and

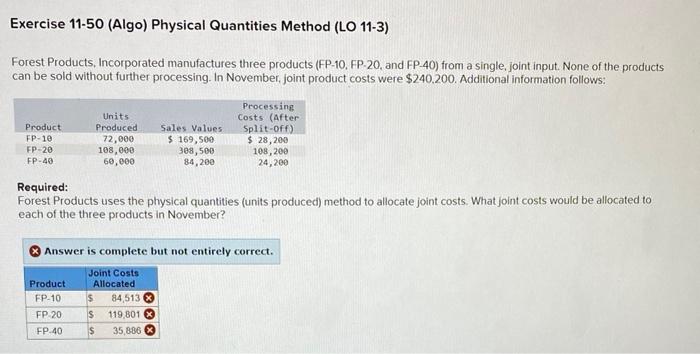

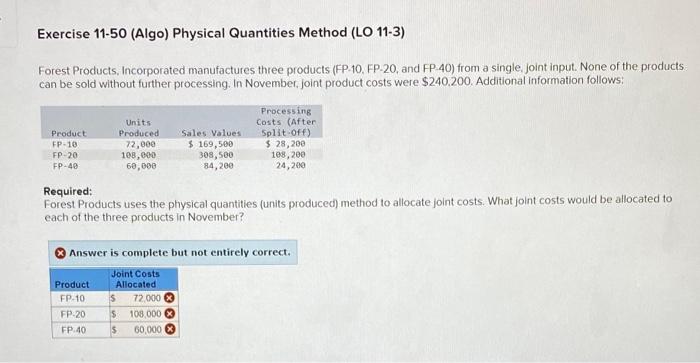

Forest Products, Incorporated manufactures three products (FP-10, FP-20, and FP-40) from a single, joint input. None of the products can be sold without further processing. In November, joint product costs were $240.200. Additional information follows: Required: Forest Products uses the physical quantities (units produced) method to allocate joint costs. What joint costs would be allocated to each of the three products in November? Answer is complete but not entirely correct. Forest Products, Incorporated manufactures three products (FP-10. FP. 20, and FP.40) from a single, joint input. None of the products can be sold without further processing. In November, joint product costs were $240.200. Additional information follows: Required: Forest Products uses the physical quantities (units produced) method to allocate joint costs. What joint costs would be allocated to each of the three products in November? X Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts